Efforts to separate the chairman and chief executive roles at banks seem to be losing steam.

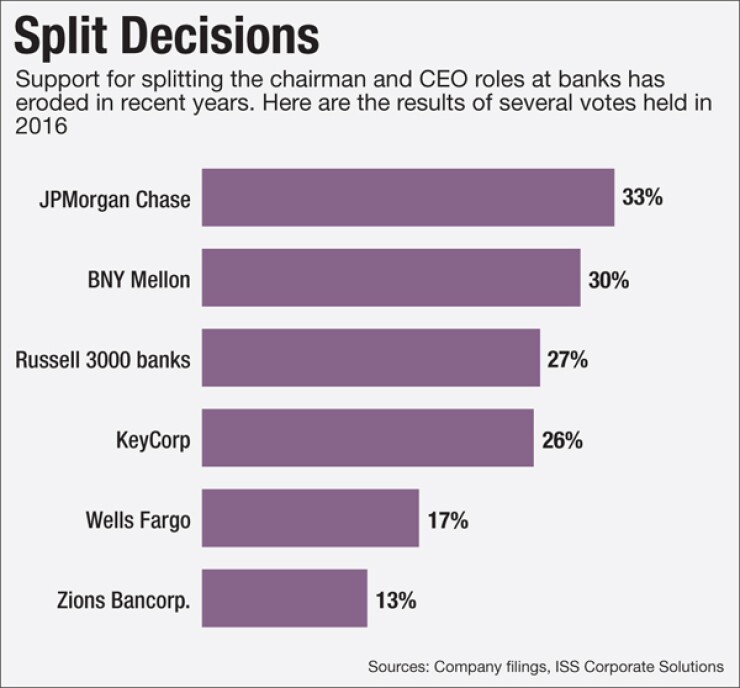

Banks periodically face pressure to split the posts, which some proponents view as good corporate governance. Such measures, however, only drew support from about a quarter of investors at banks that held votes on the issue during recent annual meetings, based on analysis from Keefe, Bruyette & Woods.

Bank of New York Mellon, JPMorgan Chase, KeyCorp, Wells Fargo and Zions Bancorp. were among the banks that, by relatively wide margins, survived shareholder proposals to strip the chief executive of his or her chairmanship.

-

Shareholders at KeyCorp in Cleveland soundly rejected a proposal to separate the chairman and chief executive roles.

May 19 -

JPMorgan attracted stronger support for its annual say-on-pay vote after dozens of conversations with major shareholders prompted it to make a series of changes to executive compensation.

May 17 -

Corporate governance experts normally recommend splitting the chairman and CEO roles at public companies, but Wells' shareholders let John Stumpf keep both jobs.

April 26 -

Activist investors are turning their sights back toward banks after going easier on them than on other industries in recent years. Look for the next bank M&A wave to be fueled by aggressive hedge funds as they push for board seats and ultimately sales of financial institutions.

January 31

There are groups that will predictably vote for or against having an independent chairman, said Peter Kimball, an associate director at ISS Corporate Solutions. Swing votes are the ones that make the difference.

"There are lots of shareholders in this middle ground that will take this case-by-case approach depending on how a company is performing and how its corporate governance looks generally," Kimball said.

Support for such having an independent chairman has cooled in recent years. In 2012, nearly 35% of shareholders who were given a chance to vote on splitting the chairman and CEO roles backed such proposals, according to ISS Corporate Solutions.

At KeyCorp, investors in 2012 approved stripping Beth Mooney of her chairmanship.The Cleveland company's board decided to go against the nonbinding vote and instead expanded the duties of Key's lead independent director.

Only 26% of Key's shareholders

About a third of JPMorgan Chase's voting shares supported having an independent director replace Jamie Dimon as chairman, while 30% of shares at Bank of New York Mellon supported a plan to replace Gerald Hassell with an outside chair.

Still, some industry observers said it makes sense to divide the titles.

"It has also always been a good corporate governance practice to have a split between the two," said Brian Kleinhanzl, a managing director at KBW.

"There are times when it makes sense to separate those roles, but it's also not a one size [fits] all decision," said Laura Hay, a managing director at Pearl Meyer. "A lot of it has to do with where that organization is in their strategy and if they have … identified someone who can be helpful in a chairman role."

One argument has been that, by splitting the roles, a CEO can focus on day-to-day operations while the chairman devotes time on areas such as regulatory compliance, corporate governance and succession planning. A counterargument holds that a company can accomplish that goal by having a strong lead independent director.

"The titles matter, obviously, but they don't matter as much as the real responsibilities," said Dan Siciliano, faculty director at the Arthur and Toni Rembe Rock Center for Corporate Governance at Stanford Law School.

Votes on separating the chairman and CEO titles are often viewed as a referendum on a company's performance, industry experts said. It can be perceived "as a vote of no confidence" when the CEO loses his or her chairmanship, Hay said.

Bank shareholders were generally supportive of executive compensation this year — another issue viewed as a vote on performance — even though many financial firms have had difficulties boosting earnings in recent quarters.

That being said, a number of companies received less support than they did in prior years. At Citigroup, backing for executive compensation fell to 64% from 85% in 2014. Support at Goldman Sachs fell to 66% from 97% two years earlier.

"I think overall what you're looking at is general frustration" due to a decline in stock prices and earnings, Kleinhanzl said of the compensation votes. "I think especially with all the large banks what you've seen is just … [a reflection of a] relatively weak macro environment."

Though executive compensation has declined, "people are a little frustrated that comp isn't coming down" at a faster rate, Kleinhanzl said.