-

The $2 trillion stimulus package, which the House passed earlier in the day, aims to expand Federal Reserve liquidity resources and provide financial institutions with some regulatory relief.

March 27 -

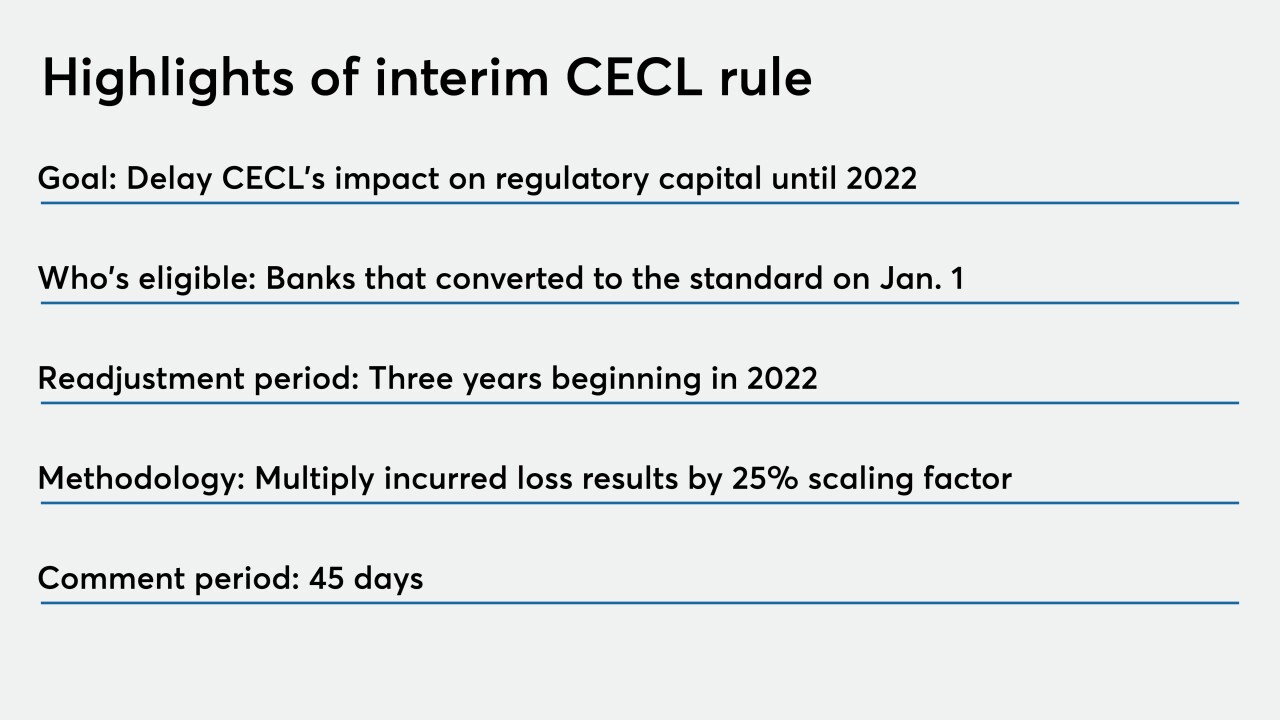

Lawmakers and regulators opted to delay compliance for banks that have implemented the credit loss standard, sparing them near-term capital hits.

March 27 -

The $2 trillion stimulus package, which the House passed earlier in the day, aims to expand Federal Reserve liquidity resources and provide financial institutions with some regulatory relief.

March 27 -

Regulators are allowing banks that implemented the loan-loss standard to forestall any capital hits until 2022.

March 27 -

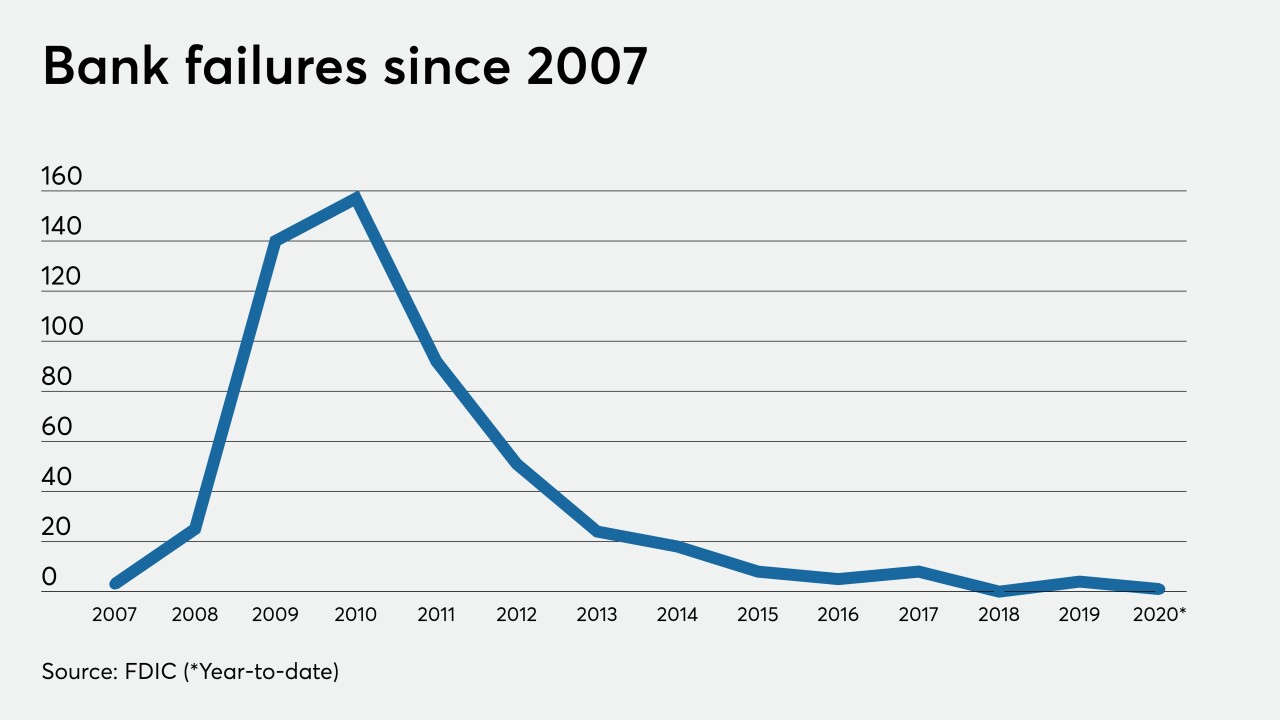

An uptick in closings is likely, but how many institutions go under and how fast will depend on a variety of factors, including the duration of the pandemic.

March 26 -

The joint statement said examiners will not impede banks and credit unions’ responsible efforts to offer open lines of credit, closed-installment loans or other products to borrowers dealing with fallout from the pandemic.

March 26 -

The regulator's extension for first-quarter documents applies to BHCs with less than $5 billion in assets.

March 26 -

The joint statement said examiners will not impede banks’ responsible efforts to offer open lines of credit, closed-installment loans or other products to borrowers dealing with fallout from the pandemic.

March 26 -

While analysts agree banks are in better shape than in 2008, lawmakers are dusting off a crisis-era tool used by the Federal Deposit Insurance Corp. to soothe potential liquidity fears during the coronavirus pandemic.

March 25 -

Details of the $2 trillion deal were still fluid Wednesday, but lawmakers were closing in on a plan that would aim to put lenders and consumers alike on stronger financial footing as they weather the coronavirus pandemic.

March 25