With electronic clearing now starting to shorten check float, what are consumers hooked on float to do?

Many who still use checks at the register will switch to plastic so they can keep postponing payments, bankers say.

Someone "savvy enough to play the float … may go to using a credit card," said Dennis Feterl, the vice president of treasury services at First Premiere Bank in Sioux Falls, S.D.

In fact, 14% of consumers polled in a recent ESP Consulting survey said they would consider switching to a credit card if they lost the float that comes with checks.

Ken Kerr, the vice president for retail payment strategies at the Salisbury, Md., research firm, noted that plastic can defer payment far longer than check float.

With a credit card "you can pay for things 30 days in the future," said Mr. Kerr.

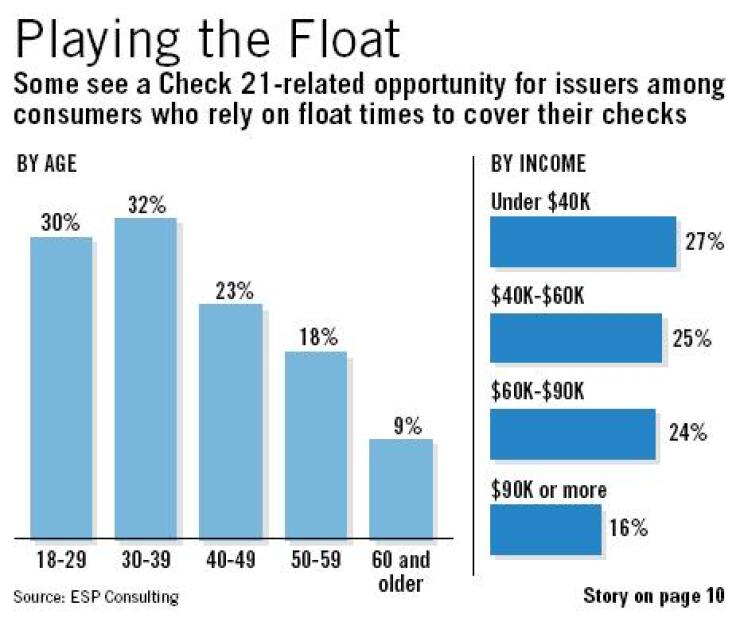

Over all, 23% of the consumers in the January-February survey said they sometimes write checks knowing there is not enough money in their accounts to cover them.

Almost a third of those in their 30s and more than a quarter of those earning $40,000 or less sometimes end up racing a check to the bank, the survey found.

Mr. Feterl noted that some people who count on float are motivated by serious financial woes and might pile up debt if they switched to plastic.

But other float players are just smart, Mr. Feterl said - "probably smart enough not to get themselves in trouble."

"Float is definitely going down," said Danne Buchanan, the chief executive of NetDeposit Inc., the technology subsidiary of Zions Bancorp. in Salt Lake City. "People are smart. I think that we will see a movement to offline debit and credit cards."

Banks have spent years fine-tuning their check handling systems, and local checks typically now clear within a day or two, Mr. Buchanan said. But nonlocal checks can take several days - especially if, like most consumer bill payments, they are mailed. This is where banks are having the most success in speeding up settlement.

More than a billion consumer checks were converted into automated clearing house payments at billers' lockbox sites last year, and the number is expected to increase this year. In addition, the Check Clearing for the 21st Century Act, which kicked in last October, is expected to spur the use of electronic image exchange networks.

ACH and image exchange both enable banks to transmit payment information digitally, cutting several days out of the settlement process for nonlocal checks.

But Taylor Vaughan, the senior vice president for treasury management at First Horizon National Corp., said it will be some time before the technology makes a significant dent in average check processing speed.

"The bottom line is that banks still do back-office batch processing," he said, "so the perception that float is going down is more optimistic than reality."

Though he agreed that less float could prompt some people to make more purchases with credit cards, he said he does not expect that to happen for at least three to five years.

Gail Hillebrand, a senior attorney with Consumers Union of Yonkers, N.Y., said bank customers are very attached to their float. She has received "a lot of e-mails from people who thought float was a natural part" of their checking accounts - and ought to be.

For their part, the card companies are happy with anything that would increase card use.

"Do we think Check 21 could be a boon for our industry? I'd say the answer is yes," said Gregory Papajohn, a spokesman for MasterCard International.

However, Mitch Christensen, the executive vice president of payment strategies at Wells Fargo Services Co., the San Francisco banking company's Scottsdale, Ariz., technology division, noted that about 90% of checks written today are local checks, so there are few opportunities left for people to play with float.

"The number of people using float to manage their money is very small," he said.