-

Firms that spread big-dollar deposits to community banks have seen a rush in demand as small businesses seek emergency loans to weather the coronavirus pandemic.

April 7 -

The OCC and FDIC are holding off on easing debt limits in response to the coronavirus pandemic, leaving billions of dollars locked up at banking subsidiaries that could be used for lending amid the deepening economic crisis.

April 7 -

After Congress temporarily lowered the leverage ratio used by smaller institutions, the federal agencies said they would allow a one-year transition before banks have to comply again with the regular standard.

April 6 -

First State Bank, which the FDIC sold to MVB Financial, had struggled with profitability and capital levels for several years.

April 3 -

The agency proposed changes in December to how customer relationships affect the definition of brokered funds, which has big implications for banks that are not well capitalized.

April 3 -

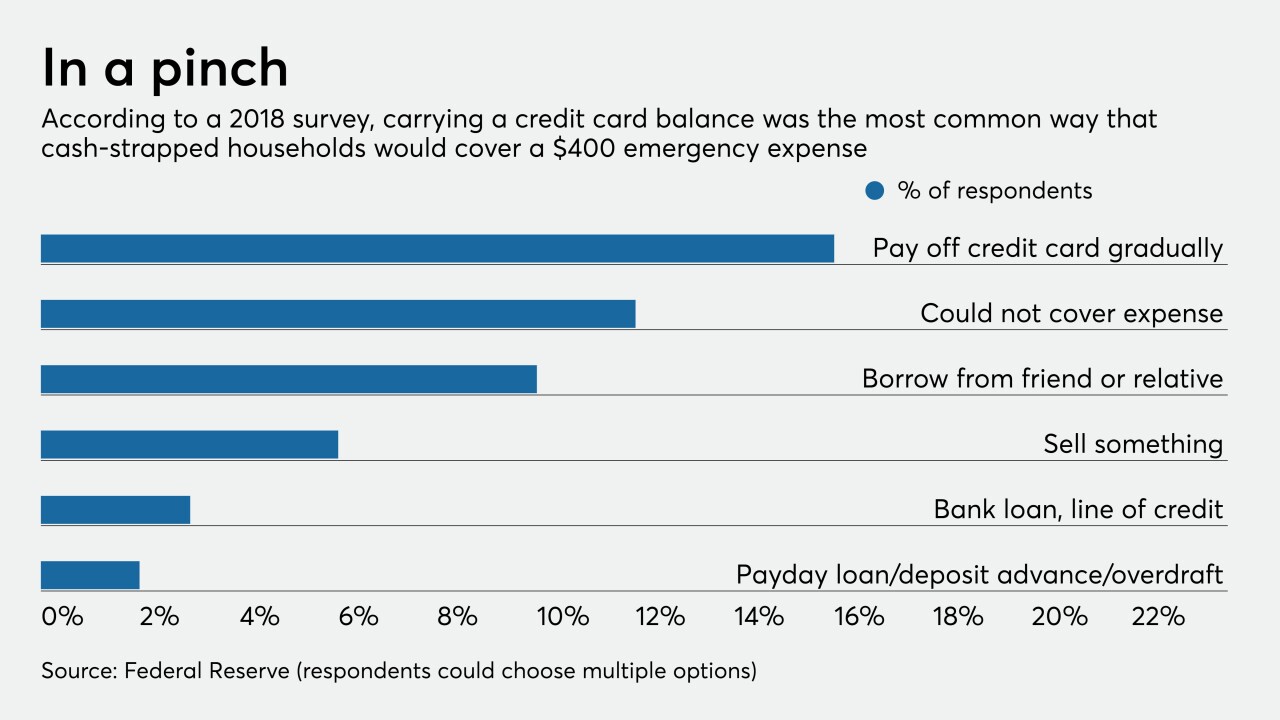

Regulators point to traditional financial institutions as well-positioned to meet short-term credit needs during the coronavirus pandemic, but there are still a host of questions about whether the industry should try to compete with high-cost lenders.

April 2 -

The agencies will give the industry another month to submit feedback on the so-called covered fund portion of the rule "in light of potential disruptions resulting from the coronavirus.”

