William J. Reuter just closed his second deal in several months.

The chairman and chief executive of Susquehanna Bancshares Inc. of Lititz, Pa., says it is unlikely that he will be doing any more in the near future given the state of bank M&A.

"Things are a little on the quiet side right now," says Reuter, 62. "I think there are a lot of banks out there that can't get for their franchise anywhere near what they thought it was worth."

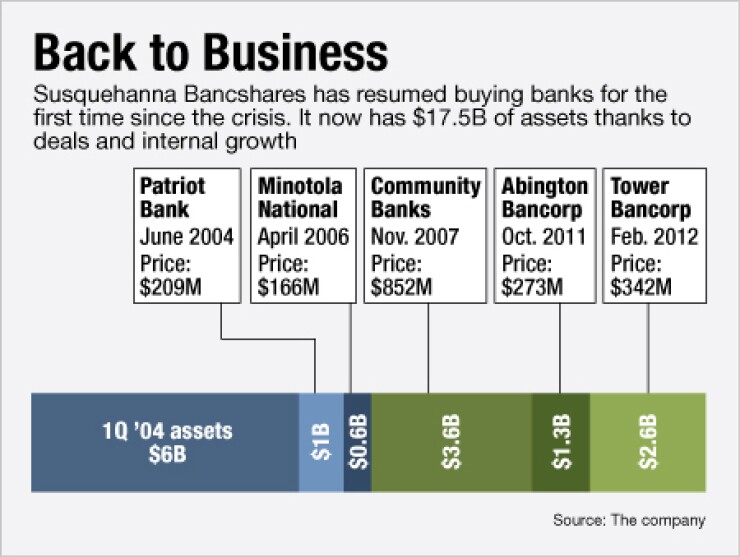

With deals off the table for now, the $17.5 billion-asset company intends to spend the rest of 2012 integrating Tower Bancorp Inc. and Abington Bancorp Inc. while using its bigger profile to steal customers from other banks.

"Our principal focus is ratchet up internal growth rates," Reuter says, adding that hitting its target of 5% annualized loan growth would be akin to "picking up a free bank."

The deals were connected, Reuter said. The way Abington was structured left Susquehanna with $85 million in excess capital. Its options were to use it to repurchase stock, pay out a bigger dividend or do a deal.

Susquehanna chose a deal because Tower greatly enhances its growth prospects. Tower and Abington added 70 branches and $3.9 billion of assets. It is now one of the top three in deposit share in at least 14 counties where it operates, he said.

Wall Street prefers that banks play it safe at the moment, Reuter said.

"Basically, the market doesn't like M&A," Reuter says. "Any time you announce [a deal] the stock is going to take some kind of hit."

Finding banks worth buying has been tough

"The other nine or ten didn't go anywhere," Reuter says.

Susquehanna wants to do further deals, particularly in the region Reuter describes as a "triangle" between Philadelphia, Baltimore and Lancaster, Pa. The region is dominated by small banks, which makes doing deals hard because "there is not a lot that moves the needle for us," Reuter says.

The bank could also at some point move into attractive regions further south such as Richmond, Va,, and the Maryland suburbs of Washington D.C., Reuter said. But those are distant ambitions.

Regulatory pressures and rising stock prices should compel mergers to pick up, perhaps by the end of 2012, Reuter predicted.

"I think the first six months [of 2012] will be slow," he says. "I do think you are going to end up seeing a roll-up of a lot of banks."

Susquehanna's profits of $55 million last year were 72% higher than in 2010.