-

The former head of the agency said the proposed changes to the enhanced supplementary leverage ratio will make banks vulnerable to disruption and failure.

September 6 -

In a report, the watchdog said the economic environment and competition instead have driven trends in small-business lending.

September 5 -

The appointments are on top of other recent personnel changes under Chairman Jelena McWilliams, who took the reins of the agency in June.

September 4 -

The OCC required the company to raise more capital and complete a CRA plan. Varo Bank still needs FDIC and Fed approval before opening.

September 4 -

The agencies had proposed revisions designed to make compliance less complex, but banks have expressed concern that the plan could have the opposite effect.

September 4 -

Unilateral approaches to bank regulation are risky, but the OCC's plan to seek public comment independent of the other agencies could help shed light on a CRA debate that is now being waged internally.

August 27

-

The agency says it will act independently of other regulators to release a notice asking for public input on revamping the decades-old law.

August 24 -

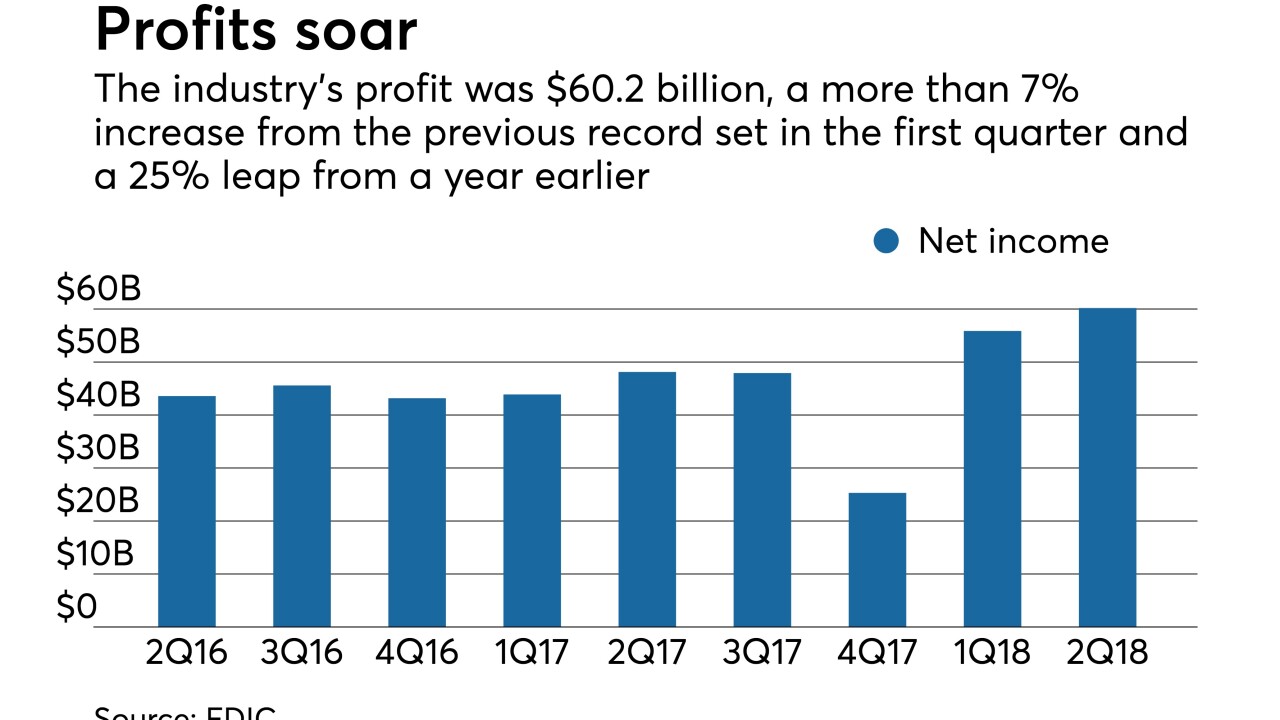

A huge chunk of the profit increase in the second quarter was due to a lower tax rate, but rising net interest margins and loan growth signal that institutions continue to derive revenue from their loan book.

August 23 -

Before the passage of the recent regulatory relief law, only banks with assets of less than $1 billion were on an 18-month exam schedule.

August 23 -

A top regulator has signaled that the banking agencies are receptive to extending the comment deadline, after banks raised concerns about a proposed revision to the ban on proprietary trading.

August 23 -

The industry’s profit was $60.2 billion, a more than 7% increase from the previous record set in the first quarter and a 25% leap from a year earlier, the agency said in its quarterly report on the industry's health.

August 23 -

The regulation implements a recent legislative provision dealing with how banks comply with post-crisis liquidity requirements.

August 22 -

Although it’s required to by law, the Federal Deposit Insurance Corp. has not had an independent director with state bank supervisory experience since 2012. It’s time for that to change.

August 17 Conference of State Bank Supervisors

Conference of State Bank Supervisors -

The veteran banking attorney, who also worked at the FDIC and OCC, passed away Tuesday following a battle with cancer.

August 15 -

The companies had been unable to secure regulatory approval for the deal, which was announced a year ago.

August 14 -

Organizers of Piermont Bank said in their application with the FDIC that they want to raise $100 million and eventually operate in several urban coastal communities.

August 14 -

Tekalign Gedamu, who would chair Marathon International Bank, says that Zekarias Tamrat is bad-mouthing the de novo effort following his dismissal and a subsequent payment disagreement. Tamrat was slated to be the bank's president.

August 3 -

A new law exempts small lenders from expanded mortgage data reporting, but regulators are signaling that banks and credit unions no longer have to collect the data either.

August 3 -

Readers react to Wells Fargo's latest penalty, weigh in on the Vatican's criticism of credit default swaps and opine on the long tail of the financial crisis.

August 2 -

Zekarias Tamrat blamed the proposed Marathon International Bank's chairman and directors for delays in getting its application approved.

August 2