-

Zions Bancorp., still struggling with its commercial real estate portfolio, lost $182 million in the fourth quarter and $1.2 billion for the year but reported improvements in credit quality and capital.

January 25

Zions Bancorp. executives argued this week that their business is getting back to normal, but it might be time for a company with beachheads in the troubled Southwest to redefine what normal is.

In the years leading up to the credit crisis, Zions reported strong earnings that stemmed from what management regarded as one of its key strengths: a strong presence in growth markets. Its component banks collected cheap deposits from western states' exploding populations, then plowed that money into commercial real estate and construction loans in proportions far above the industry average.

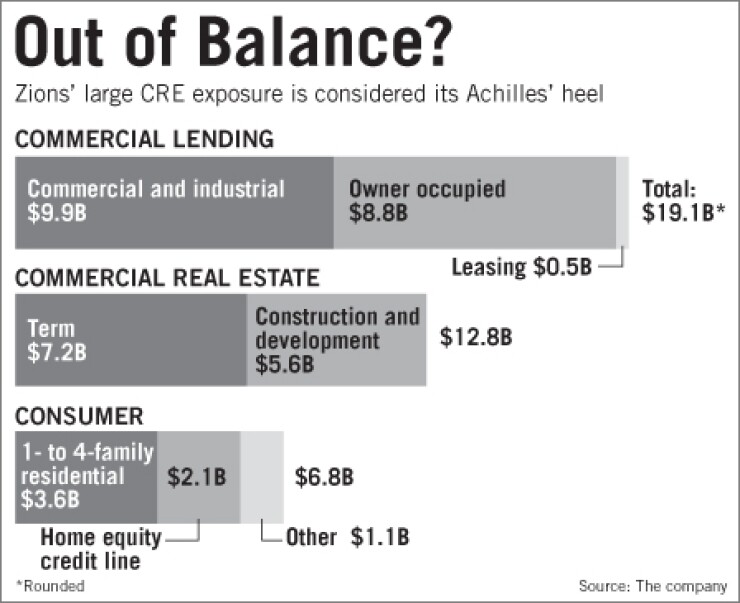

CRE accounts for nearly one-third of Zions' $40 billion lending portfolio, and almost half of that is devoted to construction.

Loading up in the sector has caused Zions a lot of pain; it took $1.2 billion in net chargeoffs last year alone. But even as the company weans itself off reliance on CRE, it will be hard to make its business model work without it.

"Zions still has that community bank model of deposit relationships and real estate lending," said analyst Brian Klock at KBW Inc.'s Keefe, Bruyette & Woods Inc. So as long as formerly high-growth markets like San Diego, Phoenix and Las Vegas struggle under real estate overhangs, he said, adjusting Zions' model and high interest margins to those markets is "going to be a tough row to hoe."

Real estate observers are pessimistic. CBRE Econometric Advisors anticipates broad-based construction lending will not return to some of Zions' key hubs before 2014, said the company's forecasting director, Jon Southard. And frenetic activity such as those cities saw in the recent decade is even more remote.

"I can't say we will never reach those levels again," he said. "But we're talking decades, not years."

Given the battering that Zions endured during the last year and a half, it is understandable that management and investor attention has been on limiting the damage from loans already in its portfolio. The $195 million CRE hit Zions reported this week only looks good next to a third-quarter loss that was $53 million bigger.

But like other banking companies, Zions believes "that economic conditions in the majority of our markets have begun to stabilize," Chairman and CEO Harris Simmons told analysts this week. Company officials predicted a very limited reserve buildup this year.

With Zions having called the bottom of its trough, Simmons has been talking about growth, and not just in its healthier Utah and Texas markets. At a Goldman Sachs investor conference in December, the CEO said that, outside of commercial real estate, "I don't see a whole lot of shrinkage in other parts of the portfolio taking place." His slides credited Zions with "the nation's strongest long-term growth profile."

Zions' fourth-quarter report showed that its "engine" is still chugging away on the funding side. Strong organic growth and two no-premium deals assisted by the Federal Deposit Insurance Corp. left Zions "kind of awash in deposits," Chief Financial Officer Doyle Arnold told analysts.

But the same markets that supply those deposits have failed to create the loan demand to make use of them.

At the current rate of shrinkage, Zions' loan portfolio would drop more than 10% in Utah, California and Arizona this year, and 24% in Las Vegas, officials said. Though the winding down of FDIC-supported assets accounted for much of the drop in lending, Arnold said, Zions expects to remain on the sidelines for "another quarter or two at least."

Zions is far from the only regional banking company facing declining loan balances. But given the company's markets and lending mix, KBW's Klock said he thinks the company may need to do more than simply wait out a sluggish economy.

Within a few quarters, he said, lending in Texas and Utah might be able to absorb some of Zions' deposits. In the harder-hit areas, however, years must pass before a healthy market develops for Zions' "bread-and-butter" CRE loans.

"Looking at the extra liquidity they have, there's a decision-making process the bank has to go through in the next 12 to 18 months," Klock said. "Are they going to try to go back and do commercial real estate and construction lending again, or can they go up the food chain and try to get up into syndicated credits and corporate lending?"

Zions' Amegy Bank in Houston has already begun moving toward the latter, Klock said, and its new CEO, Scott McLean, comes with commercial lending credentials from JPMorgan Chase & Co. In other markets, however, a quick transition would not be easy. "Out in California, now you've got JPMorgan that's going to be a competitor," Klock said.

Still, if commercial real estate analysts' forecasts of long-term weakness in western boom markets are correct, Zions will not have much choice.

"These once fast-growth markets were the hardest hit and will be the longest coming back," said Richard Parkus, the head of commercial mortgage-backed securities research at Deutsche Bank. "Underwater properties won't trade, and they can't refinance. They'll just be extended, whether they're in banks or CMBS."

Zions declined to discuss growth and lending issues with American Banker, saying that it is saving such topics for its investor day in February.

But even with CRE lending declining for the foreseeable future, Simmons said he sees the company's beaten-up growth markets bouncing back.

"The margin we've been generating, which is just shy of 4%, 100 basis points north of many of our regional bank peers, that's the equivalent of over a billion dollars in pretax income over a couple of years," Simmons said in December. "Markets that have been stressed, like Arizona, Southern California, they show promise in terms of growth as we get out in the future."