Wells Fargo has seen demand for business loans shrink substantially during the pandemic but expects it to pick up in the second half of this year as the U.S. economy rebounds.

Borrower demand remained muted during the first quarter, but exceptionally strong credit performance and a smaller loss allowance bolstered the company’s results. Shares in Wells Fargo rose by more than 5% after executives said that they anticipate growth in commercial loans later this year, which would buoy the firm’s sagging interest income.

“The demand across really most commercial client segments has been pretty weak,” Chief Financial Officer Mike Santomassimo said Wednesday during the company’s quarterly earnings call. “But we do really expect to see … demand start to pick up as the economy picks up.”

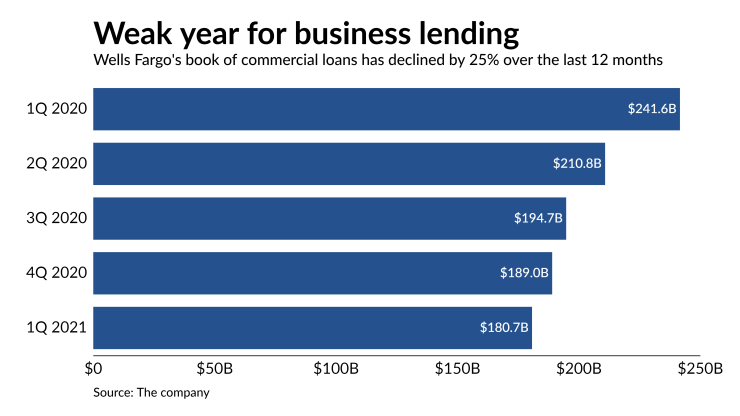

At the end of the first quarter, Wells had total loans of $180 billion in its commercial banking segment, down 25% from the same period in last year’s first quarter, when many commercial borrowers drew down credit lines in the early stages of the pandemic. Total commercial loans were down by 20% from the fourth quarter of 2019.

Since 2018, Wells Fargo has been operating under an order from the Federal Reserve that prohibits it from growing assets beyond $1.95 trillion, but Santomassimo indicated that regulatory restrictions are not a factor in the recent decline in commercial loan balances. “At this point, the asset cap is not constraining us from offering support or credit to our core customers, whether it’s on the consumer or commercial side,” he said during a call with reporters.

JPMorgan Chase, which also announced its first quarter results Wednesday at the kickoff of earnings season, offered a somewhat less optimistic outlook about commercial loan demand.

Chief Financial Officer Jennifer Piepszak said that commercial loan growth will likely remain muted for some time, but she cast that conservative outlook as a positive factor for the U.S. economy, since it suggests that business owners are shoring up their balance sheets. “Whether we see that pick up later this year or next year,” she said during the company’s earnings call, “remains to be seen.”

JPMorgan reported that average loans in its commercial banking division during the first quarter were down 2% compared with the same period a year earlier.

For Wells Fargo, the flip side of weak commercial loan demand is that credit quality has been pristine. In the first quarter, the company reported only $39 million in commercial net charge-offs, down from $170 million a year earlier.

Despite the sparkling loan performance in the near term, potential troubles lurk for Wells Fargo in certain asset classes. Commercial real estate loans that are in nonaccrual status nearly doubled over the last year to $1.76 billion. Properties that have hotels, offices and retail space have all shown signs of weakness.

“As we have done since the start of the pandemic, we continue to closely monitor our exposure,” Santomassimo said Wednesday during the firm’s earnings call. “The reopening of the economy has had a positive impact on retail and hotel, as cash flow levels have begun to improve. That said, stress remains, and retail in particular was the driver of charge-offs in the first quarter.”

Wells reported first-quarter net income of $4.7 billion, up from $653 million a year earlier. The results were boosted by a $1.6 billion reduction in the allowance for credit losses, which compared with a $3.1 billion increase in the allowance during the first quarter of 2020.

Cost-cutting has been a priority for Wells Fargo since the arrival of CEO Charlie Scharf in 2019, but Scharf spoke Wednesday about plans to spend more money upgrading its digital channels.

“The way we kind of look at it internally is we're in the game, but we're not at all a market leader in terms of what our digital capabilities are. We have a very, very clear road map about what we intend to build out, and we would start to be bringing those things to market this year,” he said during the company’s earnings call.

Wells reported noninterest expenses of $14 billion in the first quarter, which was down by about $800 million from the fourth quarter of last year, but up by approximately $950 million from the first quarter of 2020.

The company reiterated that it expects expenses to come in at $53 billion this year, which would be down 8% from last year.

Allissa Kline contributed to this report.