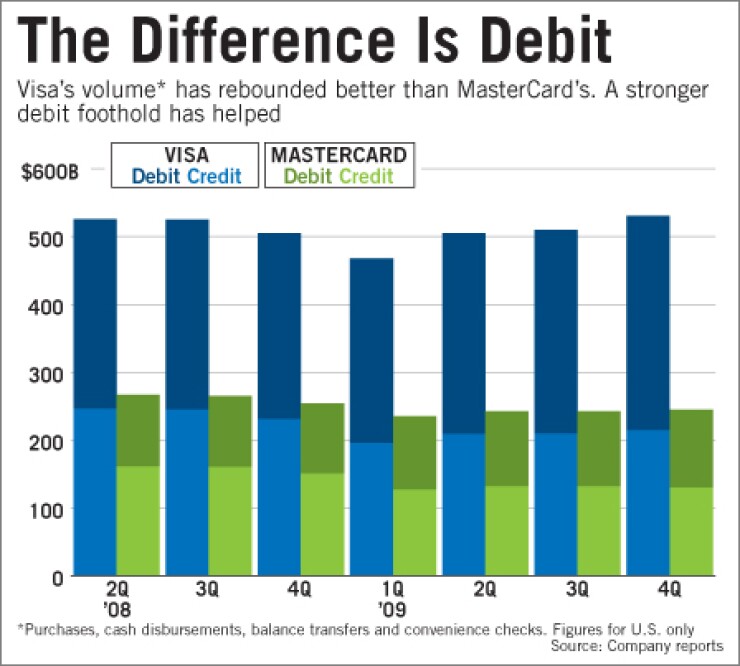

For today's consumers, there's nothing like cash on the barrelhead — and that's giving Visa Inc., with a stronger debit card foothold than MasterCard Inc., an advantage in the competition for card transactions.

Visa's overall U.S. payments volume grew in its fiscal first quarter, which ended Dec. 31; MasterCard's volume declined from a year earlier in the corresponding period (though it grew slightly from the previous quarter). Visa's margins expanded; MasterCard's shrunk. Visa's profits trounced analyst estimates; MasterCard's missed them.

MasterCard isn't just sitting tight.

The company is making a concerted effort to acquire a bigger slice of the rapidly growing debit market. But that means spending more money to offer rebates and incentives to bank customers — a reason for the margin compression.

"If you look at the differences between the two, it boils down to debit card market share," said Red Gillen, senior analyst at Celent, a Boston research firm.

"The market is saturated," Gillen said. "It's a zero-sum gain in debit. It has been for years, and this is the challenge that MasterCard faces."

Spending on Visa-branded debit cards in the U.S. during the final three months of 2009 jumped 15% from the year-ago period, to $238 billion. That compares with $85 billion in debit card purchase volume at MasterCard, which was up 10% from the fourth calendar quarter of 2008.

Total purchase volume at Visa, which includes credit and debit cards, rose 7.2% from a year earlier, to $438 billion. That was an improvement over the quarter that ended Sept. 30, when the San Francisco company's payment volume in the U.S. dipped 1% year over year, to $417 billion.

But at MasterCard, total purchase volume was still down in the U.S., dipping 1.3% from the fourth quarter of 2008, to $207 billion. However, the decline slowed from a 7.4% year-over-year drop in the third quarter when the Purchase, N.Y., company's purchase volume was $202 billion.

The debit market "is holding up much better than the credit market," said David Parker, an analyst at Lazard Capital Markets. That is clearly setting Visa apart, he said.

Visa's net income jumped by a third in its fiscal first quarter, which ended Dec. 31, to $763 million, or $1.02 a share. That handily beat the average per-share estimate of 91 cents from analysts polled by Bloomberg.

Total revenue, which includes international transaction and data processing revenue, rose 13%, to $1.96 billion.

The solid results led Visa to issue a more optimistic outlook for 2010. Visa now expects revenues to grow 11% to 15% this year. Previously the company said growth would be more toward the low end of that range.

Some analysts, though, say Visa is being too conservative in its guidance.

"We believe that, absent a double-dip recession, spend growth should continue to accelerate, driving revenue growth above the high end of management's guidance," Bruce Harting of Barclays Capital wrote in a research note.

Harting raised his 2010 and 2011 earnings estimates on the company, and upgraded the stock to "buy."

MasterCard, meanwhile, said its net income rose 23%, to $294 million, or $2.24 a share, from $239 million, or $1.83 a share, a year earlier.

The fourth-quarter results included an after-tax severance charge of 19 cents, the company said. On an adjusted basis, earnings per share were $2.43, still less than the average analyst estimate of $2.48 per share.

Visa shares rallied early in Thursday's session, gaining as much as 3.2% before reversing course amid a broad market sell-off; they ended the day at $83.05 a share, off 0.6%. MasterCard shares sagged all day, losing as much as 10.8%; they closed at $222.11 a share, down 10.3%.

Visa's cards in force grew by 5% during the quarter to 1.8 billion, while the number of MasterCard-branded cards dipped 1%.

The impact from MasterCard's loss of several big customers over the past year and a half is starting to show, analysts said. In late 2008, Royal Bank of Scotland Group PLC's Citizens Financial Group Inc. said it would switch to Visa. And in May 2009, JPMorgan Chase & Co. said it would convert much of the debit portfolio of Washington Mutual Inc. — once MasterCard's largest debit issuer — to Visa.

The switches were primarily a function of the consolidation in the financial services market, Parker said, but it's left MasterCard scrambling.

"Visa's a great product and a great company," he said. "But I think MasterCard you can make the same argument. It's just they're working off a smaller base, and they're a little bit behind."

Within the debit space, MasterCard has been focusing on expanding its prepaid business. Last September, for example, Wal-Mart Stores Inc. introduced payroll cards for its employees that run on the MasterCard network.

Another big win for MasterCard last month could give the company a big lift this year.

In January MasterCard wooed SunTrust Banks Inc. away from Visa, a deal that will add about 5 million accounts to its portfolio, according to data compiled by SourceMedia Inc.'s PaymentsSource.com.

SunTrust said at the time the deal was announced that it expects the conversion process to be complete within a year.

The deal has given MasterCard a spurt of confidence.

"We're not sitting there being satisfied with that," MasterCard's chief financial officer, Martina Hund-Mejean, said in an interview, referring to SunTrust. "And we're obviously going to go after whatever we can in the market."

Visa's chairman and chief executive, Joe Saunders, sounded unfazed by the loss of SunTrust. "You should expect sooner or later that we're going to lose a customer," he said during a conference call. "We don't lose very many. We have gained a lot more than we have lost. But that being said, it's a tough competitive environment."

Revenue at MasterCard grew 6%, to $1.3 billion, tempered by a 35% increase in rebates and incentives. MasterCard spent $574 million on rebates and incentives during the quarter. By comparison, Visa spent $374 million.

MasterCard expects rebates and incentives, as a percentage of revenue growth, to climb at an even steeper rate in the coming quarters. "Rebates and incentives are just another form of reinvestment in our business," Hund-Mejean said during the company's conference call. "So it should not be surprising to see this line increase as we work to drive volume and new business opportunities."

Despite the higher spending on rebates and incentives, MasterCard remains committed to its forecast for annual margin growth of 3% to 5% and average annual net income growth of 20% to 30%.