In retrospect, Jamie Dimon’s comment that his bank could duplicate the capabilities of online lenders might have served as a warning.

“Can we do something like that? Of course we can,” the JPMorgan Chase Chairman CEO

The partnership got off to a strong enough start that, in 2017, the two companies announced they were extending their relationship for up to four more years.

But on Monday, JPMorgan said that it is pulling out of the partnership, and its explanation suggests that the $2.7 trillion-asset bank may now be in position to make good on Dimon’s promise from three years ago.

“It’s been a great collaboration with OnDeck,” JPMorgan said in a written statement. “They helped us create and launch an online loan application process that gave business owners faster decisions and easier access to credit, something we will continue to do on our own platform.”

JPMorgan’s withdrawal was a blow to New York-based OnDeck, which has

Part of the ODX unit’s premise was that certain technology developed for JPMorgan could be reused with other banks. But on Monday, OnDeck said that it took a $900,000 impairment charge during the second quarter for technology that supported the JPMorgan loan originations, suggesting that some of the technology it developed has no further value.

The online lender will continue to service loans that were previously originated by JPMorgan for up to two years.

In an interview, OnDeck CEO Noah Breslow argued that it would be wrong to assume that other banks will also ditch their technology partners after developing similar capabilities in-house.

“I think Chase is a very unique bank, in terms of its scale and its technology spend,” Breslow said. “I think what is true for Chase is probably actually not true for 99% of American banks.”

Under

In October 2018, OnDeck

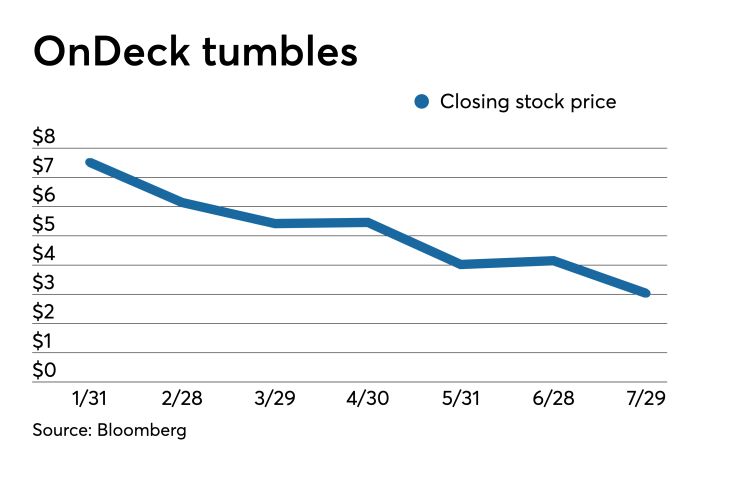

OnDeck’s shares plunged 23% Monday to close at $3.03, as investors were spooked by both the JPMorgan news and the firm’s disappointing financial results for the second quarter.

OnDeck reported net income of $4.3 million, which was down 25% from the second quarter of last year.

In addition to providing technology to other financial institutions, OnDeck makes its own small-business loans, many of them to companies that cannot qualify for a lower-cost bank loan.

While the firm’s loan originations increased by 1% to $591.8 million, its credit quality measures showed significant deterioration. The percentage of loans that were at least 15 days delinquent climbed to 8.5%, up from 6.8% a year earlier. OnDeck’s net charge-off rate rose from 11.2% to 15.1%.

Meanwhile, OnDeck revised its earnings guidance, saying that it now expects to record total net income this year of $12 million to $20 million, which is down from the company’s previous estimate of $20 million to $30 million.

"While we are not pleased about taking current-year guidance down, the changes we are making are positioning us for greater success in 2020 and beyond," Breslow said during the company's earnings call.

Breslow also said during the call that the benefits of OnDeck becoming a bank — which include a lower cost of funding, greater regulatory certainty and the ability to offer more products — outweigh the costs.

Breslow did not reveal a timetable for becoming a bank or say which type of bank charter OnDeck might pursue, though he did note in an interview that the options do not currently include the fintech charter developed by the Office of the Comptroller of the Currency.

He also said that the company’s decision to pursue a bank charter was unrelated to JPMorgan’s move.

Other fintech companies that have applied for bank charters include Square and Varo Money.

David Cotney, a senior adviser at FS Vector, a consulting firm that specializes in regulatory compliance, said that he does not expect lots of other online lenders to follow OnDeck’s example.

“I don’t think there is going to be any big wave coming, because at the end of the day, it’s still going to be a challenging process,” he said.