Nashville might have a new topic to croon about: Tennessee bank failures.

Regulators have not seized a single bank in the state since 2002. During the recent financial crisis, Tennessee benefited from a relatively stable economy and a state banking commissioner with a reputation for doing his best to keep banks from failing. That could soon change.

"The pangs are now spreading to other states," says Walter Moeling 4th, a partner at Bryan Cave. "Tennessee has been immune so far, but nobody is immune to a four-year recession."

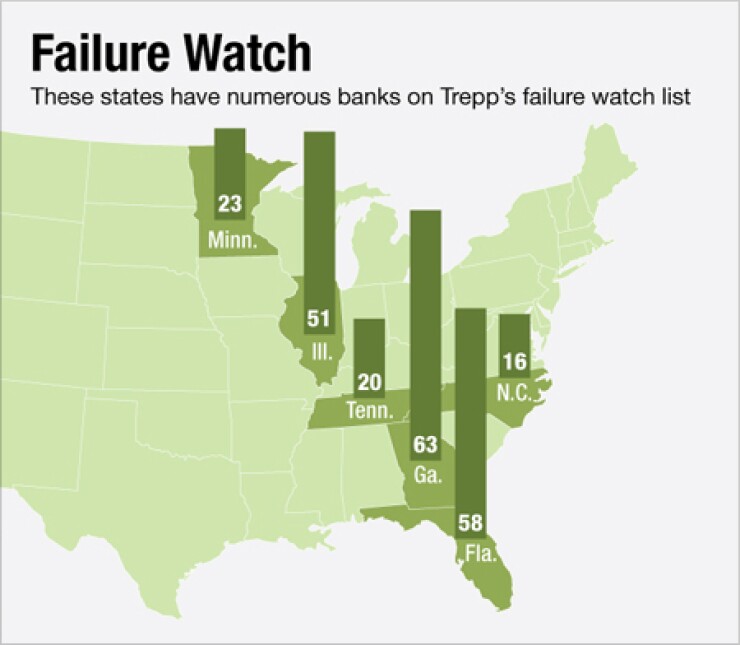

Data from Trepp Inc. shows Tennessee was sixth on its list of states with the most banks at risk of failing. There are 20 banks based in the state on Trepp's failure watch list, with 12 of those having a high risk of being taken over, based on Sept. 30 data. A year earlier, there were 13 Tennessee banks on the watch list, with three of those at high risk of failure.

"Tennessee is noticeably worse off [now] than it was in 2010," Trepp's Matthew Anderson says.

Leading a possible failure pack is the $1.2 billion-asset Tennessee Commerce Bank in Franklin,

Tennessee Commerce's equity quickly eroded last year following an examination by the Federal Deposit Insurance Corp. The bank also

Regulators gave the bank until the end of last year to boost capital ratios. Its holding company, Tennessee Commerce Bancorp Inc., hired investment bankers to help it solve its capital woes, but last week the company

Calls to Tennessee Commerce were not returned.

Data from Loan Workout Advisers, a Chicago bank consulting firm, shows that at Sept. 30, the latest date for which data was available, there were five other undercapitalized banks in the state besides Tennessee Commerce: BankEast in Knoxville, Bank of Bartlett, Community South Bank in Parsons, Farmers Bank of Lynchburg and Mountain National Bank in Sevierville.

Being undercapitalized is not necessarily a death knell, but all of the banks are operating under consent orders with regulators and need to make marked progress or find additional capital to have such orders lifted. Calls to those five banks were not returned.

The banks do have some things working in their favor. For instance, Tennessee's economy has remained middle-of-the-road, if not relatively strong. Its unemployment level in December was 8.7%, compared with 8.5% nationally, according to data from the Bureau of Labor Statistics.

While unemployment in Tennessee is high, it is well below the rates of the nation's hardest-hit states, such as Georgia (9.7%) and Florida (9.9%).

State-chartered banks also have Greg Gonzales, the commissioner of the Department of Financial Institutions. He was unavailable for comment, but several banking lawyers say Gonzales has given struggling banks as much room as possible to figure out how to address their problems. Gonzales wants to avoid as many failures as he can, lawyers say.

As evidenced by last year's failure of Community Banks of Colorado,

"His resolve to hold the line on bank failures is being severely tested, as numerous institutions within the state cross the capital adequacy point of no return," Justin A. Barr, the president of Loan Workout Advisers, said by email Thursday.