-

Colin Walsh, Varo Money's CEO, learned a lot from his first stab at deposit insurance. Lesson one: Work with one regulator at a time.

September 27 -

The House of Representatives passed two bills that would tie appraisal waivers for Small Business Administration loans to bank rules for commercial real estate loans, despite objections from the Appraisal Institute about its members being cut out of transactions.

September 26 -

Five agencies issued a final rule that established swamp margin requirements with restrictions on certain qualified financial contracts.

September 21 -

The changes mandated by the recent regulatory relief law would narrow the definition of "high-volatility commercial real estate" exposures that get a higher risk weight.

September 18 -

The House Financial Services Committee has steadily passed regulatory reform legislation this year. But any measure faces a stiffer challenge in the upper chamber.

September 14 -

The proposal, required by the regulatory relief package that Congress passed in May, would exempt the healthiest banks from having to count reciprocal deposits as brokered deposits.

September 13 -

The House Financial Services Committee has steadily passed regulatory reform legislation this year. But any measure faces a stiffer challenge in the upper chamber.

September 13 -

The Senate Banking Committee said it is postponing a hearing on the implementation of regulatory relief for "logistical reasons."

September 11 -

Regulators will continue to issue guidance to articulate general views on appropriate practices, but they will not issue enforcement actions based on violations.

September 11 -

The agency says the effort, part of a review conducted every 10 years, will help eliminate regulatory red tape.

September 10 -

The former head of the agency said the proposed changes to the enhanced supplementary leverage ratio will make banks vulnerable to disruption and failure.

September 6 -

In a report, the watchdog said the economic environment and competition instead have driven trends in small-business lending.

September 5 -

The appointments are on top of other recent personnel changes under Chairman Jelena McWilliams, who took the reins of the agency in June.

September 4 -

The OCC required the company to raise more capital and complete a CRA plan. Varo Bank still needs FDIC and Fed approval before opening.

September 4 -

The agencies had proposed revisions designed to make compliance less complex, but banks have expressed concern that the plan could have the opposite effect.

September 4 -

Unilateral approaches to bank regulation are risky, but the OCC's plan to seek public comment independent of the other agencies could help shed light on a CRA debate that is now being waged internally.

August 27

-

The agency says it will act independently of other regulators to release a notice asking for public input on revamping the decades-old law.

August 24 -

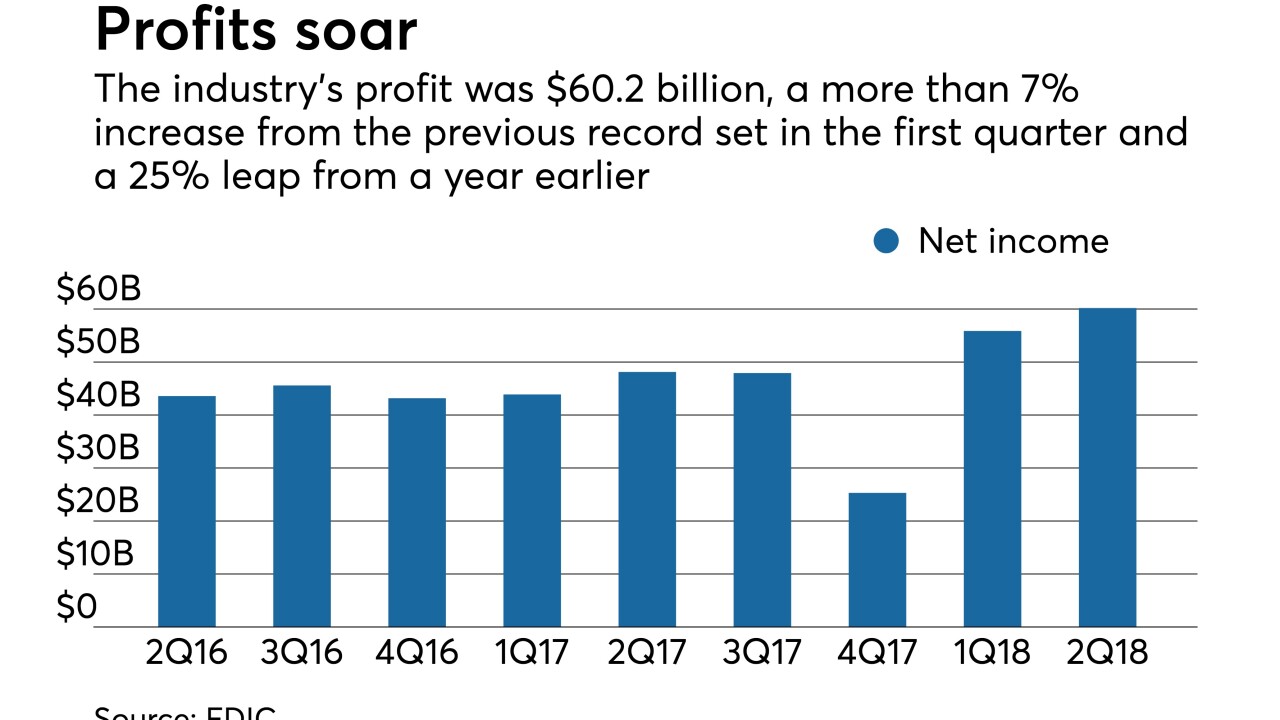

A huge chunk of the profit increase in the second quarter was due to a lower tax rate, but rising net interest margins and loan growth signal that institutions continue to derive revenue from their loan book.

August 23 -

Before the passage of the recent regulatory relief law, only banks with assets of less than $1 billion were on an 18-month exam schedule.

August 23 -

A top regulator has signaled that the banking agencies are receptive to extending the comment deadline, after banks raised concerns about a proposed revision to the ban on proprietary trading.

August 23