April 2 -

The ICBA chief’s plea for a six-month halt to regulations not related to the pandemic followed similar calls by community groups and a key Senate Democrat.

March 31 -

The $2 trillion stimulus package, which the House passed earlier in the day, aims to expand Federal Reserve liquidity resources and provide financial institutions with some regulatory relief.

March 27 -

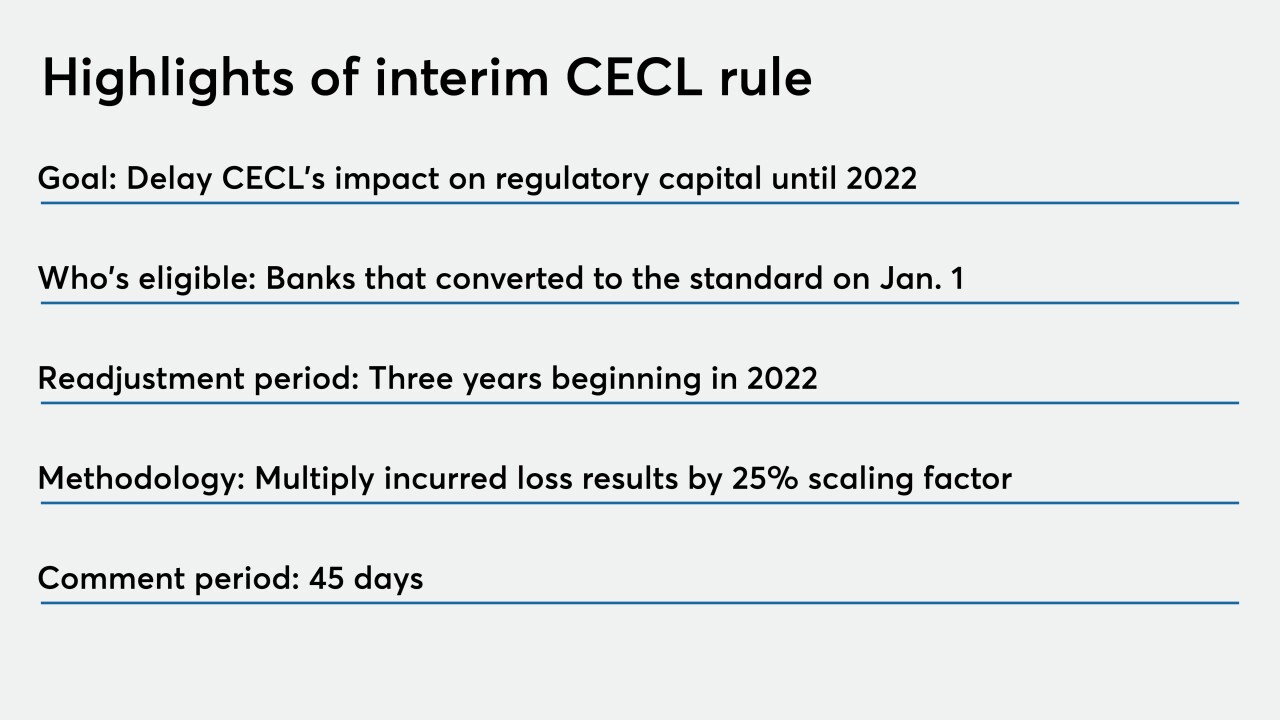

Lawmakers and regulators opted to delay compliance for banks that have implemented the credit loss standard, sparing them near-term capital hits.

March 27 -

The $2 trillion stimulus package, which the House passed earlier in the day, aims to expand Federal Reserve liquidity resources and provide financial institutions with some regulatory relief.

March 27 -

Regulators are allowing banks that implemented the loan-loss standard to forestall any capital hits until 2022.

