Editor’s Note: This post

Generating nearly $4 billion in annual revenue, identity protection is a big business — one that has consistently drawn the attention and

In years past, the Federal Trade Commission had the sole purview of the identity protection space. But the newest regulator, the CFPB, has since taken up the mantle of de facto identity protection industry regulator. Since 2012, regulators — most notably the CFPB — have levied $1.6 billion in fines and settlements related to identity protection and similar products primarily sold through U.S. financial institutions.

In moves that some considered emblematic of regulatory overreach, federal and state regulators have punished a number of companies, citing what they considered to be dubious marketing and sales practices.

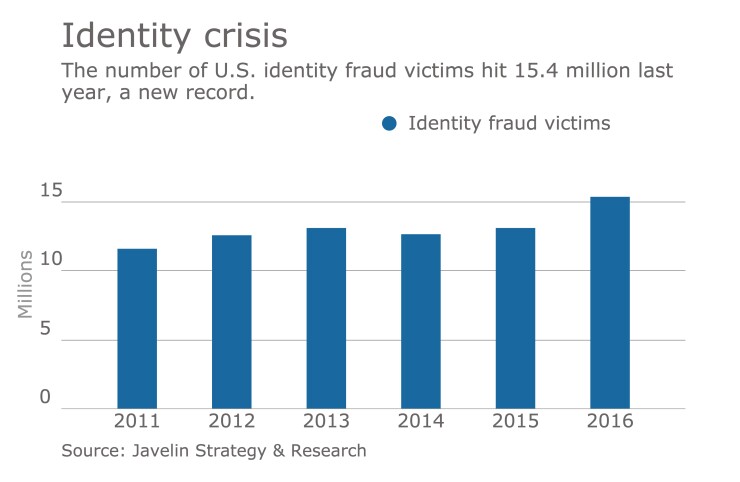

With each new fine or settlement, banks backed away from offering these products to their customers. As a result, far fewer major financial institutions continue to sell these products, despite the fact that identity fraud has hit a record high.

Furthermore, banks that still sell the service no longer rely on the identity protection providers to do the grunt work. These days, it’s more likely the service will be bank branded and with greater bank oversight when it comes to sales and marketing practices than they once were.

However, a new U.S. president and emboldened Congress may effectively change the dynamic that drove so many financial institutions from the

As the practices that once put providers and financial institutions in regulatory crosshairs have become less of an issue, financial institutions would have one less obstacle to get back into the game. The real question then becomes: Which