An Internal Revenue Service ruling against down-payment gift providers is expected to make it even harder for the Federal Housing Administration mortgage insurance program to hold on to, much less regain, market share.

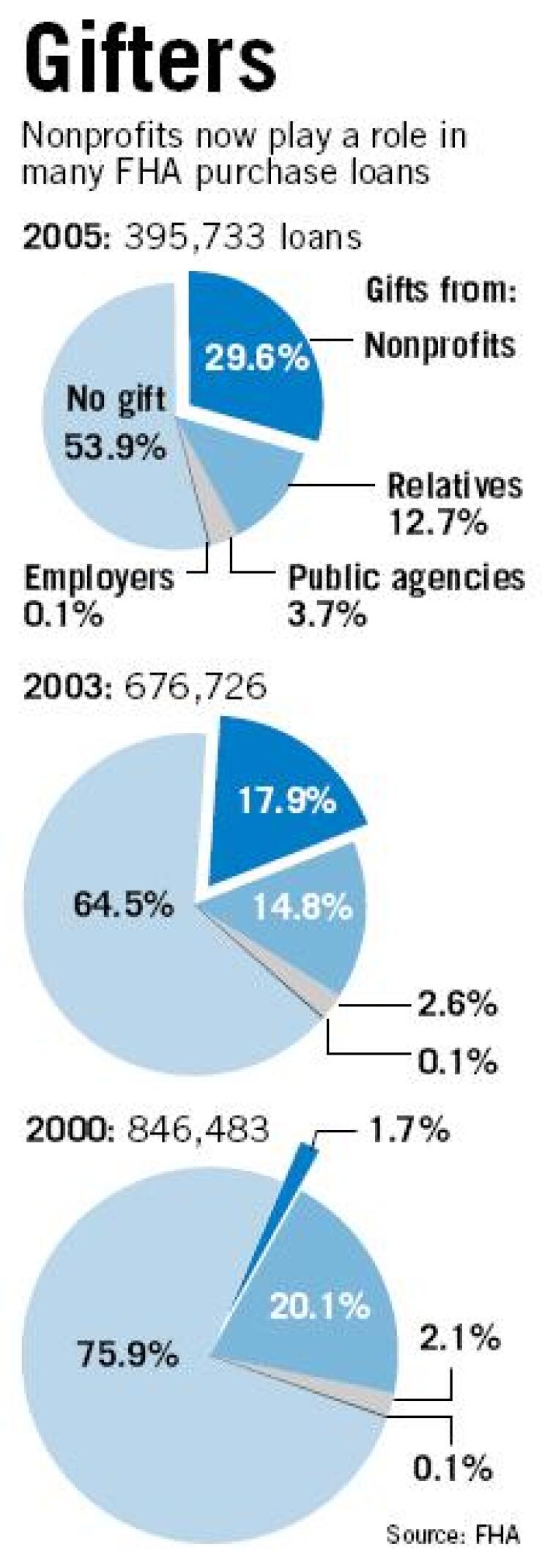

Over the last few years, gift providers have grown to facilitate about a third of FHA loans for home purchases. The ruling, which the IRS announced last week and will publish May 22, would end the ability of many such gift providers to claim they are tax-exempt charities.

And that would in turn eliminate their ability to provide the gifts under FHA underwriting rules, which allow gifts from only a small list of sources that includes relatives or an employer.

"Because it's become such an integral part of the FHA program … the impact will be very significant," said Brian J. Chappelle, a partner at the Washington consulting firm Potomac Partners LLC.

Steve O'Connor, a vice president at the Mortgage Bankers Association, agreed that the IRS ruling "could have a very significant impact on FHA."

Such programs help borrowers get around the 3% down-payment minimums on FHA loans. Generally, they are supported by donations from home sellers of the same amount plus a fee.

Born in the late 1990s, the down-payment-assistance industry has been beset by finger-pointing and infighting; a spate of scandals at some providers over things like executive compensation and inaccurate marketing of seller contributions as tax writeoffs; and concerns that such programs endanger borrowers and housing markets by inflating sales prices and put the FHA at risk.

