PNC Financial Services Group

PNC Financial Services Group

PNC Financial Services Group is a diversified financial services company offering retail banking, corporate and institutional banking, asset management, and residential mortgage banking across the United States.

-

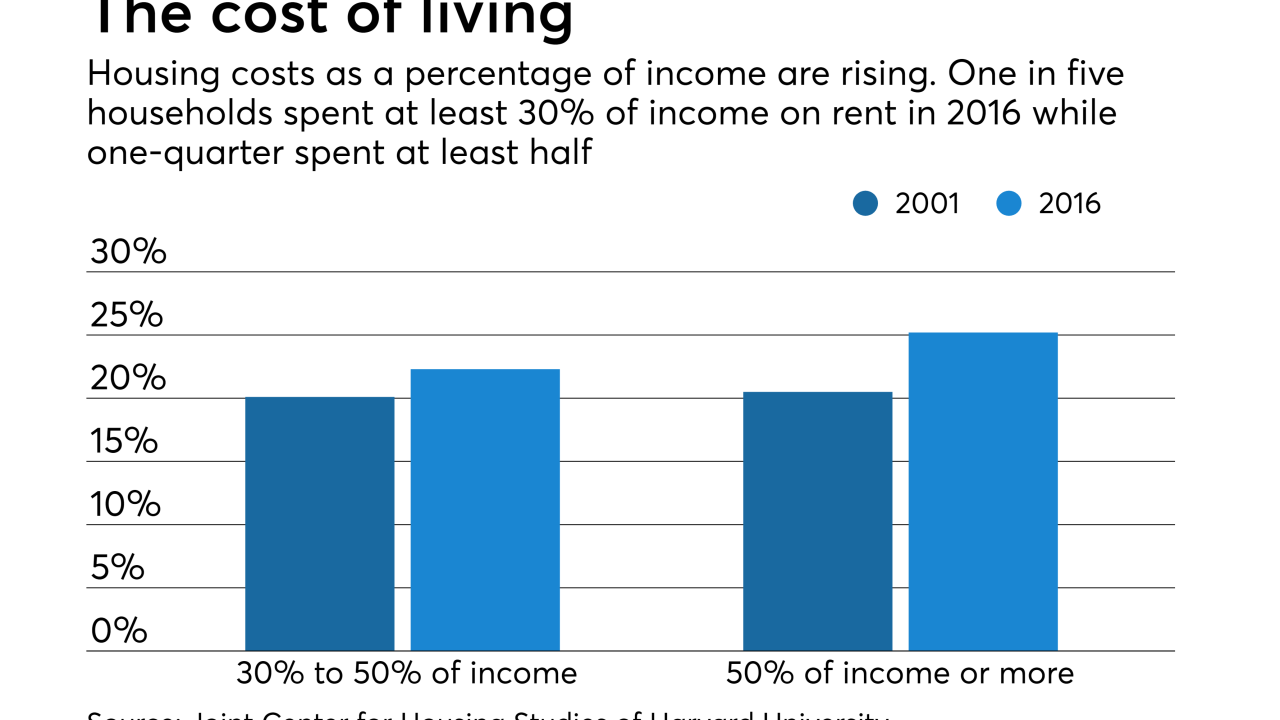

Advocates are seeking more federal funding for affordable housing. A federal investigation into the banks’ alleged manipulation of a popular tax-credit program can’t be helping their cause.

September 18 -

Some are relying on a national, digital strategy. Others say the right balance of costs and growth comes from more traditional means such as targeted branch openings and out-of-market expansion.

September 12 -

JPMorgan Chase, SunTrust and PNC are pressuring outside counsel to get more women and minority lawyers to represent them in court even at the risk of alienating the big, traditional law firms that they have done business with for years.

August 7 -

Bank of America’s consumer loans grew a lot. But its rivals? Not so much. The mixed results raise questions about whether BofA’s performance is a leading or trailing indicator, and if credit quality is going to be more of a problem industrywide.

July 16 -

PNC revealed the plan as part of its report of strong second-quarter results, and CEO Bill Demchak said it is an example of the regional bank's growth-oriented investments.

July 13 -

The regional bank's move is part of an industrywide transformation of call centers and operations centers to handle more complex tasks and trim costs.

