-

The Federal Reserve and Federal Deposit Insurance Corp. will hold two public meetings to consider the deal's impact on the U.S. banking system.

March 14 -

Community bankers and state regulators want the FDIC and other agencies to rethink their approach to a simplified capital ratio for smaller institutions.

March 14 -

If there is renewed interest in a proposal to restrict incentive-based plans, that isn’t enough to overcome obstacles that have hindered the rulemaking for so long.

March 13 American Banker

American Banker -

The combined bank would be chartered in North Carolina, with the FDIC serving as its lead federal regulator, N.C. Banking Commissioner Ray Grace says. The merger partners had other options, including the Fed and the OCC.

March 12 -

While the OCC has led the charge on modernizing the Community Reinvestment Act, Gov. Lael Brainard gave a rundown of new ideas under discussion — from updating assessment boundaries to a comprehensive community development test.

March 12 -

The FDIC should consider limiting its toughest restrictions on brokered deposits to problem banks.

March 12 -

Comptroller of the Currency Joseph Otting and Federal Deposit Insurance Corp. Chairman Jelena McWilliams acknowledged industry concerns with the proposal meant to improve how banks comply with the trading ban.

March 11 -

Readers consider Square's bid to become an industrial loan company, weigh the Federal Deposit Insurance Corp.'s oversight of brokered deposits and debate reforms to the Consumer Financial Protection Bureau.

March 7 -

U.S. regulators are poised to scrap their proposal for revising Volcker Rule restrictions on banks' trading in favor of a newer version as they respond to a misstep that drew fire from Wall Street lobbyists, according to people familiar with the effort.

March 6 -

By applying to become an industrial loan company, the fintech would be able to use insured deposit accounts as a cheap source of funding without having to comply with the tough rules banks face.

March 6 Calvert Advisors LLC

Calvert Advisors LLC -

A legal memo conducted on behalf of the trade group says the agency’s policy goes beyond statutory intent and places undue restrictions on healthy banks.

March 4 -

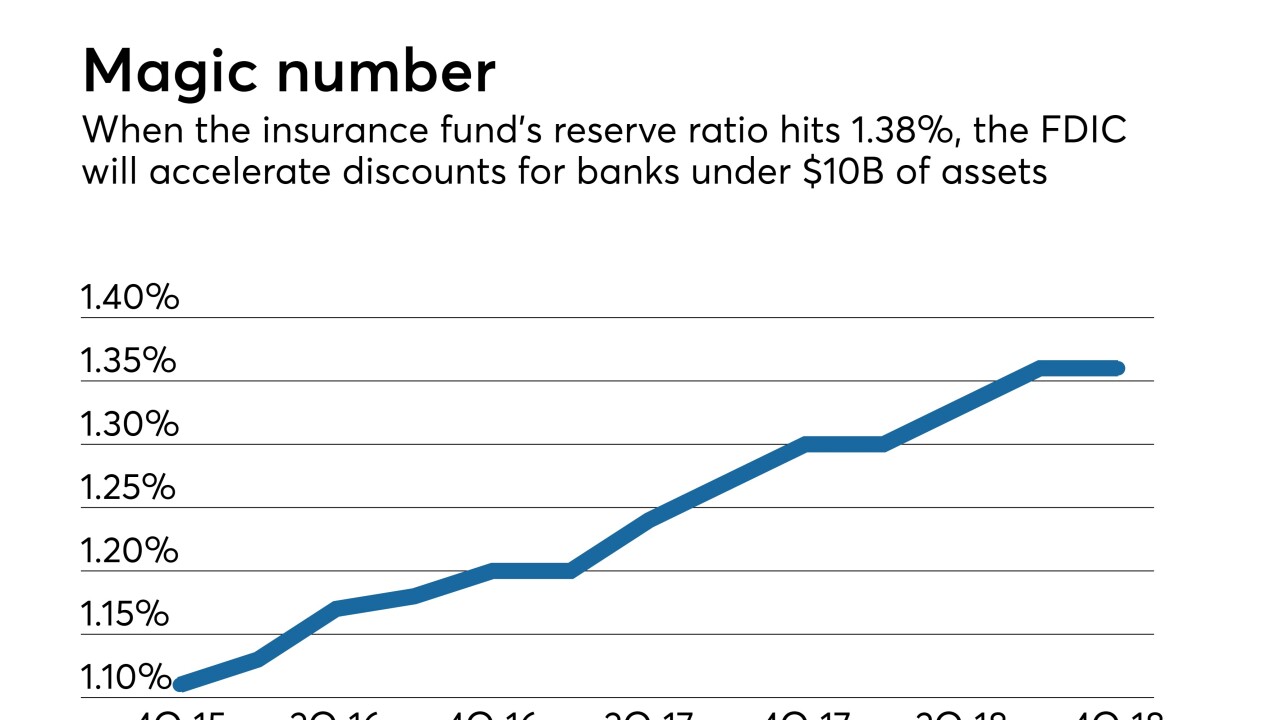

The FDIC reserve fund is nearing a threshold that will trigger a temporary reprieve on deposit insurance premiums for banks with less than $10 billion of assets.

February 28 -

By applying to become an industrial loan company, the fintech would be able to use insured deposit accounts as a cheap source of funding without having to comply with the tough rules banks face.

February 28 Calvert Advisors LLC

Calvert Advisors LLC -

With the two companies said to be still mulling which charter to seek, the various options each have possible advantages and drawbacks.

February 27 -

Lawmakers on the Senate Banking Committee pushed Federal Reserve Chair Jerome Powell for details about how he plans to review the proposed merger between the two regional banks.

February 26 -

The federal banking agencies will not hold a hearing on a proposal to reduce the number of residential real estate transactions that require an appraisal.

February 22 -

Readers weigh legislative proposals on pot banking, consider JPMorgan's new digital coin, debate the Federal Deposit Insurance Corp.'s brokered deposit rules and more.

February 21 -

Banks earned $59.1 billion in the fourth quarter, a 133% year-over-year increase, due to a one-time charge in the year-earlier quarter and a lower effective tax rate throughout 2018.

February 21 -

More than three dozen organizations are asking the FDIC to reject Square’s pending application to become an industrial loan company, according to a letter filed Tuesday.

February 20 -

The agency’s effort is a good first step to updating brokered deposit rules, but regulators excluded several important considerations in their advance notice of proposed rulemaking.

February 20 Jones Waldo Holbrook & McDonough

Jones Waldo Holbrook & McDonough