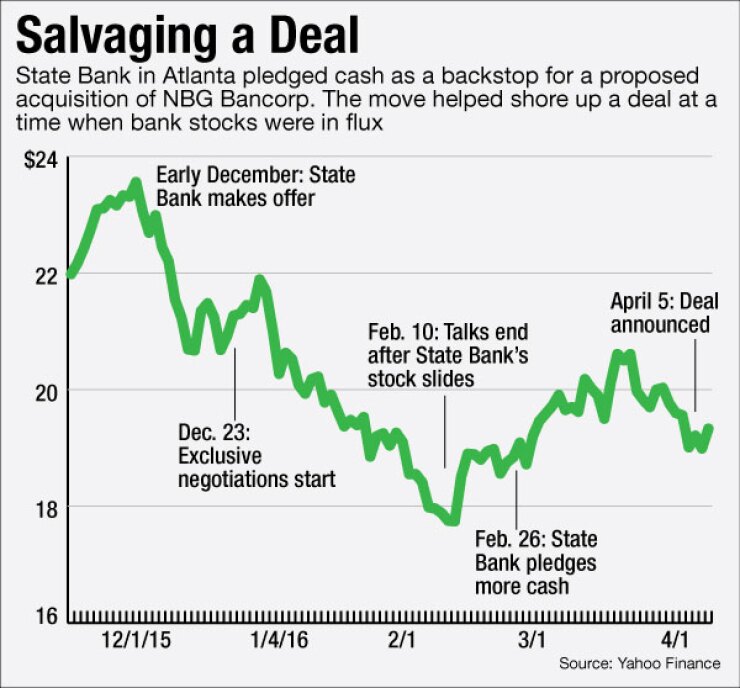

To steal a line from Yogi Berra, cash is just as good as money when you're trying to salvage a bank acquisition on life support.

State Bank Financial in Atlanta found that out during negotiations to buy the $375 million-asset NBG Bancorp in Athens, Ga. It agreed in early April to buy NBG for $68 million in cash and stock.

But the $3.5 billion-asset State Bank had dangled an all-cash option earlier in the year to keep NBG engaged after the deal nearly fell apart, State Bank disclosed this week in a regulatory filing.

-

State Bank Financial in Atlanta has agreed to buy NBG Bancorp in Athens, Ga.

April 5 -

State Bank Financial in Atlanta has agreed to buy S Bankshares in Glennville, Ga.

May 19 -

State Bank Financial in Atlanta just hired a lending team that will take its SBA lending operation to the next level. The moves comes as the SBA reports a record number of 7(a) loans.

May 9

The problem? State Bank's stock price plummeted by 19% between late December and mid-February to $17.74 a share because of broader volatility among bank stocks. The swoon happened shortly after NBG had agreed to exclusive negotiations, and it broke off negotiations as a result.

By late February, State Bank's stock had rallied to above $19 a share, prompting the company to return to NBG in hopes of rekindling talks. NBG, however, refused to return to the table unless a new proposal "included a minimum purchase price that would be paid regardless of the value" of State Bank's stock, the filing said.

State Bank agreed, pledging to pay the entire consideration — $45.44 a share — in cash if its stock fell below $18 at closing. Otherwise, the offer was evenly split between cash and stock. NBG agreed to resume negotiations.

The companies announced the deal on April 5. The day before, State Bank's stock closed at $19.56 a share.

The filing disclosed that another, unnamed bank was also invited to bid on NBG. That bank offered a deal valued at $44.17 a share, with three-fourths of the consideration involving stock.

State Bank has been a prolific acquirer since the financial crisis, shifting from failed banks to whole-bank transactions. The company agreed on Thursday to buy S Bankshares in Glennville, Ga.