- Key insight: Eastern Bankshares' stock tumbled Friday after its CEO said it would be in the best interest of shareholders to consider certain M&A deals.

- What's at stake: Eastern is the target of an activist investor that's calling on the bank to swear off M&A and securities restructurings.

- Supporting data: Eastern's shares were down by more than 5% by midday Friday.

Executives at Eastern Bankshares in Boston, which is on the verge of completing its third bank acquisition in four years, say the company is focused on organic growth and post-merger integration work.

But never say never.

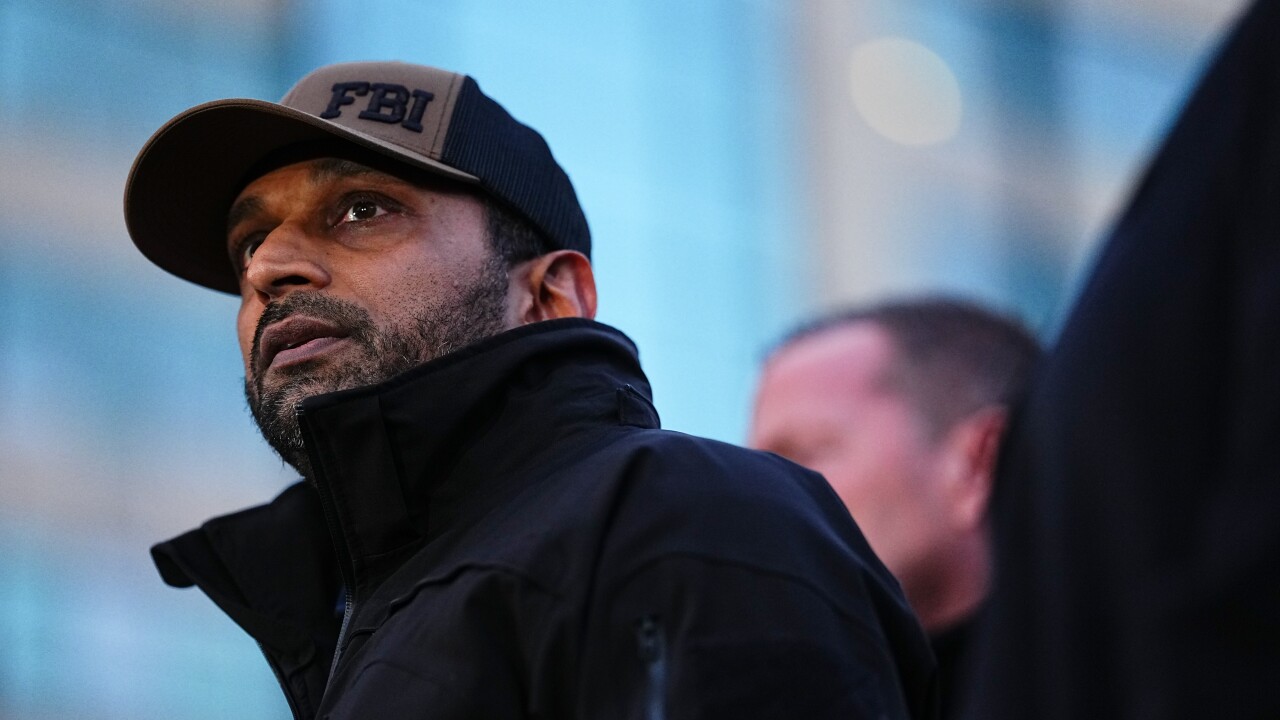

"If a merger opportunity were to arise, it's in our shareholders' best interest for us to evaluate the opportunity," Eastern CEO Denis Sheahan told analysts Friday during the bank's third-quarter earnings call.

The talk about a potential future merger deal may have spooked investors, especially in light of

On Monday, South Florida-based HoldCo Asset Management published an 83-page report that accused Eastern's leaders of diluting shareholder value over the course of three acquisitions the bank has announced in the past five years.

HoldCo said Eastern overpaid for all three banks, including the

HoldCo, which previously urged the sale of Dallas-based Comerica, suggested that

In lieu of "a satisfactory sale price," HoldCo suggested that a possible resolution could involve Eastern's "commitment to refrain from damaging actions," such as additional acquisitions and securities restructurings, and the return of all excess capital to shareholders in the form of share repurchases.

If a resolution cannot be reached, HoldCo said a proxy battle is one option that's on the table.

On Friday's call, Mark Fitzgibbon, an analyst at Piper Sandler, asked Eastern's leaders if they plan to meet with HoldCo and whether the bank might implement any of the firm's suggestions.

Sheahan, who became Eastern's chief executive after its acquisition of Cambridge Bancorp last year, said the bank is "very open to engaging" with shareholders, but he didn't commit to making any changes.

"We welcome that dialogue from whomever," Sheahan said. "But I would say most importantly, I really want to turn our focus to the future, and even more so with the combination with HarborOne, to execute on the strategy that we've built to really drive that top-quartile financial performance. … We think that's going to deliver very, very attractive shareholder returns."

Sheahan also said that just because Eastern will evaluate future merger opportunities, it won't necessarily make a deal. "It's not our focus today," he said.

He declined to comment specifically on the HoldCo report.

In a research note after the call, Piper Sandler's Fitzgibbon said the presence of an activist investor may not be a negative factor for Eastern's shareholders.

"Having an activist shareholder is … likely to ensure that the company continues to aggressively drive operating performance in the right direction," Fitzgibbon wrote.

Read more about bank earnings here:

Eastern reported third-quarter net income on Friday of $106.1 million, versus a loss of $6.2 million in the year-ago quarter. Earnings per share were $0.53, topping consensus estimates of $0.37.

Total revenue was $241.5 million, an increase from $203.4 million in the same quarter last year.

Net interest income was $200.2 million, up from $169.9 million in the year-ago period. Fee income also increased, totaling $43.1 million as of Sept. 30, up from $33.5 million a year ago.

Wealth management assets under management reached a record high of $9.2 billion at the end of the three-month period, Eastern said. Expenses declined by about $20 million, coming in at $140.4 million, largely as a result of a reduction in nonoperating costs.

Once Eastern completes the HarborOne transaction, it will have about $30 billion of assets.

Eastern is the third bank that HoldCo has targeted in recent months with a public report. In addition to Comerica, which ultimately

The activist investor, which owns 3.8% of First Interstate's common shares,

First Interstate did not immediately respond to a request for comment.