Bank consolidation has been torrid in recent weeks, though it is unclear whether momentum will continue to build in coming months.

Eighteen deals, with a total value of more than $2.4 billion, have been announced since mid-July, marking the busiest two-week period in recent memory. While the overall numbers for 2019 still lag those of a year earlier, the latest flurry is providing indications that more deals could be in the works.

A number of factors could be contributing to the resurgence, industry observers said.

Buyers and sellers are finally coming to terms with pricing now that bank stocks have bounced back from a malaise that set in late last year, said Stephen Scouten, an analyst at Sandler O’Neill.

"The bid-ask spread was far too wide for several months," Scouten said. "There has been time for expectations to shift back down to reality for sellers, and we’ve seen some recovery in the share price for buyers."

Other factors could involve more sobering views on margins and loan production. While credit remains good, a number of banks have started reporting

Multiples are declining as activity picks up. The average price to tangible book value for a seller has fallen to 161% from 174% a year earlier, based on data from S&P Global Market Intelligence and Mercer Capital. The median price-to-earnings multiple is also down.

Sellers are recognizing that they may not get the valuations they want, but an economic downturn could reduce valuations even more, said Vincent Hui, managing director at bank consultant Cornerstone Advisors.

At the same time, more banks are looking at expansion as a way to offset revenue headwinds.

"The only real counter is scale," said Michael Jamesson, a principal at Jamesson Associates, a community bank consulting firm in Scottsville, N.Y. "And the easing of M&A prices may have convinced sellers that they will not get a higher price by waiting."

The last few weeks have included some of the year's biggest deals, including Valley National Bancorp's

Those deals have had relatively small premiums. Oritani is selling for 140% of its tangible book value, while the ratio for Old Line is 177%. The price Simmons will pay for Landrum represents 175% of the seller's tangible book value.

The reasoning for bigger deals may be more about long-term strategy, Scouten said. In addition to revenue pressure, buyers realize that they will need to invest more in technology and infrastructure to compete against bigger banks and nonbanks.

To be sure, activity for 2019 could still end up below that of a year earlier.

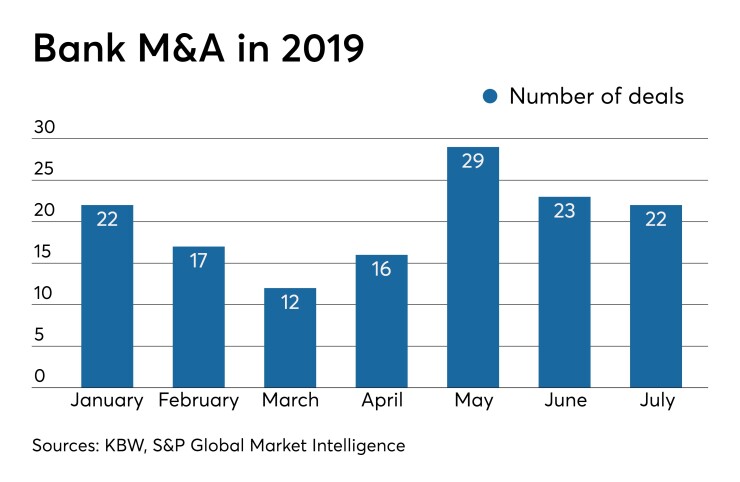

Banks announced 139 bank deals through July 26, representind a 16% decrease from a year earlier, according to data from Keefe, Bruyette & Woods and S&P Global. Overall deal value, excluding the

Other factors could help spur more deals, including a desire by closely held banks to provide shareholders with more liquidity and an exit strategy, said Lee Burrows, CEO of Banks Street Partners in Atlanta, which recently sold to Performance Trust. The view is that a weaker economy could make harder for those shareholder to shed their investments.

Succession concerns are another potential factor, Jamesson added.

There are plenty of family-owned banks that lack firm succession plans as the next generation shows a preference to cashing out, said Curtis Griffith, chairman and CEO of South Plains Financial in Lubbock, Texas. South Plains

"They're not having a whole lot of fun anymore," Griffith said.