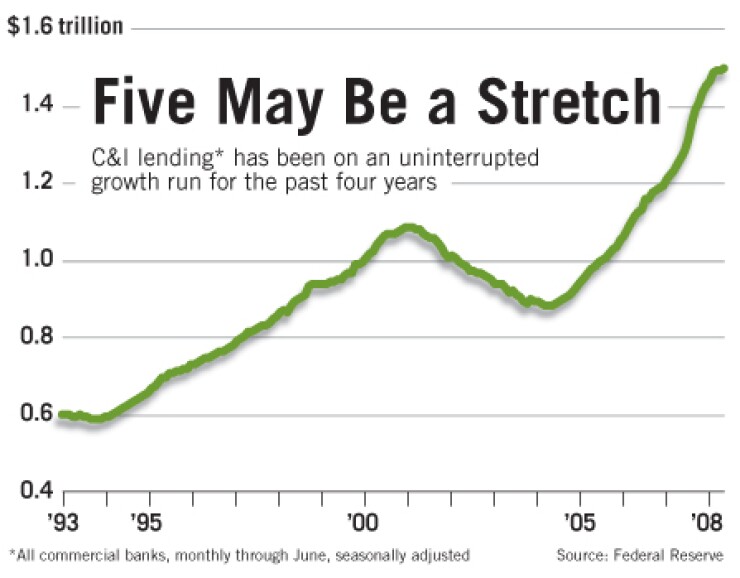

Bankers and analysts, trying to assess whether the financial sector is nearing the bottom of a brutal credit cycle, agree that commercial and industrial lending will be a critical indicator this quarter.

The C&I lending market generally has avoided the perils of the subprime mortgage contagion, which has spread beyond home lending and into credit cards and auto loans. But in reporting second-quarter results, several big banking companies cautioned that they have noticed early signs the troubles could bleed into C&I this year, particularly if the economy continues to flounder.

It "is a giant shoe that could still fall" and become "the Achilles heel to banks' profitability in 2009," Gerard Cassidy, an analyst at Royal Bank of Canada's RBC Capital Markets, said in an interview last week.

James Abbott, an analyst at Friedman, Billings, Ramsey & Co. Inc., wrote in a research note: "Several companies have begun to show signs of weakness in commercial and industrial loans. … We expect this trend of deterioration to continue through the end of 2008, reflecting further weakness in regional housing markets and general economic conditions."

Howard A. Atkins, the chief financial officer at Wells Fargo & Co., said on the San Francisco company's earnings call last month that signs of stress appeared in loans and lines of credit to small-business owners, particularly those with ties to residential construction. Losses in the small-business category increased by $30 million during the second quarter, he said. The portfolio "showed signs of stabilizing near the end of the second quarter as a result of almost 18 months of tightened underwriting and account management activities targeted at reducing exposure to the highest risk accounts," Mr. Atkins said. "Losses in this portfolio, as in all of our loan portfolios, will obviously be impacted by how the overall economy performs."

Joe Price, Bank of America Corp.'s CFO, told analysts on a call last month that the Charlotte company's commercial portfolios are sound in general, though chargeoffs increased during the quarter. He cited both loan growth and economic weakness as factors behind B of A's $113 million of new losses on small-business loans, a group within its commercial business.

Richard K. Davis, the chairman and chief executive of U.S. Bancorp, did not cite figures that specific during a call last month, but he labeled areas of his company's C&I lending as a concern. The Minneapolis company's overall C&I portfolios is in solid shape and poised for growth, Mr. Davis said, but portions of it are bound "to deteriorate in an environment like this."

U.S. Bancorp cited stress for building suppliers and agribusiness companies that are struggling with escalating livestock feed costs.

In a regulatory filing last month, Sovereign Bancorp Inc. of Philadelphia disclosed that a borrower in its syndicated commercial portfolio had filed for bankruptcy protection. The company has $73 million in exposure to the bankrupt borrower. "It appears the entity may have engaged in some high-risk business practices, which caused a sudden liquidity crisis and ultimately led to the bankruptcy," the filing said. Sovereign said it has yet to determine the extent of expected losses from the loan, but it cautioned that its "third-quarter results could include a significant chargeoff."

JPMorgan Chase & Co. said that mounting problems with credit quality that will weigh on earnings the rest of this year.

Michael J. Cavanagh, the New York company's CFO, said on a call last month that its commercial portfolio performed well in the second quarter. However, "when you look at some small portion of the portfolio," including "anything related to home builders," there are loans under stress. The portfolio likely will "require incremental reserves" for the rest of this year, Mr. Cavanagh said.

Sung Won Sohn, an economist at California State University in Los Angeles and a former bank executive, says banks that are bracing for the worst are taking a wise step. In an interview last week, Mr. Sohn said that, official readings aside, economic growth is so anemic that conditions already resemble a recession. "If you look at employment, productivity, personal income — they've all been trending down for months," he said. "If that's not a recession, I don't know what is."

Investors as a group also hold a pessimistic view. Despite periodic gains, bank stocks remain down for the year nearly across the board. "We still have a lot of issues to work through in financials," said Jack A. Ablin, the chief investment officer at Bank of Montreal's Harris Private Bank in Chicago.