Frank Williams Jr. wants to win from losing.

On Friday, Williams, who owns steel companies throughout the East Coast, took a controlling stake in Greater Atlantic Financial Corp., whose bank failed in late 2009. The shell has nothing to its name — except for $30 million in operating losses.

Using tax benefits from carrying forward those losses, Williams, as the chairman and chief executive, intends to resuscitate the Reston, Va., company and turn it into a consolidator.

If he can successfully merge some profitable community banks into Greater Atlantic and still use the carryforwards, then Williams could create returns. In doing so, he could become the first activist investor to pull off such a strategy, observers say.

Net operating losses "are often one of an undervalued company's hidden assets because it is not quite as apparent as cash is when you look at a balance sheet," says Damien Park, a managing partner at Hedge Fund Solutions LLC.

"There are plenty of companies that are targeted by activist investors because they have a lot of [net operating losses] and they're usually operating companies that have a lot of cash as well," Park says.

"But it is not an easy thing to do."

Observers say such a strategy has yet to be executed successfully because it's rife with challenges. Crucial hurdles include finding the right target, getting regulatory approval and meeting the accounting standards for the tax benefit.

"The ability to utilize [net operating losses] and from a failed bank holding company to acquire others is probably going to be very limited," says Bill Massey, a certified public accountant at Saltmarsh, Cleaveland & Gund in Florida.

"Even for people trying to buy a bank with lot of NOLs, you're going to lose probably 95% of" the benefit.

Many banking companies tapped loss carryforwards during the recession. But some hit a wall as they sought capital or a merger because of a tax code that deems the net operating losses as "impaired" if owners of a certain threshold trigger a change in control.

Even Williams, who is still seeking advice on his strategy, wonders whether it could be done.

"I don't know whether that's going to work," he says. "I'm still looking at how to utilize that shell to, quite frankly, shelter income … that could very well include acquiring other banks."

Williams has taken risks in banking before. Most recently, he settled a proxy fight with Alliance Bankshares Corp. in Chantilly, Va., nominating two members to the company's board.

One of his nominees, Douglas McMinn, resigned June 30. Williams declined to comment on the resignation and McMinn could not be reached for comment.

Investing in Greater Atlantic "was a gamble … and I do a fair amount of gambling in this market," Williams says. "Some you win and some you lose."

Williams' biggest win was when he invested and joined the board of a community bank in Rockville, Md., 25 years ago, once known as Capital Bank. The bank eventually sold at 3.4 times book to FCNB Corp. in Frederick, Md., which later sold to BB&T Corp. of Winston-Salem, N.C., of which Williams says he is "a great admirer" as an investor.

Williams did not become an activist investor until 2009, when he filed a proxy fight with Alliance, accusing management of not "sticking to their knitting." The parties settled early last year; the company replaced its CEO and added four seats to the board.

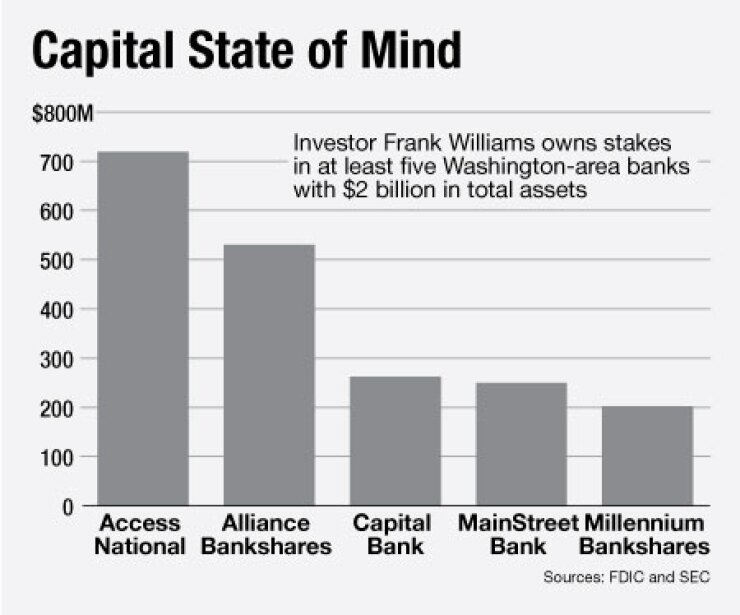

Aside from Alliance, Williams has stakes in more than a dozen community banks, mostly in the Northeast. Recently, he has moved aggressively into northern Virginia.

Running a bank may bring a whole new set of challenges.

For now, Williams "has no regulatory requirements," says Harold Reichwald, a lawyer at Manatt, Phelps & Phillips. That would change if he finds a bank to buy since he would need to have Greater Atlantic recognized — again — as a bank holding company.

Williams acknowledges that regulatory requirements are likely looming, adding that he is working on getting the right management team in place.

The company only has three employees, including Williams. But the son of a Georgia banker says he has no intention of running Greater Atlantic as CEO over the long run.

Nor does he want to miss a renaissance of mergers and acquisitions in the banking industry.

"There will be major consolidation in community banking over next few years," Williams says. "I don't want to say [banking] is a hobby but you could say it's a second life for me, as opposed to construction."