-

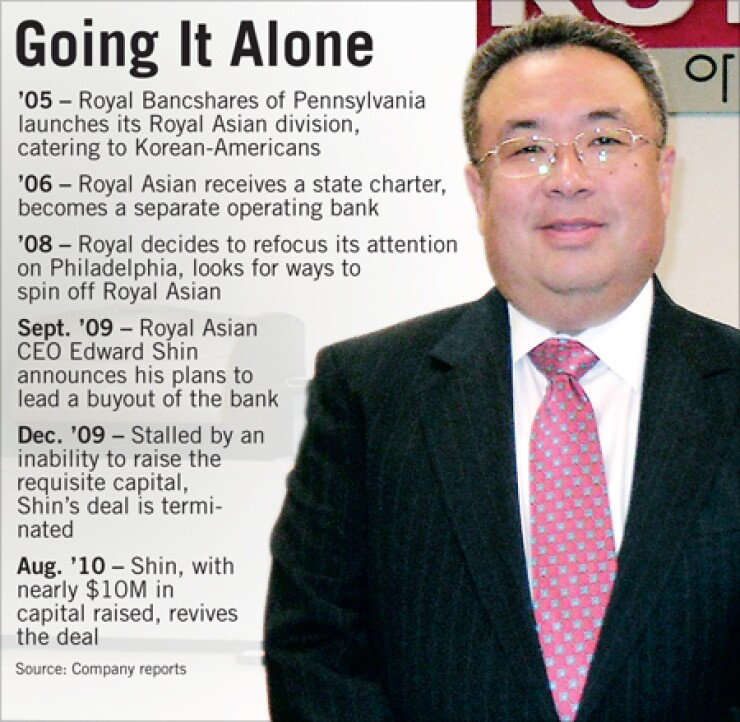

Royal Bancshares of Pennsylvania announced it has terminated an agreement to sell its Royal Asian Bank unit to a group of investors.

December 22 -

The president and chief executive officer of Royal Asian Bank in Philadelphia is leading a group of investors that struck a deal to buy it.

September 28

Edward Shin has been pounding the pavement.

For months he has been making calls to friends, having long chats with family members and visiting longtime customers — all in an effort to sell them on his idea of creating an independently owned Korean-American bank in their communities in northern New Jersey, New York City and Philadelphia.

The pitch appears to have paid off. Last week Shin announced that he and an investor group would buy Royal Asian Bank from Royal Bancshares of Pennsylvania Inc., eight months after calling off a similar deal. That purchase failed because Shin and his group couldn't raise enough capital.

In an interview Thursday Shin, the bank's president and chief executive, said his success this time does not stem from improvement in the capital markets. Indeed, there was no magic to it, he acknowledges, just effort and perseverance.

"The market conditions are getting harder," Shin said. "It is very tough, but I've received great support from the Korean-American community. We are very close to our goal."

This grassroots approach is a good model for capital raising by community banks given the market conditions, said Gray Medlin, the president of Carson Medlin Co. in Raleigh.

"It is a good thing that he was willing to pound the pavement, that is about the only way you can get capital right now," Medlin said of Shin's efforts. "Conventional raises are happening, but they are few and far between. They are a more objective process with investors that are buying in just for a return."

By going it alone, Medlin said, Shin has the opportunity to promote his vision. "Investors get to hear a guy who really believes in his bank," Medlin said.

William Michael Cunningham, the founder of the minority bank fund MBF LP in Washington, said ethnic-focused banks tend to turn to their communities for capital and that is particularly true of the Asian-American community, where the need for a dedicated bank is perceived to be greater.

"Asian banks have a compelling reason to exist. Most banks have material in Spanish, but how many have it in Korean or Mandarin?" Cunningham said. "Also, in terms of capital, the Asian community tends to be wealthier."

Shin said he has been specifically promoting the need for the Korean-American community to have its own bank.

"We are going to be a true community bank owned by the community," Shin said. "That will allow us to choose our direction and do our own business plan."

All of the money he has raised has come from within the bank's markets. His smallest investment is $250,000. So far, his group has raised about $10 million. The investors are buying the bank at book value, which was $12.3 million at June 30.

Ultimately, the price tag will be based on the book value the month before the deal closes.

Shin announced his intentions to buy Royal Asian last September, hoping that the news would attract investors. Investment bankers said that is a common tactic used to "smoke out" capital. But capital raising was especially tough in the fourth quarter of 2009, and a slew of deals were called off.

Royal Bancshares encouraged this independence. In an interview Friday, James J. McSwiggan, the president and chief operating officer of the $1.18 billion-asset company in Narberth, said it had long intended to divest Royal Asian.

The Asian bank was launched as a division of Royal Bank America and received its own charter in 2006. The plan was for the community to take a stake in the bank with Royal Bancshares' ownership dwindling to roughly a quarter.

In 2008, amid the economic meltdown, Royal Bancshares decided to focus on the Philadelphia market and determined that Royal Asian would be better off alone.

"When you are in ethnic banking, you need to concentrate on that market. Royal Asian focuses [primarily] on Korean-Americans in northern New Jersey and New York City," McSwiggan said. "We are a bank in Philadelphia and we want to focus on cultivating opportunities in our backyard."

Also, Royal Bank America has been coping with a high level of nonperforming assets. At June 30, that bank's nonperforming assets made up 11.77% of total assets.

Still, the company is flush with capital, meaning that it is selling Royal Asian for much different reasons than other companies, which are selling whatever they can to boost capital. "This allows us recapture our initial investment," McSwiggan said.

And while he is pleased with Shin's efforts, he's remaining cautious until the deal closes.

"We really hope that Eddie is successful in getting the capital he needs," McSwiggan said.