Community banks are facing tough choices as revenue growth slows in wealth management.

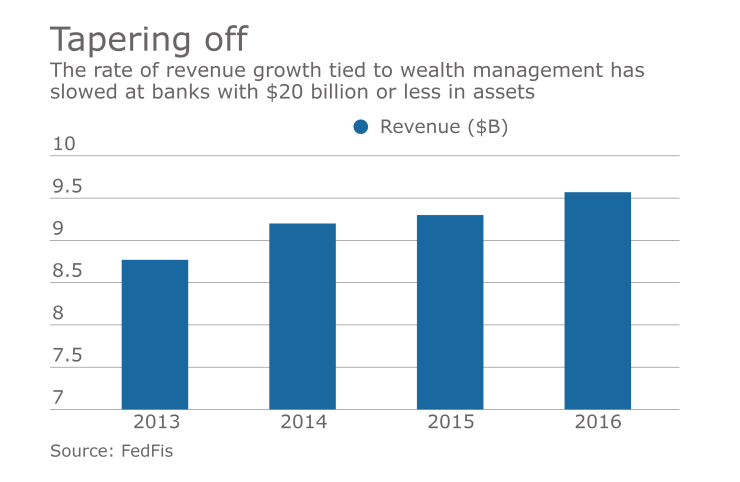

Wealth management income at banks with $20 billion or less in assets rose by 2.9% last year, based on call report data compiled by FedFis. The growth rate, which includes fiduciary activities, investment banking and fees from securities brokerage and annuity sales, was only 1.1% in 2015.

It can be tough to stay the course in a slow-growth business, especially one that is crowded with banks and nonbanks. As a result, a number of banks may have to decide whether to bulk up, by hiring talent or making acquisitions, or cut loose to reallocate funds to faster-growing areas.

Wealth management is a challenging business for small banks, industry observers said.

“Rarely in the community banking space have they integrated it well,” said L.T. Hall, CEO of Resurgent Performance, an Atlanta consulting firm. About 10% to 15% of community banks meaningfully benefit from offering wealth management services, he said.

Banks that have tried to expand into wealth management have made "a lot of missteps," said Jon Winick, CEO of Clark Street Capital in Chicago. “Some of the potential synergies banks thought they would get by getting in this space have been very difficult to realize,” he said.

Still, opportunities could arise for banks with the wherewithal to bulk up. There is still a need for expertise helping people who need to transfer wealth. And a rising rate environment could give people a reason to reevaluate what they want to do with their money, Hall said.

“There’s tremendous disruption coming in this space,” Winick said. An “advisory reset” is taking place, he said, as younger people “have other ideas” when it comes to investing.

Beefing up in wealth management may save long-term customer relationships, so much so that it could outweigh a simple assessment of short-term profitability, Hall said. “The banks I’ve seen that have been in it and then gotten out … I think it has hurt their growth.”

Several banks have made efforts to enhance their wealth management or investment advisory services in the last year, including Berkshire Hills Bancorp in Pittsfield, Mass.; Orrstown Financial in Shippensburg, Pa.; and Nicolet Bankshares in Green Bay, Wis.

The financial results at those companies have been mixed so far, according to FedFis research.

Wealth management revenue at Berkshire fell 8% last year, to $8.9 million, after increasing by 2% in 2015. Berkshire was both a buyer, acquiring a

Berkshire's revenue decrease was caused, in part, by the timing of those deals, said Jason Edgar, the company's director of wealth management. "As Berkshire Bank continues its momentum and expansion in new markets, we anticipate significant opportunities to continue to grow and mine wealth management relationships," he said.

Nicolet’s wealth management revenue jumped 63% last year, to nearly $9 million, reflecting the April purchase of Navigator Planning Group. The bank's wealth management revenue rose 6% in 2015.

“It was getting to be a very difficult time to be a large independent” firm due to regulatory requirements, said P.J. Madson, a former adviser at Navigator who became Nicolet's head of wealth management after the deal closed. Nicolet "asked us to look at wealth management from an independent viewpoint."

At Orrstown, revenue rose 7% in 2016, to $7 million, after falling by 3% the year before.

Tom Quinn, Orrstown’s president and CEO, conceded that wealth management had become “a fairly flat marketplace,” though his company has been able to expand by hiring advisers who brought accounts over when they joined. Orrstown also bought Wheatland Advisors in Lancaster, Pa.,

“I expect we’ll continue to do well … because we believe in our model,” Quinn said. Management teams with good business models will “continue to outpace the market. … I think that’s why we have a lot of confidence.”

Efforts to reach Berkshire were unsuccessful.

At least one bank is getting out of wealth management.

Republic Bancorp in Louisville, Ky., recently announced that it will exit wealth management because of intense competition in its markets. Then again, the $4.8 billion-asset company generated only $547,000 in wealth management income last year, according to FedFis data.

“There are so many great nonbank wealth management options out there now that it didn’t” justify the costs and compliance requirements, said Michael Sadofsky, Republic’s chief marketing officer. “We weren’t serving enough clients.”

Republic, which aims to expand a planned call center, is directing its former wealth management clients to other firms, Sadofsky said.

The move makes sense for Republic because wealth management was a “distraction” that made up less than 1% of its revenue, said Andy Stapp, an analyst at Hilliard Lyons. The company can devote more attention to other operations, including efforts tied to tax refunds and short-term lending.

“They [have] a lot of other things that I think they should focus on,” Stapp said.