Call them the community bank survivors who are now claiming their reward for making it.

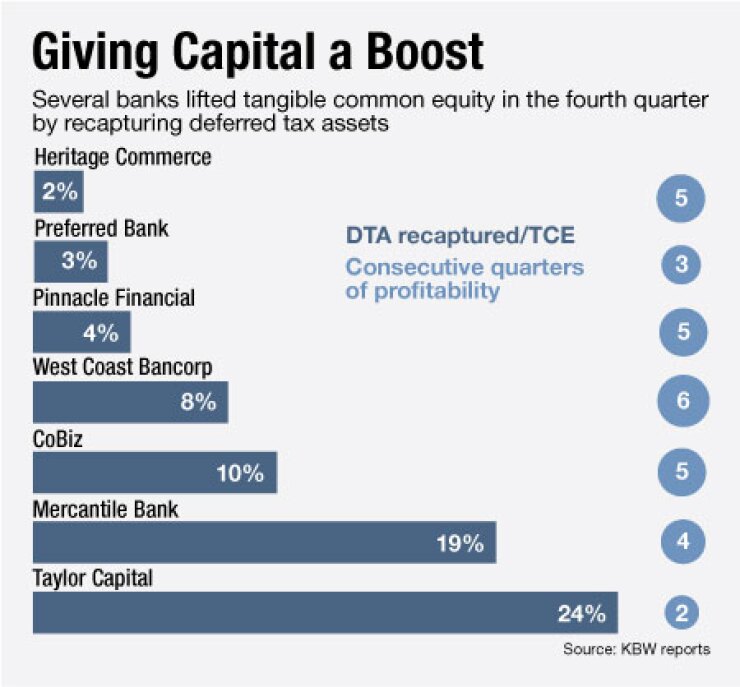

In the fourth quarter, several community banks were able to convince outside auditors that profits were here to stay so they could use tax assets created at the onset of the economic downturn when credit costs soared. Such assets were taken off balance sheets after several quarters of losses, when profitability seemed like a distant notion.

Banks that recaptured their deferred tax assets, or DTAs, have toughed it out, reaching a point where the worst days are seemingly in the past. While many of the banks are still sorting through credit issues, the recapture is considered a major confidence builder.

"It is an inflection point for these banks," says Joe Gladue, an analyst at B. Riley & Co. "You can't retake it unless you can convince the auditors that you have demonstrated the ability to make money."

The

For instance, Taylor Capital Group in Chicago reclaimed $73.2 million in deferred tax assets in the fourth quarter; its tangible book value per share rose 47% from a quarter earlier, to $10.84. Along with $35 million of new capital, the recapture also lifted the company's tangible common equity ratio by 344 basis points, to 6.6%, according to a report from KBW Inc.'s Bruyette & Woods Inc.

John Barber, a KBW analyst, said in an interview that better tangible book values should help banks raise capital at more-attractive terms, helping them exit the Treasury Department's Troubled Asset Relief Program.

Taylor's reversal came sooner than expected, based on another KBW report. KBW analysts expect another 14 or so banks to make meaningful DTA reclamations in 2012. There is no standard for sustained profitability before a company can reclaim a DTA, though various auditors say three to six quarters is a good rule of thumb.

Taylor was profitable for just two quarters. Randall Conte, the the $4.6 billion-asset company's chief financial and operating officer, said in an interview Wednesday that its Cole Taylor Bank was profitable throughout 2011.

Conte joined Taylor shortly after it booked a $60 million valuation allowance against its deferred-tax asset in the third quarter of 2008. Taylor used a "fix and grow" strategy, shrinking a $500 million book of residential construction loans in 2008 to roughly $64 million at the end of last year. Taylor also expanded commercial-and-industrial lending and created asset-based lending and mortgage divisions.

"We finally got to a point where our diversification was paying off, revenue was up and our credit costs were down," Conte said. "It became apparent to us that it was more than likely we would be able to utilize that tax benefit going forward."

In other words, management was confident the company had returned to the black and its auditor, KPMG LLP, agreed. Taylor's stock has risen 13% since the company announced the reversal after the market closed on Jan. 24.

While Taylor reclaimed its entire DTA, KBW warned in an early January note that not every bank will be able to. Some are doing it in spurts, and others permanently lost some of the benefit through highly dilutive recapitalizations that triggered change of control penalties. Taylor completed several capital raises in recent years, but always structured the deals to avoid the penalty, Conte said.

Preferred Bank, a Los Angeles lender, completed partial recaptures in the third and fourth quarters. Its initial valuation allowance was $30 million, but it could lose $5 million to $6 million of it because of a $77 million capital raise in the second quarter of 2010. The $1.3 billion-asset bank was undercapitalized at the end of 2009 and needed the capital.

"When we were weighing survivability, there was no real decision to make there," said Edward J. Czaika, the bank's chief financial officer, in an interview Tuesday. "It was painful, but it needed to be done."

Czaika said the boost to capital should have a trickle down to shareholders. "This is capital boon to banks. I imagine a lot of banks will want to start paying dividends again and will look to use it grow."