Bank of America Corp., which says Six Sigma statistical analysis has improved efficiency and saved it more than $2 billion, is now using the technique to speed up its deposit business.

The industry-standard midafternoon deadline may be one of the last vestiges of banker's hours.

Federal Reserve regulations bar banks from imposing a cutoff any earlier than 2 p.m. at a branch or noon elsewhere. Bankers have long said they need a midafternoon cutoff to post deposits and payments in their own back offices and then make deadlines at clearing houses and other trading partners later in the day.

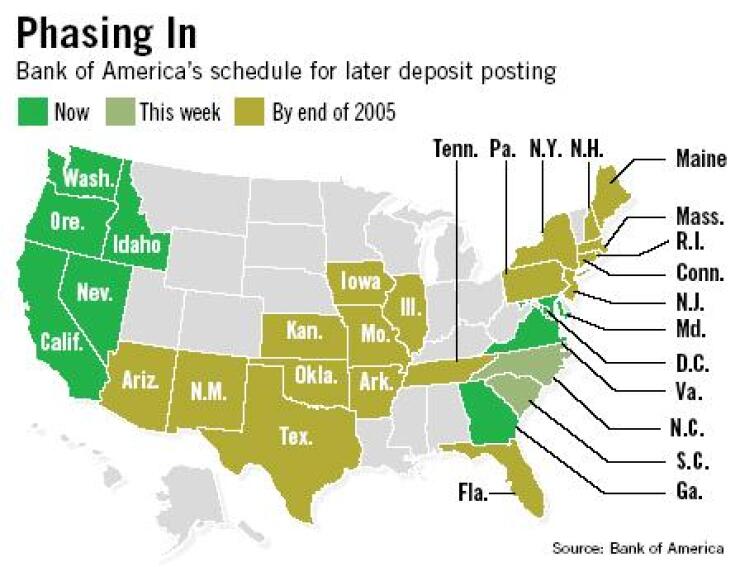

Since late February, with Six Sigma's help, B of A has been rolling out a late-afternoon deadline for customers to make deposits for same-day posting.

B of A's customers in eight states and the District of Columbia can now make deposits at its ATMs as late as 6 p.m. on weekdays and at branches as late as 5 p.m. (6 p.m. on Fridays) for same-day posting.

By the end of next year the Charlotte company expects the later deadlines to be in force at all of its locations. "It really is a national initiative," said senior vice president Christopher Marshall, its consumer operations executive.

Industry observers say Bank of America's later cutoff could increase customer satisfaction and attract business, especially from the owners of small stores who do not like being pulled away for that midafternoon trip to the bank.

And, the deadline change will probably open a new front in the battle for retail market share.

Jerry Milano, a senior vice president at Clearing House Payments Co. LLC (a successor to the New York Clearing House) and the head of its National Check Exchange operation, applauded B of A's move.

"Obviously there will be a market reaction. The world doesn't stand still," Mr. Milano said.

Bank of America's initiative is "gutsy for a bank of that size," he said.

B of A operates the nation's largest retail banking network: about 6,000 branches and more than 16,000 ATMs in 29 states.

In February it pushed back deposit deadlines in California, Mr. Marshall said. Later deadlines are now in force in Georgia, Maryland, Nevada, Oregon, Idaho, Virginia, and Washington state, he said, and North Carolina and South Carolina are expected to switch this week.

The process will continue through the fourth quarter and next year until the entire system is converted, he said.

Mr. Marshall said the bank used Six Sigma to make its check-processing system more efficient. The analysis technique was used to wring wasted time out of its back office sites, where the checks are handled, and to study truck routes for making deliveries more efficient.

"We began to solve for a different variable," Mr. Marshall said. "Instead of solving for Fed deadlines, we began solving for customer delight."

Bank of America is perhaps the financial services industry's strongest advocate of Six Sigma, which the company has used to improve a wide spectrum of business practices. Projects have included tracking spending and results on promotional parties, improving online banking features, and reducing expenses related to relocating employees.

Though customers are responding well to the new deadlines, Bank of America does not plan to promote them until it has made the switch nationwide, Mr. Marshall said.

"We are going market by market. It would be counterproductive to roll out a program that is available in Virginia and have someone in Massachusetts disappointed," he said. "Given our almost unique position as a national franchise, we have to be very careful."

But once announced, the later deadlines could prompt a scramble reminiscent of the one B of A triggered in May 2002 when it eliminated the $5.95 monthly fee for using its online bill payment service.

Until then most banks had considered bill-pay fees an important source of income. Since then, however, many have followed suit by eliminating their fees, though sometimes only for consumers who maintain a minimum balance.

Edward Neumann, the managing director of consulting at Javelin Strategy and Research of Pleasanton, Calif., said the later deposit deadlines are likely to have more effect on the competition for small-business accounts than for consumers.

"We don't think it moves the needle that much on the consumer side," because so many retail transactions today, payroll deposits in particular, use direct deposit, Mr. Neumann said.

But "small businesses would be willing to switch banks if they were given extra time" in the afternoon, he said. Every hour a bank delays the deposit deadline "is real dollars to them."

Mr. Neumann said he knows of some other banks that plan to extend the deadline, though he would not identify any. B of A may upset their timing, he said.

Spokespeople for half a dozen major banks contacted for this story would not say whether they intend to adjust their deposit deadlines; said executives who could discuss the question were not available; or did not respond to messages by deadline.

One banker who did speak was Thomas S. Kunz, a senior vice president and the director of payments and e-business at PNC Financial Services Group Inc. of Pittsburgh.

Though Mr. Kunz would not discuss the B of A effort, he said preparations for digital check imaging will make it easier for banks to offer later posting deadlines, especially at ATMs.

Once banks can convert a check into an electronic file at the point of presentment, they will be able to transmit those files to processing sites almost instantly, Mr. Kunz said. No one will have to go to the back of an ATM to collect the checks for processing.

U.S. Bancorp of Minneapolis said it already offers an end-of-day cutoff in 85% to 87% of its markets. Charles Tufts, its executive vice president of retail services, said a predecessor company, Star Banc Corp. of Cincinnati, had offered what he called "end-of-day balancing" since the mid-1990s.

Avivah Litan, a vice president at the research and consulting firm Gartner Inc. of Stamford, Conn., said preparations for the Check Clearing for the 21st Century Act could make it easier for other banks to follow Bank of America's lead.

Check 21 will take effect late next month. Banks have "sunk so much money into this infrastructure that they want to get benefits immediately," Ms. Litan said. Other banks are likely to follow B of A "if they have the infrastructure in place."

But Mr. Marshall said that though improved technology certainly helped B of A push back its deadlines, digital imaging "really wasn't a factor at all."

"There may be added benefits of having … [later deadlines] in place when Check 21 rolls out," he said, but the law "was not the driving factor."

Gail Hillebrand, a senior attorney in San Francisco for Consumers Union, said a later deposit deadline may not do consumers much good unless banks also start clearing checks faster.

The deadline extension "won't help if they put a hold on your deposit," Ms. Hillebrand said. "This is good, but there's still more to do."

Banks can hold checks for as long as two days before making the funds available if the depositing and the paying bank are in the same Federal Reserve district, or up to five days if they are in different districts. Bankers say they typically make funds available faster but need to be able to place holds if they suspect fraud.

Diane Wagner, a spokeswoman for B of A, said it will continue to put holds on nonlocal checks, foreign checks, and those that are subject to its standard policy on holds.