Installment lenders are concerned that efforts by the Consumer Financial Protection Bureau to curb the most abusive practices associated with payday loans will wreak havoc on their business.

The CFPB's payday

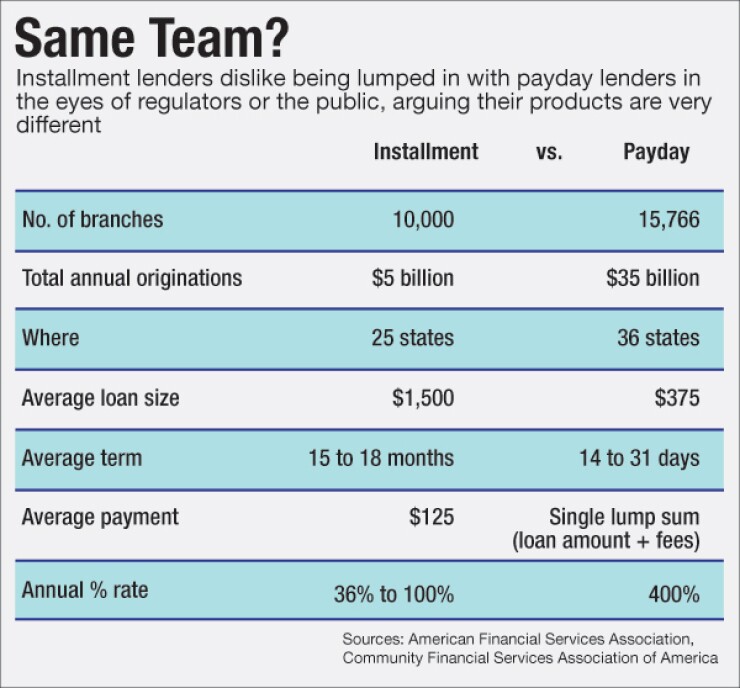

But some fear the proposal has gone too far by lumping installment loans, a longer-term credit product that has been around for 100 years, in with payday loans, which typically are due at a borrower's next paycheck.

-

WASHINGTON Community banks and credit unions would be forced to stop making short-term, small dollar loans if the Consumer Financial Protection Bureau's payday lending proposal is adopted, two trade groups said Monday.

June 27 -

Community bankers are trying to determine how they can offer affordable small-dollar loans that fit within the Consumer Financial Protection Bureau's complex 1,341-page payday lending plan.

June 22 -

Consumer advocates are urging the Consumer Financial Protection Bureau to strengthen its proposal to rein in payday lending, arguing it would still allow borrowers to be abused.

June 14 -

Lenders are questioning the legal justification for the Consumer Financial Protection Bureau's putting a 36% annual percentage rate threshold in its payday proposal, claiming loans made at that rate are unprofitable. That figure has been the subject of intense debate in the past decade.

June 8

"These are really two different markets – they're like apples and oranges," said Bill Himpler, executive vice president of legislative affairs at the American Financial Services Association, the trade group for installment and auto finance lenders. "It would be akin to lumping a hamburger joint like McDonald's and Morton's Steakhouse into the same category just because both are restaurants."

The CFPB estimates there will be a 60% to 70% reduction in payday loan volume as a result of its plan, but only a 7% to 11% reduction in the number of borrowers who take out payday loans. The plan would eliminate the ability of lenders to allow borrowers to take out multiple loans, which make up a large share of payday loans being originated.

Though both payday and installment loans are offered by some lenders, there are key differences, mostly in the annual percentage rates charged and in state licensing requirements.

Installment lenders offer annual percentage rates that range from 36% to 100% or perhaps higher. Payday loans typically have APRs of 350% or more.

"Installment loans are a much safer structure," said Martin Eakes, the co-founder and chief executive of Self-Help Credit Union and the Center for Responsible Lending, who has fought battles with payday lenders in Arizona, Colorado, North Carolina, Ohio and Washington.

"There are no payday lenders making loans below 100%," Himpler said.

Triple-digit interest rates are considered abusive by consumer advocates, and several of the options provided in the CFPB's proposal would still allow for some high-cost loans.

Many states require separate licenses for payday and installment loans. Some payday lenders have been seeking to get licensed as they migrate to longer-term loans, in part because of the CFPB's plan.

Jamie Fulmer, a senior vice president at Advance America, a Spartanburg, S.C., payday and installment lender, said there are many reasons why lenders are seeking to diversify their products.

"I think anyone offering products covered by this arbitrary rule has grave concerns about its impact on the viability of their business model going forward," Fulmer said.

The centerpiece of the CFPB's plan is a requirement that encourages lenders to verify a borrower's ability to repay a loan and not have to reborrow within the next 30 days and still meet living expenses.

But that is where the options provided to both payday and installment lenders end.

Payday lenders offering loans of up to $500 and a term of less than 45 days can choose an alternative "principal payoff" option that allows up to two extensions of the loan if the borrower pays off at least one-third of the principal with each extension.

For short-term loans, lenders would be barred from accepting an auto title as collateral and from offering a principal payoff to consumers with outstanding short-term loans or who have been in debt on such loans more than 90 days in a rolling 12-month period.

For lenders originating long-term loans, there are two different alternatives. One allows the interest rate to be capped at 28% with an application fee of $20 or less. A second option has an all-in cost of 36% or less, excluding a "reasonable" origination fee, a term that does not exceed two years, and payments that are roughly equal.

Installment lenders could opt to originate loans under the option that allows for an all-in cost of 36%, Himpler said, but the total loan amount would have to be $2,500 or higher to justify the costs.

"The CFPB plan is based on data that is pertinent to payday lenders with APRs in excess of 200% and no underwriting, and default rates of 30% to 40%," Himpler said. "That's not us. Our guys want to stay in business."