-

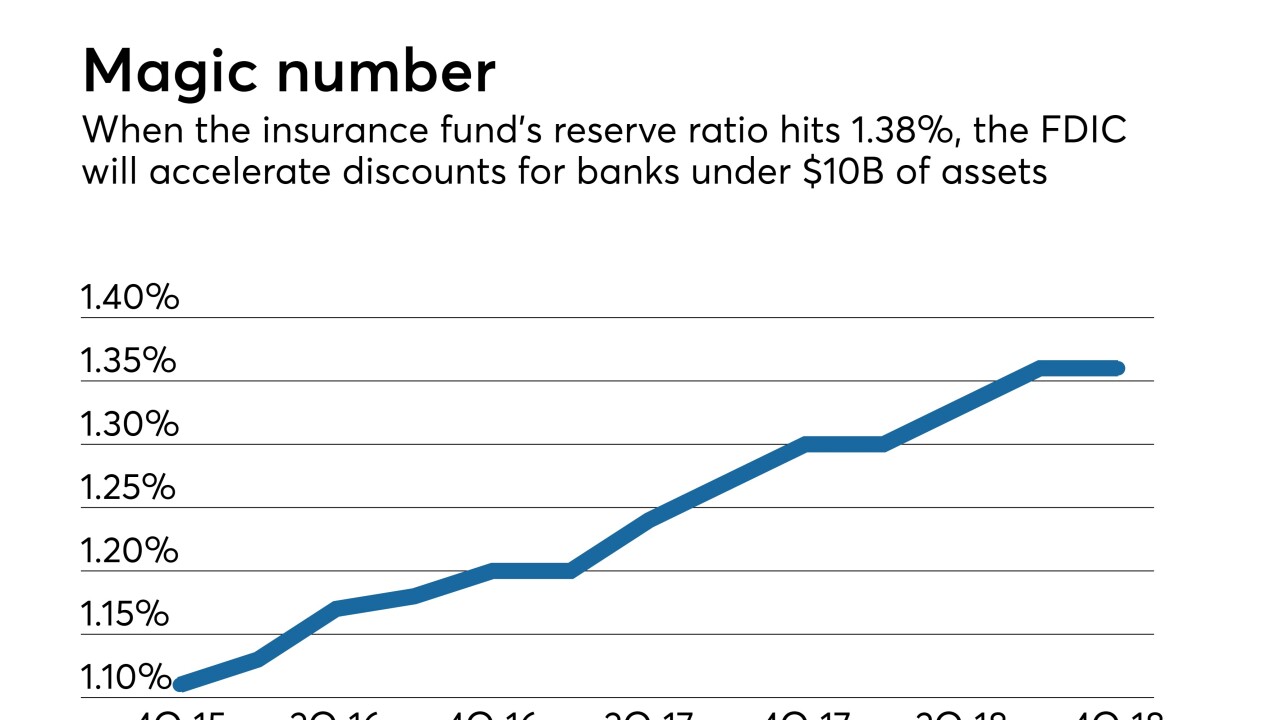

The FDIC reserve fund is nearing a threshold that will trigger a temporary reprieve on deposit insurance premiums for banks with less than $10 billion of assets.

February 28 -

By applying to become an industrial loan company, the fintech would be able to use insured deposit accounts as a cheap source of funding without having to comply with the tough rules banks face.

February 28 Calvert Advisors LLC

Calvert Advisors LLC -

With the two companies said to be still mulling which charter to seek, the various options each have possible advantages and drawbacks.

February 27 -

Lawmakers on the Senate Banking Committee pushed Federal Reserve Chair Jerome Powell for details about how he plans to review the proposed merger between the two regional banks.

February 26 -

The federal banking agencies will not hold a hearing on a proposal to reduce the number of residential real estate transactions that require an appraisal.

February 22 -

Readers weigh legislative proposals on pot banking, consider JPMorgan's new digital coin, debate the Federal Deposit Insurance Corp.'s brokered deposit rules and more.

February 21 -

Banks earned $59.1 billion in the fourth quarter, a 133% year-over-year increase, due to a one-time charge in the year-earlier quarter and a lower effective tax rate throughout 2018.

February 21 -

More than three dozen organizations are asking the FDIC to reject Square’s pending application to become an industrial loan company, according to a letter filed Tuesday.

February 20 -

The agency’s effort is a good first step to updating brokered deposit rules, but regulators excluded several important considerations in their advance notice of proposed rulemaking.

February 20 Jones Waldo Holbrook & McDonough

Jones Waldo Holbrook & McDonough -

Since the collapse of IndyMac in 2008, the agency has frequently helped to shield depositors over the $250,000 insurance limit from losses. But it’s a policy that was never formalized, and it remains to be seen whether the agency’s new head, Jelena McWilliams, will follow it.

February 14