Indeed, despite the programs' huge role today in the FHA, the Department of Housing and Urban Development has expressed discomfort with them. For instance, it has refused repeated calls by several providers to issue guidance on how they should work.

The Bush administration last month began pushing a broad slate of FHA reforms, including risk-based pricing, higher loan limits, and no-down-payment loans. Most of the proposal has been introduced as legislation in the House with bipartisan sponsors. Many believe that the Republican backing of measures to revitalize the FHA, which runs against conservatives' love of private-market solutions, means there is a good chance a bill will eventually pass, if not this year.

Such reforms "would provide safer, more affordable financing options for this type of borrower, as opposed to mortgage products that are risky and more costly," a HUD spokesman said by e-mail.

Also, HUD "recognizes" that loans with "assistance from seller-funded nonprofit gift providers do not perform as well as loans to borrowers with no such assistance."

Mr. O'Connor said the change would fuel the push for FHA reform. "Without that help in the marketplace, we need to find another way to reach out to these borrowers," he said.

The IRS ruling, which it described in a press release as targeting "down-payment-assistance scams," left room for some gifters to retain nonprofit status.

But it appeared to rule that out for most gifters that rely on financing from sellers to fund their programs, which the Government Accountability Office said in a study last year made up 93% of nonprofit gift organizations.

The IRS decision was not completely a surprise, given the negative attention the industry has drawn. In November, when the Department of Justice sued Partners in Charity Inc. of West Dundee, Ill., over its description of seller contributions as deductible (it agreed to settle the charges last month), the IRS said that it was investigating Partners in Charity and 11 other groups. On Thursday the IRS said that it is now examining 185 such organizations and that it had denied applications for tax-exempt status from 20.

Rick Del Sontro, the chief executive of the Home Downpayment Gift Foundation in Washington, said that after initial conversations with lawyers, he was unsure if the foundation would lose its tax-exempt status. But if that happened, it would appeal in court, he said. Even so, "the big question for us" is whether the FHA and lenders "choose to hang in there with us."

"If somebody said to me today, 'Are you in business?' my answer is yes," Mr. Del Sontro added.

The HUD spokesman would not say whether it would immediately call for lenders to stop using the programs or give them a chance to appeal if they are found to be for-profit. But another official, who requested anonymity, said HUD expects to issue some sort of guidance for lenders on how to proceed.

Stuart Vener, the president of Responsible Homeownership Inc., a for-profit Las Vegas company that manages a down-payment gift program funded by a nonprofit sister, Community and Housing Development Corp., said he felt hopeful that the specifics of how its business works would mean the latter can keep its nonprofit status.

Community and Housing Development, makes the gifts, with funds donated by Responsible Homeownership, which collects "fees" from sellers, and also from other sources, including through donations of used cars and contaminated properties, Mr. Vener said.

The two biggest nonprofit gifting organizations are Nehemiah Corp. of America and Ameridream Inc.

Nehemiah said in a statement that it "is studying and evaluating the IRS ruling" but that it was already "disappointed that a program that has been granted tax-exempt status for more than nine years and has served hundreds of thousands of Americans would have this tax exemption arbitrarily threatened in this fashion." It said it intends to "contest the IRS opinion."

Ameridream did not respond to requests for comment by press time.

Some observers are also worrying about how eliminating the programs will affect what has appeared to be a weakening housing market. "This is really bad timing," said David Lereah, the National Association of Realtors' chief economist.

Indeed, Mr. Del Sontro said a fading "appetite" for making low-down-payment loans, higher interest rates on home equity piggybacks, and the less competitive house-sales environment had made him very optimistic about business. "We had forecasted this to be a very, very strong year. In fact, probably the best year in five years."

He said his group doled out more than $12 million of gift funds in the first quarter, a number that has been rising despite the overall downward trend for other gifters caused by the FHA's falling share.

The FHA's share of mortgage originations has fallen from about 13.5% in its fiscal 2000 and 2001 to 4.1% last year, according to HUD. The percentage of its purchase mortgages, by loan count, that included down-payment gifts from nonprofits rose from 1.7% in 2000 to 28.2% so far this fiscal year.