-

In a surprise settlement, the Consumer Financial Protection Bureau ordered the Texas lender to pay a penalty and compensate for overcharging service members on more than 45,000 loans.

July 14 -

The Consumer Financial Protection Bureau said it was invoking a special authority to supervise entities that pose risks to consumers in taking on World Acceptance Corp.

February 26 -

The state of Connecticut recently handed the small-dollar marketplace loan provider a cease-and-desist order, but Rodney Williams says his company is getting much-needed emergency funds into marginalized communities at a low total cost, and that the rules need to be rewritten.

May 23 -

OneUnited's new installment-loan product is meant to break customers out of a cycle of debt. It will compete with similar offerings from heavyweights like Wells Fargo, Bank of America and Huntington.

January 13 -

Banks could be a better option than payday lenders to meet consumers’ short-term credit needs. But all the OCC’s regulation does is enable partnerships that circumvent state usury laws.

April 28 The Pew Charitable Trusts

The Pew Charitable Trusts -

There are ways to remove bad actors from the industry — such as reinstating the Consumer Financial Protection Bureau’s payday lending rule and banning certain fees and collection practices — without hindering consumers’ access to emergency credit.

March 29 OppFi

OppFi -

There are ways to remove bad actors from the industry — such as reinstating the Consumer Financial Protection Bureau’s payday lending rule and banning certain fees and collection practices — without hindering consumers’ access to emergency credit.

March 15 OppFi

OppFi -

The agency's "no-action" letter is intended to provide more regulatory certainty for the bank after it announced a short-term credit product available to checking account customers next year.

November 5 -

Bank of America plans to offer some of its customers access to short-term loans, the latest blow to the payday lending industry.

October 8 -

Regulators are urging banks to offer small-dollar loans again and lifting existing restrictions on nonbank lenders. But the real challenge is making those loans favorable to consumers without losing money.

July 29 -

Many of its borrowers have struggled to make payments since the pandemic struck, so it is helping them by suspending debt collections and capping rates on new loans at 36%.

July 28 -

Trump-appointed regulators gave the industry the green light to offer installment loans during the pandemic. But with concerns that the light could turn red in 2021, bankers remain extra cautious.

July 19 -

Consumers now have more control over their own financial decisions and loan options.

July 14 Community Financial Services Association of America

Community Financial Services Association of America -

Consumers now have more control over their own financial decisions and loan options.

July 8 Community Financial Services Association of America

Community Financial Services Association of America -

An interagency notice meant to encourage lenders to offer small consumer loans also provides federal agencies too much say on what constitutes “reasonable” pricing.

June 2

-

The templates are meant to make it easier to obtain agency approval for small-dollar loan products and to accommodate mortgage servicers that want to provide online loss mitigation options.

May 22 -

The comptroller of the currency, who is stepping down after two and a half years on the job, ruffled feathers and won some fans in pushing through CRA reform, cutting costs and trying to reshape the agency’s examiner culture.

May 20 -

Four federal agencies offered guidance Wednesday on how to offer products that compete against payday loans without incurring Washington's wrath. The announcement could spark the rebirth of deposit advances, which were regulated out of existence during the Obama administration.

