-

Richard Lashley, an activist investor known for pressuring underperforming banks to find buyers, has won a seat on the board of BCSB Bancorp Inc. in Baltimore.

August 2 -

An activist investor at Cardinal Bankshares Corp. in Floyd, Va., is protesting the company's latest executive hire.

August 1 -

Antsy investors are urging some community banks that have survived the recession but just can't get much forward momentum to create value or find a partner that can.

July 22

Cardinal Bankshares' biggest outside shareholder is hopping mad over an act that normally gives investors comfort: succession planning.

Cardinal, a small-town banking company tucked in the Blue Ridge Mountains of Virginia, has drawn the ire of Schaller Equity Partners after it hired a former accountant as the presumed heir apparent to its 69-year-old chairman and chief executive.

Of course, for Douglas Schaller, the president of the investment group that bears his name, Michael Larrowe is not just any accountant. Larrowe was Cardinal's external auditor when it was involved in the first whistle-blower case filed under the Sarbanes-Oxley Act of 2002.

Larrowe's role with Cardinal at that time "raises more questions than answers" about him joining the company, Schaller wrote in a letter to the company's management after the hiring was announced last week. Schaller has said before that he would prefer Cardinal sell itself.

Leon Moore, the Floyd, Va., company's longtime chairman, president and chief executive, says that he is grooming Larrowe to take his place, and he's adamant that the well-capitalized Cardinal should remain independent.

"We don't intend to just fold up shop and go away," Moore said in an interview Wednesday. "We're not a new kid on the block. We may not be the biggest on the block, but we continue to try to serve our community and grow, and that's our plan going forward."

Cardinal made national headlines nearly a decade ago when David Welch, a former chief financial officer, sought whistle-blower protection under Sarbanes-Oxley shortly after he was fired in late 2002. Welch had alleged that Cardinal and Larrowe, as the company's outside auditor, used loan recoveries to inflate earnings, along with insider trading.

In 2004 and 2005, a Department of Labor arbitration judge ordered Cardinal in several instances to reinstate Welch but the company balked. The judge's order was reversed by the Arbitration Review Board; Welch appealed up to the Supreme Court, which in 2009 refused to hear the case.

Moore, who has expressed an interest in retiring, said Larrowe was unavailable to comment. Moore, however, defended the company's new hire, saying Larrowe's experience as an external auditor and bank consultant made him "a good candidate" to join Cardinal. His financial background is "very strong in just about any area you want to look at for a community bank," Moore added.

Until April, Larrowe had been the chief administrative officer at Waccamaw Bankshares Inc. in Whiteville, N.C. Before that, he was the chief operating officer at Bank of the Carolinas Corp. in Mocksville, N.C., where he is involved with litigation over his termination last year.

Calls to representatives of Waccamaw and Bank of the Carolinas were not returned.

Larrowe has supporters. He has "been around senior management and community banks for over 30 years … so to say he's not qualified is not true at all," said D. Anthony Plath, a finance professor at the University of North Carolina at Charlotte. "He's highly creditable and highly knowledgeable."

Schaller also pressured Cardinal to pursue a sale this spring. His efforts began shortly after Henry Logue resigned in May as the chief executive of its Bank of Floyd after just six months in the post.

"The day [Logue] quit changed everything," Schaller said in an interview Wednesday. "I now find myself as an accidental activist investor."

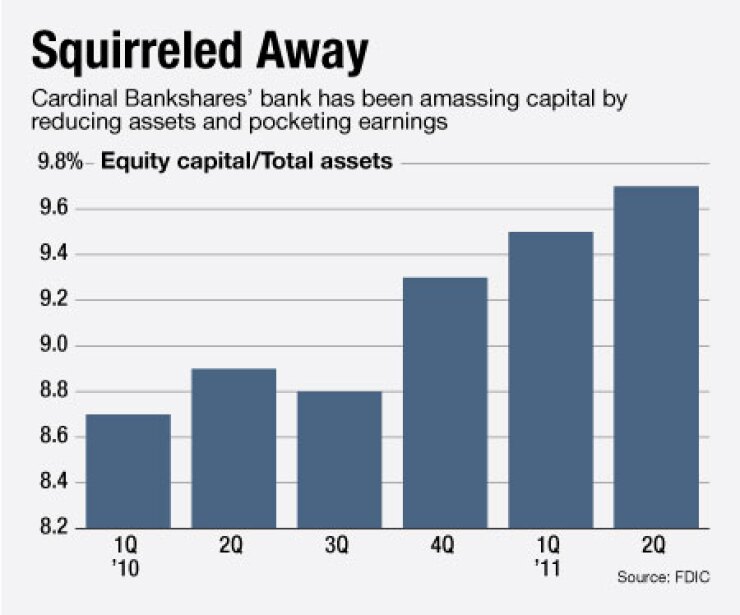

Another issue for Schaller, who owns 9% of Cardinal's common stock, is the massive amount of capital the company has retained. Its Bank of Floyd had a total risk-based capital ratio of 16.5% at March 31, and Schaller wants management to sell to a competitor who will use the capital to expand. "The bank is a fortress like Fort Knox, and if anything, they would be accused of lazily sitting on capital and never doing anything with it," he said.

Schaller didn't start investing in Cardinal until the company tapped Logue to become the CEO of Bank of Floyd in November. After Logue's departure, Schaller said he became increasingly concerned with management, especially when he noticed that Cardinal had gone through eight CFOs since 1996.

"Everything here points to a people problem," Plath said. The turnover in recent years indicates that "somewhere in the bank there is opposition, I guarantee that."

Schaller said that Cardinal has historically been reluctant to sell itself, which has tarnished the company's reputation with prospective buyers.

"Nobody has approached Cardinal because the board is wrapped around [Moore's] finger," Schaller said. "Nobody has been able to unseat him in his authority."

Moore said that Cardinal once tried to find an acquirer. In March 2003, the company's board agreed to terminate its sale to MountainBank Financial Corp. in Hendersonville, N.C., after the would-be seller failed to get shareholder approval.

Schaller has singled out the $1.03 billion-asset National Bankshares Inc. in nearby Blacksburg, Va., as a potential acquirer with more branches and an attractive servicing platform.

James Rakes, the chairman, president and chief executive at National Bankshares, said in an interview Wednesday that he was flattered by Schaller's statement, though he would not express interest in any possible targets.

"In no way would I talk to anyone except for the officers and directors of the bank, whether I did or did not have an interest," added Rakes, who has known Cardinal and Moore for about 30 years. "Oh yeah, it's a good, solid community bank."

Moore said that the company is looking to grow and only retrenched over the past five years in response to the sluggish economy.

"We want to expand in different markets, and we also are looking at maybe some acquisitions both in banking and other service areas," Moore said. "We're not just a little bank in Floyd County anymore. We've grown, and that is what we will continue to do."

Schaller said he wonders how Cardinal will grow, given the challenges of an expensive regulatory environment, anemic loan growth and the company's location in a state that has had just one traditional bank acquisition this year.

(Alliance Bankshares Corp. in Chantilly, Va. said July 27 that it has agreed to sell itself to Eagle Bancorp Inc. in Bethesda, Md., at a 13% discount to tangible book value.)

"From my standpoint, if you find a bank with excess capital, there's so much opportunity," Schaller said. "Clearly, you will see community banks either have to grow or sell out. I thought I saw a perfect growth vehicle in Cardinal."