-

Republican Bob Corker of Tennessee and Democrat Mark Warner of Virginia are acknowledging the legislative efforts to end government control of Fannie Mae and Freddie Mac are dead, at least for now.

May 23 -

For nearly a decade, the FHFA has restricted Fannie Mae and Freddie Mac from trying to influence the raging debate over whether they should live or die.

May 18 -

Freddie Mac has quietly started extending credit to nonbanks that issue mortgages, a move it says will help the companies maintain access to a crucial stockpile of cash if their home loans go sour.

May 7 -

The Treasury secretary said reforming Fannie Mae and Freddie Mac will come into focus more in 2019, when Federal Housing Finance Agency Director Mel Watt’s term will end.

April 30 -

The annual progress report on the Fannie Mae and Freddie Mac conservatorships reiterated that a new credit score model will likely not be operational until after the implementation of a new Single Security Initiative.

March 29 -

After several years of preparation, Fannie Mae and Freddie Mac will start issuing a new, common mortgage-backed security starting June 3, 2019, the Federal Housing Finance Agency said Wednesday.

March 28 -

A bill to allow captive insurance companies to be reinstated as members of the Federal Home Loan Bank System appears to be dividing the FHLB community.

March 21 -

A late addition to regulatory relief legislation would direct the Federal Housing Finance Agency to review credit-scoring alternatives, but some say the provision is redundant.

March 13 -

The Federal Home Loan banks could "design and implement" their own system for deciding how to allocate resources for affordable housing initiatives under the proposal by the Federal Housing Finance Agency.

March 6 -

The Supreme Court dealt hedge funds and other big investors a blow Tuesday by refusing to revive core parts of lawsuits that challenged the federal government’s capture of billions of dollars in profits generated by Fannie Mae and Freddie Mac.

February 20 -

The House Financial Services Committee chairman is calling out Fannie Mae and Freddie Mac's regulator for authorizing payments to two housing trust funds while the mortgage giants have their own financial struggles.

February 16 -

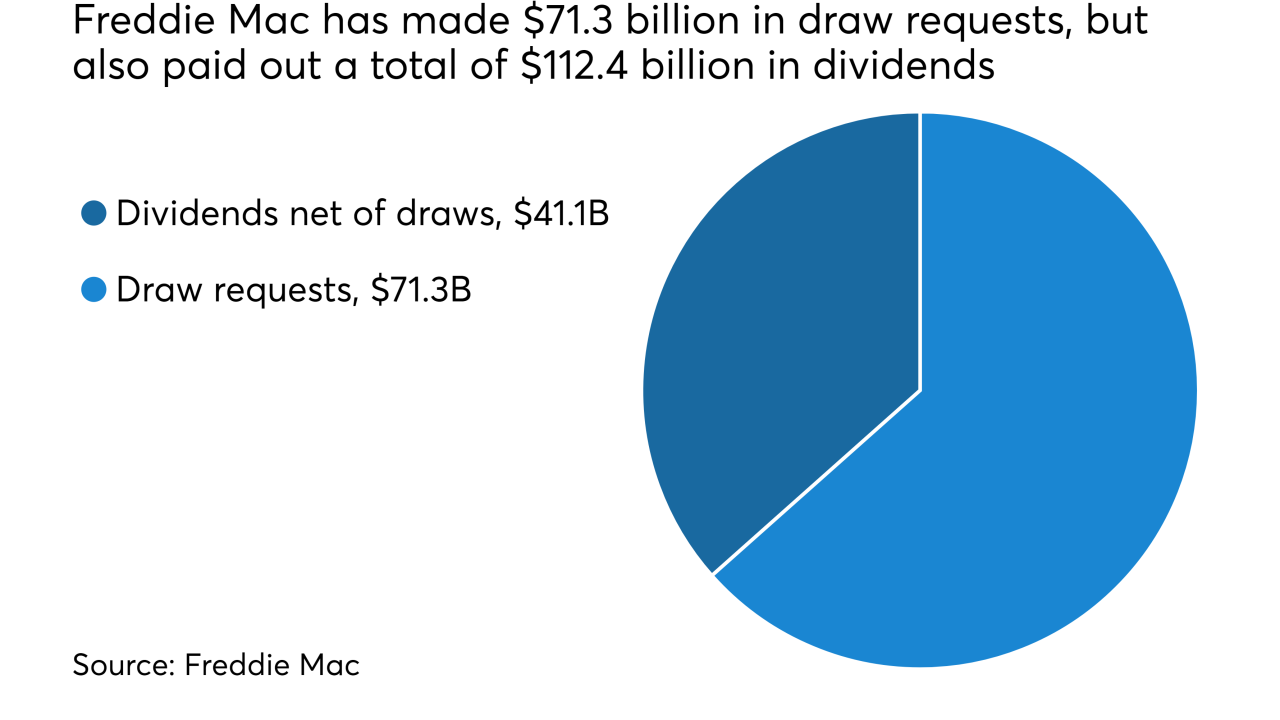

Freddie Mac posted a fourth-quarter net loss of $3.3 billion and will request $312 million from the Treasury after recent tax reform legislation forced it to write down the value of deferred tax assets.

February 15 -

Despite a legislative push by some senators and other stakeholders to jump-start housing finance reform, efforts to form consensus over a bill once again are stuck in neutral.

February 15 -

Tax reform caused Fannie Mae to burn through retained earnings that had been approved just two months ago and to post a fourth-quarter loss. CEO Timothy Mayopoulos argued it was a one-time event that overshadowed strong fundamentals.

February 14 -

Fallout from the Fed's blow to Wells Fargo; a call for calm in the rush to regulate cryptocurrencies; point-of-sale lending has its day; and more.

February 9 -

As conservator, FHFA Director Mel Watt has substantial leeway to remake the government-sponsored enterprises without congressional input. Here's one way he might do so.

February 7 -

The Federal Housing Finance Agency said Friday it will give commenters more time to weigh in on a potential update to the credit scoring requirements for Fannie Mae and Freddie Mac.

February 2 -

Three senators have unveiled a bill that would allow captive insurance companies to regain full membership in the Federal Home Loan Bank System.

February 1 -

An exclusive look at the Senate's tightly held housing finance plan drew the most interest from readers this week, while TD's foray into AI and the roller coaster at CFPB also dominated attention.

January 19 -

Senate negotiators are working on a bill that would place Fannie Mae and Freddie Mac into receivership and replace them with multiple mortgage guarantors, according to sources.

January 18