May 20 -

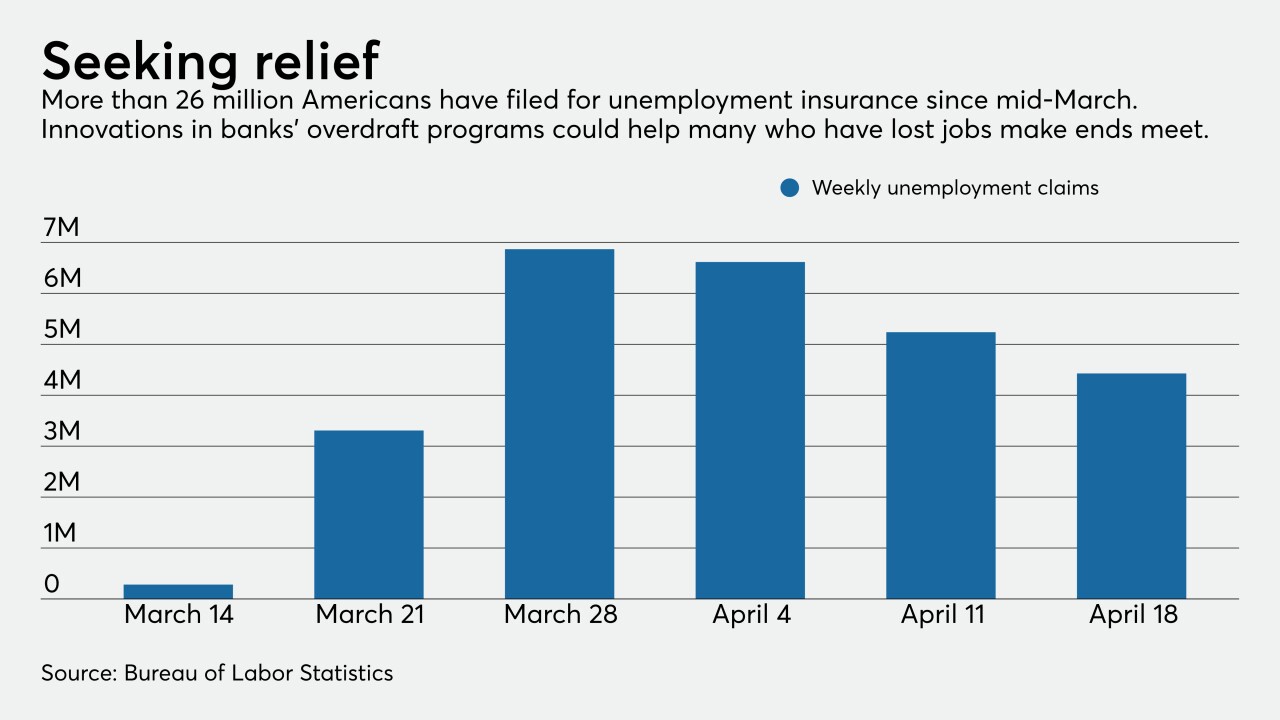

Some bankers, economists, policy experts and even Mark Cuban say that creative uses of overdraft programs could be lifelines for consumers and businesses whose finances have been upended by the coronavirus crisis.

April 28 -

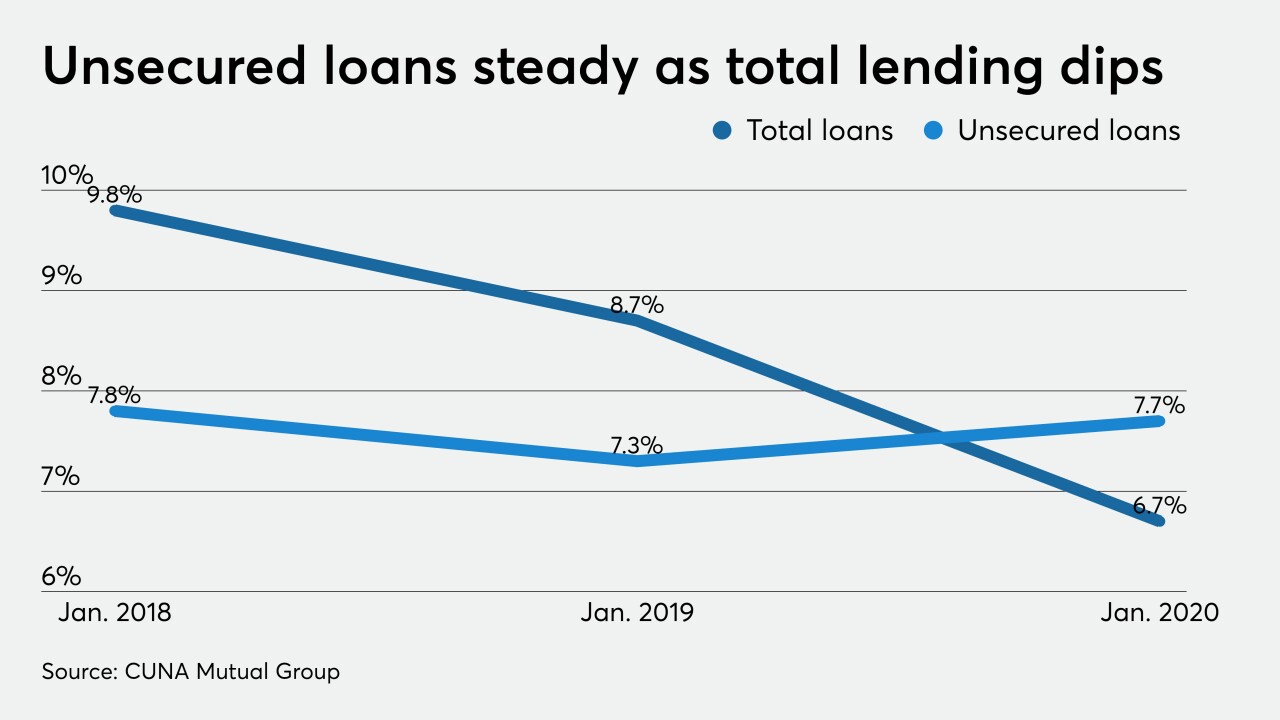

Banks, which previously shunned unsecured small-dollar lending, are now embracing the product because of the outbreak. It's just a matter of whether the shift is permanent.

April 13