March 27 -

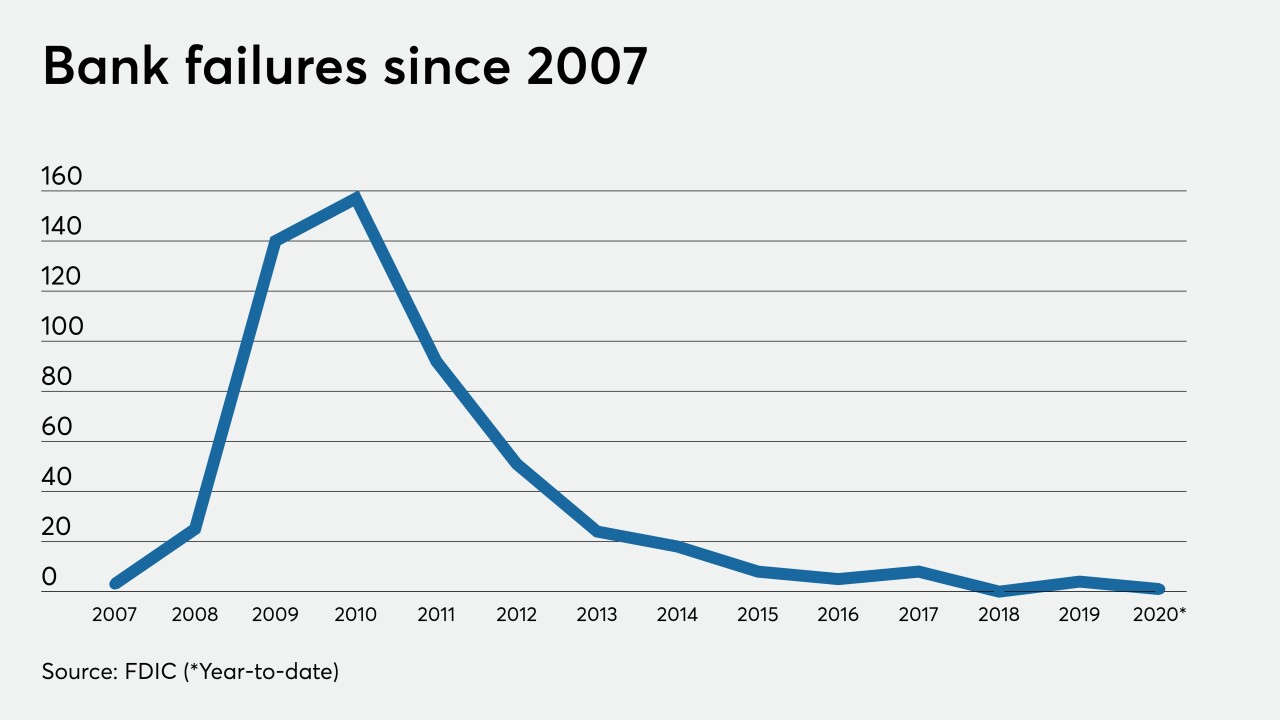

An uptick in closings is likely, but how many institutions go under and how fast will depend on a variety of factors, including the duration of the pandemic.

March 26 -

The joint statement said examiners will not impede banks and credit unions’ responsible efforts to offer open lines of credit, closed-installment loans or other products to borrowers dealing with fallout from the pandemic.

March 26 -

The regulator's extension for first-quarter documents applies to BHCs with less than $5 billion in assets.

March 26 -

The joint statement said examiners will not impede banks’ responsible efforts to offer open lines of credit, closed-installment loans or other products to borrowers dealing with fallout from the pandemic.

March 26 -

While analysts agree banks are in better shape than in 2008, lawmakers are dusting off a crisis-era tool used by the Federal Deposit Insurance Corp. to soothe potential liquidity fears during the coronavirus pandemic.

March 25 -

Details of the $2 trillion deal were still fluid Wednesday, but lawmakers were closing in on a plan that would aim to put lenders and consumers alike on stronger financial footing as they weather the coronavirus pandemic.

March 25 -

The $2 trillion deal passed by the Senate late Wednesday would aim to put banks and consumers alike on stronger financial footing as they weather the coronavirus pandemic.

March 25 -

Regulators' decision to delay reporting for troubled-debt restructurings should allow banks and credit unions to be more nimble modifying loans impaired by the coronavirus outbreak.

March 23