The challenger bank Revolut last week launched an instant messaging feature for U.S., European and U.K. customers in the London company's latest feature announcement in its quest to build a "global financial super app."

While most of the top payments apps used in the U.S. and European continent support payment memos and payment requests, none offer a direct messaging feature like Revolut's. By contrast, a growing number of messaging-focused apps including Apple Messages, Facebook Messenger and

"We're delighted to bring instant messaging to our customers, moving us one step closer to being a global financial super app," said Nikolay Storonsky, Revolut's CEO. "We listened to our customers who said they wanted to be able to discuss and clarify payment details within the app, rather than having to swap between Revolut and different messaging apps to send or receive funds."

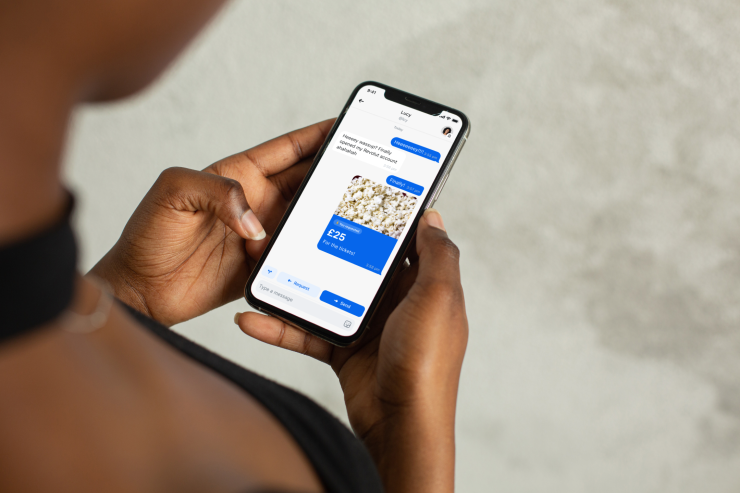

Revolut's new chat capabilities, embedded in the financial transfers part of its app, will mirror many of those already popular in messaging apps, such as end-to-end encryption (meaning Revolut will not have access to read users' messages) and letting users send each other gifs and virtual stickers.

Users will have the option to opt out of messaging altogether, and the chat function is not available to users enrolled in Revolut <18, the app's offering for minors. The chat feature can only be used between users in the U.S., U.K. or European Economic Area, and only if they share their phone numbers or have payment history.

The closest comparison among financial applications might be Venmo, which allows payers and recipients to share the details of a payment (minus the amount) with their social network. Users can like and comment on payments visible in their social feed, but the app does not support direct messaging outside the context of a payment.

While Revolut's growing set of features revolve around finance, the app's feature set is beginning to resemble that of

Revolut said in its announcement of its direct messaging feature that it has "more than 20 million customers worldwide," which for now is a far cry from