Community bankers are counting on a new federal rule that relaxes requirements on real estate appraisals to help them better compete with nonbank lenders on smaller commercial real estate loans, but appraisers themselves say that the change will only encourage banks to take more risks.

The three federal bank regulatory agencies last month increased the threshold for loans that require an outside appraisal on the property used as collateral from $250,000 to $500,000. The rule was last updated in 1994 and lenders say regulators changed it because it did not accurately reflect current property values.

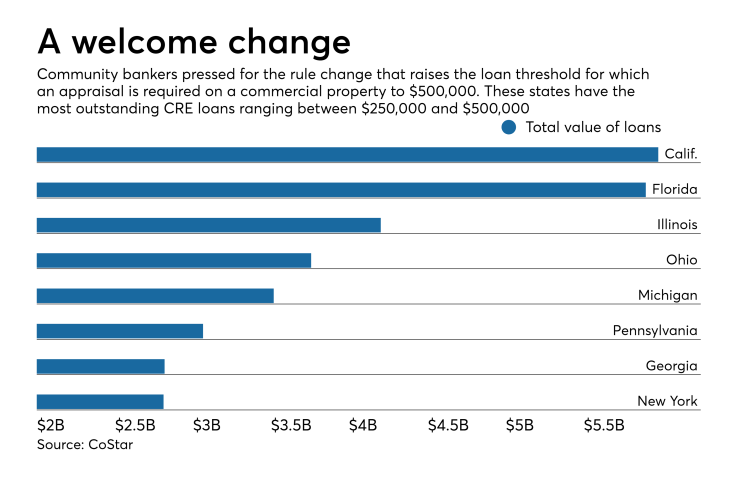

The rule change will remove the costly appraisal requirement on tens of thousands of commercial properties, which could allow banks to make more loans in this size range, said Justin Bakst, the director of capital markets at CoStar.

As of April 20, roughly 154,000 properties nationwide were each valued at between $250,000 and $500,000, according to CoStar. Those properties are valued at about $68 billion.

Though these loans should be right in community banks’ wheelhouse, many small banks have actually shied away from them because they became too costly to make once appraisal fees were factored in, said Jon Winick, CEO at Clark Street Capital, a Chicago firm that advises banks on loan sales.

“To spend $3,500 for an appraisal on a $250,000 loan, that wasn’t worth it,” Winick said.

Community bankers said that the rule change should help them better compete with insurance companies, individual investors and other nonbank lenders that were not subject to the same appraisal requirements.

Eliminating in-person appraisals for loans of less than $500,000 will both reduce costs for small banks — allowing them to offer better rates and terms — and speed up decision-making, they said.

Banks had not officially asked for an increase in the threshold since it was last updated in 1994, said Chris Capurso, an attorney at Hudson Cook in Richmond, Va., who advises banks on lending laws. But a federal law that requires federal agencies to review their regulations every decade opened the door for the current push, Capurso said.

Additionally, the price of commercial real estate has significantly increased since the financial crisis, which made it more palatable for regulators to boost the threshold, said Curt Everson, president of the South Dakota Bankers Association.

Banks will still need to value their collateral, but instead of hiring a certified independent appraiser, they now can commission an evaluation of properties in this value range using publicly available real estate data.

“Evaluations cost less than appraisals, take less time than appraisals and do not require the bank to go out and find a certified appraiser,” Capurso said. “All of this adds up to banks, especially banks with fewer resources, being able to make more CRE loans.”

However, appraisers have questioned why regulators are making it easier for banks to make CRE loans at a time when they’ve been

The Federal Deposit Insurance Corp., the Office of the Comptroller of the Currency and the Federal Reserve Board dismissed concerns about the change posing increased risk to the financial system.

“The agencies … determined that the increased threshold will not pose a threat to the safety and soundness of financial institutions,” they said in a

Bankers in rural areas have also supported the rule change, as they believe it will help address the problem of a dearth of commercial real estate appraisers in certain sections of the country.

“The supply of licensed and certified appraisers, especially those willing to work in rural areas, has diminished,” Everson wrote in a September letter to regulators. “In too many instances … owners of small businesses on main street, farmers and ranchers seeking to restructure current year operating loans into longer term notes incur higher costs … because of appraisal threshold requirements that have not been updated in decades.”

Some bankers had called for regulators to raise the appraisal-requirement threshold to $1 million, saying that the $500,000 cap would still shut them out of too many deals. However, Capurso noted that regulators based the $500,000 figure on the increase in the Federal Reserve’s Commercial Real Estate Price Index over the past 24 years.

“The agencies didn’t come to the limit haphazardly by merely doubling the previous limit,” Capurso said. “There’s a basis to it, and I think it’s a fair one to use.”