Investors have been heartened to see troubled banks replace leadership or repay bailout money, but they still are finding hard numbers deep in the books that are reinforcing their more surface perceptions of the industry's "haves" and "have-nots."

Concerns about credit quality, depressed returns and the accounting methods applied to hard-to-value assets are holding down price-to-book ratios for some banks, which by this point probably need no reminder of the consequences of poor lending decisions.

Meanwhile, the list of bank stocks trading at or above book value - or total assets minus intangible assets and liabilities - tends to read like a rehash of the companies seen coming through the crisis in a relatively strong position.

"Investors are trying to separate the survivors from those that might be permanently impaired," said Brad Evans, a portfolio manager with Heartland Advisors, a Milwaukee fund manager that specializes in value investing. "You still have banks perceived to have high financial risk because of the employment of debt or leverage in their business model combined with very high perceived operational risk. You put those two things together and that results in very depressed multiples by book value" for stocks inviting the most investor concern.

A low price-to-book ratio sometimes is the sign of a stock that is simply underappreciated by the market.

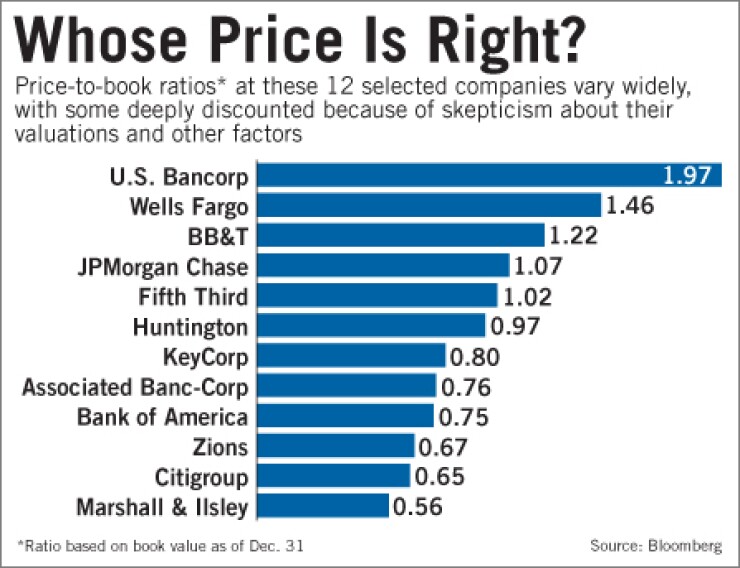

But that may not be the case for Citigroup Inc., Bank of America Corp. and Zions Bancorp and other institutions currently trading at steep discounts to book value.

Meanwhile, JPMorgan Chase & Co. has a price-to-book ratio of 1.07, meaning shareholders are giving the company full credit for its reported book value, and then some. Wells Fargo & Co., U.S. Bancorp, BB&T Corp. and New York Community Bancorp are among the other institutions trading at more than one times book value.

Money managers and analysts say that in this environment, bank stocks that trade with low price-to-book ratios most likely are being penalized either for credit quality trouble or low returns. There also is a possibility that stated book values are simply mistrusted by a market that has had a hard time making sense of how banks account for assets, leading investors to dock the share prices of companies suspected of keeping items on the balance sheet at inflated prices.

That's the line of demarcation that Joe Peek, a finance professor at the University of Kentucky's Gatton College of Business and Economics, sees in the price-to-book ratios of different bank stocks. He noted that Goldman Sachs Group Inc., which trades at 1.45 times book value, marks nearly all its assets to market. Citi, in comparison, has a mix of assets — some marked to market under fair-value accounting rules and others held at amortized cost. In any case Citi investors have complained they are perplexed as to how the values are determined and whether they can be considered reliable.

Citi's price-to-book value of 0.65 "is saying investors aren't being fooled by the accounting," Peek said. "The banks don't have to mark everything to market, but investors do, so they're marking the banks to market."

Jason Polun, a bank industry analyst at T. Rowe Price Group Inc., agreed that low price-to-book valuations may indicate that "some people out there just don't believe book." But he said skepticism over the accounting used to arrive at book value "was much more of a presssing story in 2007 and 2008, when there was much more of a disclosure issue."

The financial crisis prompted changes in accounting standards that improved the clarity with which banks report asset valuations, Polun said, making skepticism over the veracity of reported book value a smaller, though still plausible, reason for the low price-to-book ratios assigned to certain bank stocks.

A new regulation that brought off-balance-sheet assets onto banks' books this year might have complicated investors' independent calculations of book value, but bank executives were forthcoming enough about the expected effect that many analysts said they remain confident in their book value estimates for banks most heavily affected by the rule change.

That may help banks rebuild faith in their reported numbers. But the best thing a bank can do to lift its price-to-book ratio may be the thing that takes the longest: waiting out the credit cycle and proving that assets suspected of being valued under "delay and pray" or "extend and pretend" — the strategy of reworking loan terms and hoping for the best — are in fact worth their reported values.

"There's a very high level of fear regarding the commercial real estate market and the later-stage credits as we come through the cycle," Heartland's Evans said. "If the credit situation turns out to be less bad than people expect, then I would guess that the banks are probably pretty attractive here" on a price-to-book basis.