Democrats slammed Wall Street investor landlords Thursday in a Capitol Hill hearing, blaming their exponentially increasing home purchases for soaring home prices across the nation’s housing markets.

Senators and other witnesses before the U.S. Senate Committee on Banking, Housing and Urban Affairs criticized institutional investors for squeezing the market and subsequently raising rents on their tenants, calling for more transparency in ownership and an increase in supply.

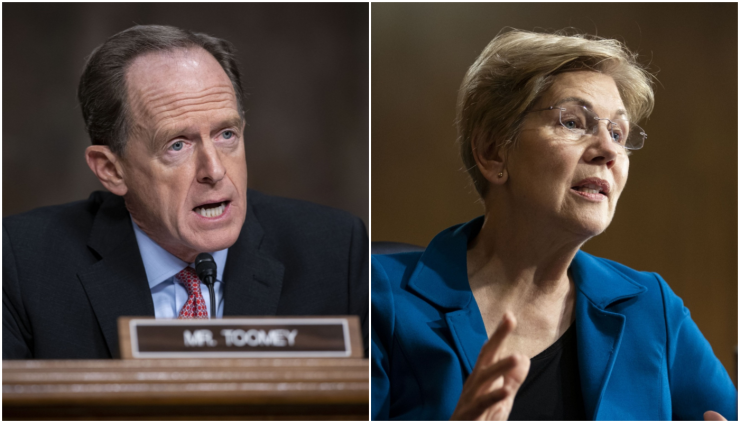

“These Wall Street firms are buying up already scarce homes from right under American families and then they jack up rents and exacerbate the inflation that is straining family pocketbooks,” Massachusetts Democrat Sen. Elizabeth Warren said.

Pennsylvania Sen. Pat Toomey, the committee’s top Republican, called the hearing — the second by the committee on investor landlords since October — a distraction from the “failing Biden economy” he said is at fault for inflation.

“It's a simple issue of supply and demand,” he said. “Institutional investors happen to be the ones with the deepest pockets and the most capital available to invest in building and the new housing stock that America needs.”

Toomey suggested that government-sponsored enterprises Fannie Mae and Freddie Mac are responsible for an overheating housing market. “Instead of blaming those who actually build housing stock, we should probably take a look at the role that democratic policies have contributed to the high cost of housing,” he said.

Today’s homebuyers face a bleak landscape, with

Nationwide, investors accounted for just over a quarter of single-family home purchases over the same timeframe, according to a December CoreLogic report. Their spending spree was even greater in specific metros, and

Institutional investors don’t own more than one in 100 of all available housing units in any state, said Joel Griffith, research fellow at the Heritage Foundation's Institute for Economic Freedom and Opportunity. Griffith and Tobias Peter, a research fellow and assistant director at the AEI Housing Center, agreed more housing supply was necessary, and directed blame for the lack of available homes on government policies.

Peter emphasized the GSEs’ increasing acceptance of appraisal waivers, in

Griffith suggested the Federal Reserve’s spending spree of mortgage-backed securities,

Democrats and witnesses through Thursday’s hearing focused on investor landlords’ alleged cutthroat eviction practices and poor property management for renters. Senators and witnesses suggested transparency about ownership would alleviate property management concerns while direct spending by local governments and nonprofits would curb investor purchases and aid dwindling supply.

“First and foremost, we need to make mortgage capital available,” said Sally Martin, director of building and housing for the city of Cleveland. “We need to provide some backstops to keep the investor behavior curbed in some of these areas where they’re just essentially raiding neighborhoods.”