-

After slamming on the brakes in 2006, Wintrust Financial Corp. in Lake Forest, Ill., is revving its growth engine once more. The $12.8 billion-asset company on Friday purchased two of the seven banks that failed in the Chicago area the same day.

April 28

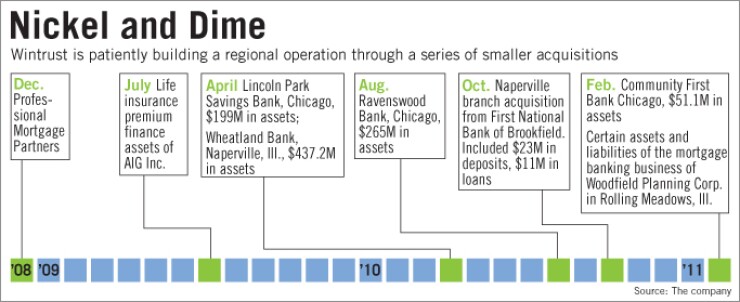

Some banking companies are chasing transformative acquisitions, but Wintrust Financial Corp. is perfectly comfortable growing block by block.

Last week the Lake Forest, Ill., company struck two deals: one for the assets of a small mortgage company, and another with the Federal Deposit Insurance Corp. for a tiny bank on Chicago's north side.

Analysts and Wintrust said neither deal is big enough to have a material impact on the company's 2011 earnings. That doesn't make the targets any less attractive, Wintrust Chairman and Chief Executive Ed Wehmer said in an interview Wednesday.

Wintrust has the capital for bigger purchases, and Wehmer said he is open to them. However, the $14 billion-asset company is more focused on buying small banks or specialty finance businesses at steep discounts.

"We raised the capital, and now we are going to deploy it and have some fun. We are taking what the market gives us, and right now that is a lot of smaller FDIC deals," Wehmer said. "If I did one big bank deal, it could shut me out for a year."

In other notable acquisitions unveiled in recent months, other large community banks are pairing up to create the next group of regional powerhouses, with First Niagara Financial Group Inc. set to buy NewAlliance Bancshares Inc. and Hancock Holding Co. agreeing to buy Whitney Holding Co., to name a couple.

Some industry observers say FDIC deals have lost some luster particularly as loss-sharing arrangements have become less generous and the inventory of failed-bank candidates has shifted to smaller banks with less core franchises.

Wehmer is interested nonetheless. "In some cases, there is no right side to the balance sheet. There is no franchise; you are buying a branch essentially, and so you bid it accordingly," Wehmer said. "In other cases, there is some franchise. For those, we are willing to pay a little bit more."

Wintrust has picked up four failed banks in the last year and has bid on "10 or so" across Illinois and Wisconsin, Wehmer said.

There were roughly three dozen deeply distressed community banks in the Chicago market at Sept. 30, according to Loan Workout Advisers LLC. Analysts said they expect Wintrust to be among this year's most-active acquirers.

"Some of the other Chicago banks have kind of stepped back," said Stephen Geyen, an analyst at Stifel, Nicolaus & Co. "That has created an opportunity for Wintrust to step up."

Bidding for bigger failed banks has been particularly competitive in that region. For instance, the assets of the $3.17 billion-asset Midwest Bank and Trust Co. were sold at a 2.7% premium last year. (FirstMerit Corp. in Akron, Ohio, bought Midwest.)

Analysts said pursuing smaller deals is the right tack for Wintrust. Wehmer is known for his pricing discipline, and the company still has the ability to grow organically.

"Ed is a contrarian, so it is not surprising that he would go after deals fewer people are willing to look at. Why go after deals where everyone else is?" said Terry Keating, a managing director at Amherst Partners, a Chicago investment banking firm. "I think it is smart for them to pick off some of the smaller stuff."

Wehmer is not just consumed with failed banks; he is just looking for good opportunities at the right price. He said he could see more deals like the one Wintrust struck last week for the mortgage banking business of Woodfield Planning Corp. in Rolling Meadows, Ill., given that many mortgage bankers are wary of the regulatory environment they will face under the Dodd-Frank law.

"That's like asking them to jump in Lake Michigan today," Wehmer said Wednesday, when temperatures were in the single digits.

Wehmer is also interested in specialty finance and said he could foresee an unassisted deal taking place this year.

Wintrust's preference for smaller deals is largely a function of its organizational structure. The company is a consortium of 15 community banks. All four of Wintrust's failed-bank purchases in the past year were brokered through its unit banks: Wheaton Bank and Trust bought Wheatland Bank in April 2010, and Northbrook Bank and Trust Co. acquired Lincoln Park Savings Bank in April, Ravenswood Bank in August and Community First Bank last week.

"With 15 charters, six of them could buy banks and the other nine … could just keep going," Wehmer said.

Wehmer said banks such as Community First and Wheatland fill in gaps in Wintrust's strategy of being the predominant community bank in its region, which he defines as anywhere within a two-hour drive from Lake Forest. Wheatland allowed the company to enter Naperville, the state's fourth-biggest city.

Community First played a key backfill opportunity. Wintrust entered Chicago last year with Lincoln Park Savings, but skipped over Rogers Park, the city's northern-most neighborhood. "Chicago has 47-odd neighborhoods, and our desire is to get into as many of them as we can," Wehmer said.