When Stewart Greenlee joined CenterBank of Milford, Ohio, as its chief executive 18 months ago, he set an ambitious goal: Transform the tiny bank into a Cincinnati-area powerhouse with $1 billion of assets.

With one deal — for the troubled Peoples Community Bancorp Inc. of West Chester — the $87 million-asset CenterBank would nearly reach that lofty target.

Late Friday, CenterBank announced that it has struck a deal to acquire the deposits, branches, and most assets of the $769 million-asset Peoples. The deal would include Peoples' performing commercial and residential loans, but none of its nonperforming loans, which at June 30 made up nearly 7% of its total.

Mr. Greenlee said in an interview Monday that CenterBank officials "looked deeply at the portfolio" and determined that the benefits of making the deal outweighed the risks. The eight-year-old CenterBank has just two branches, and buying Peoples would give it 19 more in one of Ohio's healthiest markets and boost its deposit share in the Cincinnati area from 0.14% to 1.92%, according to Federal Deposit Insurance Corp. data.

"This is a lot faster way to get" to $1 billion of assets than trying to grow organically, according to Mr. Greenlee, who was the president of Fifth Third Bancorp's mortgage unit before joining CenterBank. "Peoples has one of the best retail banking franchises in Cincinnati, with wonderful facilities and great locations."

Peoples officials did not return calls for comment, but it seemed as if the company had little choice but to sell itself to a healthier one.

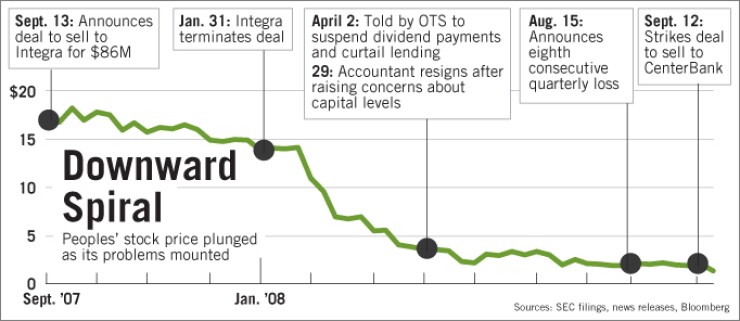

One of Ohio's oldest thrift companies, Peoples has lost money in eight straight quarters as loan losses in its commercial real estate portfolio have piled up. Its stock has lost nearly all its value, and since March it has been operating under a strict enforcement order from the Office of Thrift Supervision that virtually bars it from making new loans. A year ago its struck a deal to sell itself to Integra Bank Corp. in Evansville, Ind., but Integra called the deal off four months later.

Peoples still owes Integra $17.5 million for a line of credit that came due June 30.

CenterBank said it would pay a 5.5% premium on Peoples' deposits, though a total price has yet to be finalized.

The price would undoubtedly be well below the $85.6 million, or $17.69 a share, that Integra had agreed to pay, and just a small fraction of what Peoples would have fetched before its loan problems surfaced in late 2006.

Peoples' shares closed at $1.45 Monday.

Other banking and thrift companies in Peoples' position have been forced to sell themselves at bargain-basement prices. In June, for example, PFF Bancorp Inc. in Rancho Cucamonga, Calif., said it was being acquired by FBOP Corp. of Oak Park, Ill., for just $1.35 a share. A year earlier PFF's shares were trading at close to $30.

To get the Peoples deal done, and to facilitate future growth, CenterBank agreed to receive an $80 million equity investment by Community Bank Strategic Equity Fund LLC, a private equity fund in St. Paul that specializes in helping institutions with $50 million to $500 million of assets grow.

"CenterBank has strong management team, and we are going to be able to preserve the deposit franchise and not disrupt the good borrower base," Chip Dickson, managing director for the fund, said in an interview Monday. "What will be left is a very strong company prepared to serve the market."

The parties "were definitely in touch with regulators" as the deal was being negotiated, Mr. Dickson said, though he would not say if it was a forced sale.

"There were a lot of parties involved," he said. "We were working with them."

CenterBank has had some credit-quality problems of late as well. It had $2.3 million of nonperforming loans, of 3.48% of its total, at June 30. It lost $399,000 in the quarter, compared to earnings of $10,000 in the same quarter a year earlier. Mr. Dickson pointed out, however, that the percentage of problem loans would be much smaller once CenterBank becomes a bigger company.

As part of the deal, CenterBank plans to convert from a state commercial bank charter to a federal thrift one, and Mr. Greenlee said could it be in for a name change, too.

The deal, slated to close this year, would make CenterBank one of the largest locally controlled community banks in the Cincinnati market, and it would "want a name that really tells people who we are," he said.

Peoples would not go away entirely.

Though it would cease normal bank operations, the company said its holding company would remain to deal with managing the troubled assets, as well as to take care of its debt to Integra. A forbearance agreement Peoples had for the debt ended Monday.

Jeff K. Davis, an analyst with First Horizon National Corp.'s FTN Midwest Securities Corp., who covers Integra, said that Peoples could pay Integra with the proceeds from the sale. However, "the deal has to close, and based on what we are seeing, this is a complicated transaction."