Another banking team has taken a side in the build-versus-buy debate.

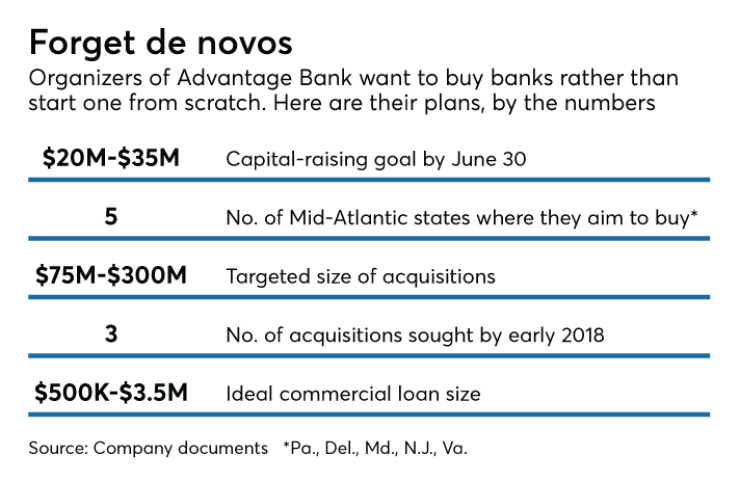

The organizers of the proposed Advantage Bank in Lemoyne, Pa., want to acquire a bank rather than apply with the Federal Deposit Insurance Corp. for deposit insurance. The group plans to raise $20 million to $35 million between now and June 30.

The group, which received preliminary charter approval from Pennsylvania’s state banking regulator in November, joins a growing list of bankers looking to raise capital to buy existing institutions rather than pursue a de novo strategy. Similar efforts are underway in

The FDIC has become more accommodating with de novos lately, reducing the period of enhanced oversight from seven years to three years and hosting meetings to drum up interest in new charters.

The process still seemed too onerous for George Groves, who is set to become Advantage’s president and CEO, and Percival Moser III, a former chief operating officer at Metro Bancorp, who would become chairman.

“We know that even though the FDIC has changed their oversight … it’s still a rigorous process,” Groves said. “We thought we could achieve both size and more flexibility by acquiring an existing bank.”

Buying an established bank would give Advantage immediate access to deposit insurance. Organizers want to buy a bank with $75 million to $300 million in assets based in Pennsylvania, Delaware, Maryland, New Jersey or northern Virginia, according on documents circulated by organizers. The group has outlined plans to buy three institutions by early next year.

Advantage would ultimately focus on areas around the Pennsylvania cities of Harrisburg and Lancaster, where it aims to capitalize on disruption caused by recent bank mergers, including BB&T’s purchases of Susquehanna Bancshares and National Penn Bancshares and the sale of Metro Bancorp to F.N.B. Corp.

“We have a couple of potential targets … that we’re in early stages of discussions,” Groves said, declining to discuss specific institutions. “If everything goes well … it’s probable that we will close one or [more deals] before year-end.”

Several bankers are taking a similar path.

Captex Bancshares, formed by George Lea and Michael Thomas Jr.,

First Boston Holdings, a group of bankers with past ties to Boston Private Financial Holdings, agreed in October to buy the $446 million-asset Admirals Bank in Boston. Ed Francis, a former Hancock Holdings executive, has formed an investment group that is trying to buy a bank around Denver.

Groups that buy an existing bank will have access to systems that already work and immediate earnings, said Kip Weissman, a lawyer at Luse Gorman. Organizers may also have an easier time paying people.

“If it’s a new bank, you hire all your own people … everything,” Weissman said. “It’s a long, hard slog.”

The challenge for aspiring organizers is finding the right bank to buy, Weissman said.

At the same time, there are signs that

Activity is “clearly picking up from zero,” Weissman said.

Groves is familiar with the application process for a de novo bank. He helped form Legacy Bank of Harrisburg in Pennsylvania, which grew to roughly $400 million in assets before

At Advantage, Groves would focus on commercial clients who need deposit services and loans ranging from $500,000 to $3.5 million, which he called “the hole in the market that’s left” following bank consolidation.

Getting Advantage up and running is a “fun challenge to take,” Groves added. “The idea of this operation is an intriguing one.”