WASHINGTON — The prospects for significant reform of the Dodd-Frank Act appear to be cratering as the political dynamic on Capitol Hill has quickly deteriorated in the wake of controversial executive orders by President Donald Trump.

After the November election that swept Trump into power and allowed Republicans to maintain majorities in the House and the Senate, bankers were optimistic that comprehensive reg reform could pass this year. Some had even hoped it might happen quickly.

But Democratic distaste for Trump's Cabinet appointments, lingering resentments over GOP blocking of former President Obama's Supreme Court nominee last year and contentious executive orders on immigration have soured relationships between the two political parties. Democrats boycotted the confirmation votes for several Trump picks, including Treasury Secretary-designate Steven Mnuchin, amid charges that the nominees had misled lawmakers.

What's left is an atmosphere of animosity and distrust on Capitol Hill, one that bodes poorly for any reform bill.

“We believe efforts to modify Dodd-Frank and provide regulatory relief to banks will take longer than expected and deliver less upside than expected,” said Jaret Seiberg, an analyst at Cowen Group, said in a note to clients.

Most major Dodd-Frank reforms will require bipartisan support in the Senate. With only a narrow majority, Republican’s won’t be able to overcome the needed 60-vote hurdle to override a filibuster. While some Democrats have been open to community bank regulatory relief and acknowledge that Dodd-Frank could be improved, it will be hard for bipartisan negotiations to take place as political drama is likely to envelop Congress.

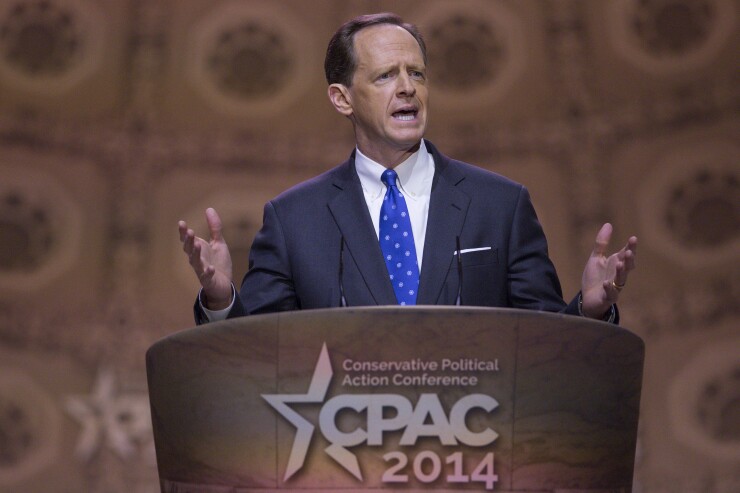

To be sure, Republicans have some tools available to them to act unilaterally. For example, Senate Banking Committee member Sen. Pat Toomey, R-Pa., is planning to use the budgetary reconciliation process — which requires only a majority to pass and cannot be filibustered — to make changes to Dodd-Frank. But what he is able to get is likely to be far less than what bankers had been hoping for.

“When the Trump administration needs legislation to implement its agenda, Democrats are likely to oppose it,” Brian Gardner, a policy analyst at Keefe, Bruyette & Woods, said in a note to clients. “That means Republicans might be able to pass only limited changes to Dodd-Frank.”

Howard Headlee, the president of the Utah Bankers Association, acknowledged there are bigger issues out there right now for the administration and GOP lawmakers, including tax reform and tackling the Affordable Care Act.

"I still remain confident that the really smart people inside the Beltway understand that Dodd-Frank reform is central to everything they hope to accomplish," Headlee said. "You can’t have the kind of job growth and income growth that they want to have without at least some Dodd-Frank reform.”

Headlee also pointed to another scenario, which he gave a “very small chance” of likelihood, that would help unravel Dodd-Frank while further poisoning the relationship between Democrats and Republicans.

“If the partisanship gets so extreme and so baked in, it could work to our favor in my view if you have a complete collapse of the decorum in the Senate,” Headlee said. Trump "may start demanding that the Republicans start to cut through the process to get his agenda through. If that becomes the standard, everything changes in terms of what is likely to get done.”

Trump has already told Republican leader Sen. Mitch McConnell to go “nuclear” and eliminate filibuster rules for Supreme Court nominations if Democrats block nominee Neil Gorsuch. Such a move would be viewed as dramatic, but if that becomes the norm, Headlee said, “everybody is numb to it and it devolves into a full-blown locomotive” of Republicans finding ways to push through Trump’s agenda, which includes dismantling Dodd-Frank.

It is still early days, however, and most are hoping Congress can come together and repair damaged relationships.

“We are concerned with the very quick, partisan bickering on Capitol Hill,” said Paul Merski, executive vice president at the Independent Community Bankers of America. “We are only in early February and things are getting very tense, but I think once these nominations are in place and many of them are starting to shake loose and the focus is on the issue at hand, we expect to get reasonable bipartisan support” for Dodd-Frank reforms.

James Ballentine, executive vice president of the American Bankers Association, said it is "premature to judge the outcome of legislative changes to Dodd-Frank or other regulatory reforms based on the first month of the 115th Congress."

“There are many days left in the session and there is still a great deal of interests in the industry and amongst members of Congress to work on banking reforms," he said.

Observers also said banks may get regulatory relief even if there aren’t legislative changes.

“From my perspective, we were always extremely unlikely to see legislative changes to Dodd-Frank,” said Ed Mills, a policy analyst at FBR Capital Markets. “The important changes to Dodd-Frank were always about the personnel changes at these regulatory bodies, and that is largely on track.”