July 9 -

Commercial real estate is their bread and butter, but many banks are scaling back in this vital loan category. Here’s why.

June 29 -

The recent string of positive news for the banking industry, from lower corporate taxes to less regulation, is starting to feel like a distant memory.

June 27 -

The quest for fast payments is advancing on the consumer side, but most banks are said to be undecided about a host of issues tied to speeding up transactions between businesses.

June 21 -

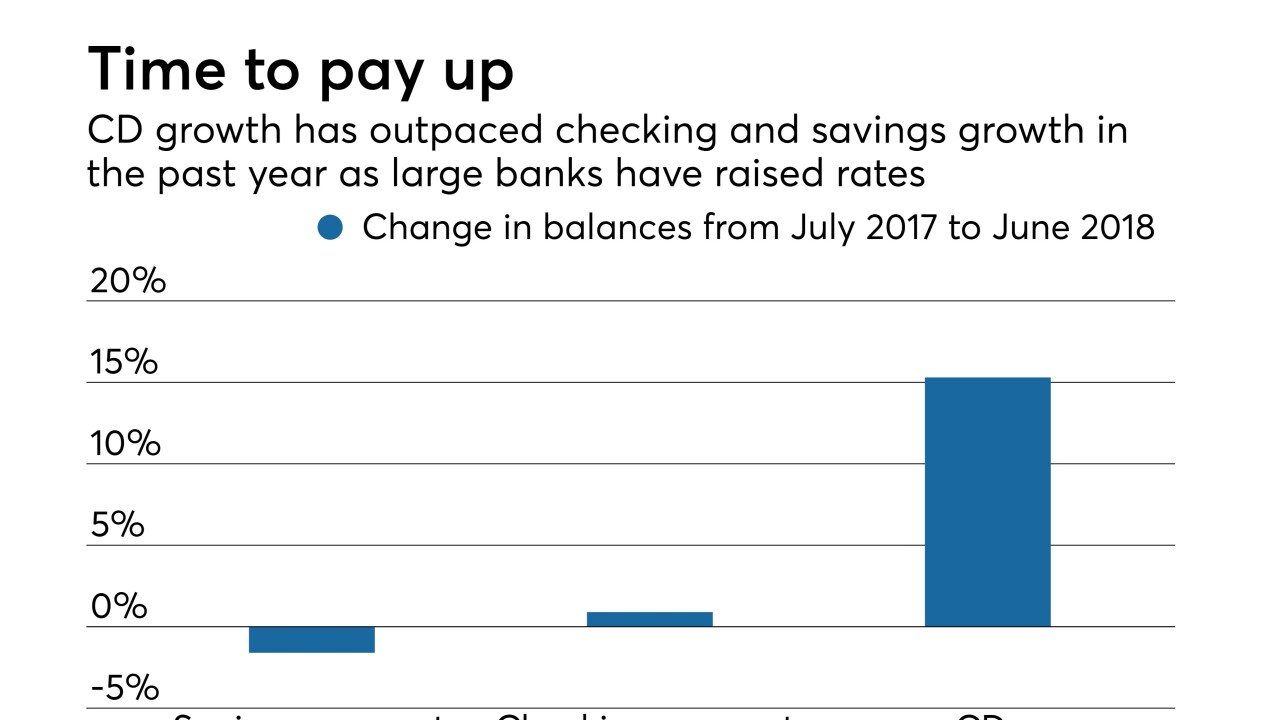

Competition for deposits is heating up as summer approaches, and banks are responding in all sorts of ways — from launching digital-only platforms to raising CD rates to reviving debit rewards. But rising interest rates could weaken demand for loans, especially mortgages.

June 14 -

The firms were initially slated to be included in a newly merged trade association, but they were blocked after some executives objected to adding more Wall Street banks.

June 8 -

Whether they’re thwarting cyber thieves or building out new apps, bank chiefs say hefty tech investments are now a cost of doing business — but they have to convince shareholders.

May 30 -

The numbers are better but still disappointing for such a healthy economy, lamented executives from large U.S. banks. Some are scratching their heads, some are remaining upbeat about the second half of the year, and others are focusing on Plan B.

May 30 -

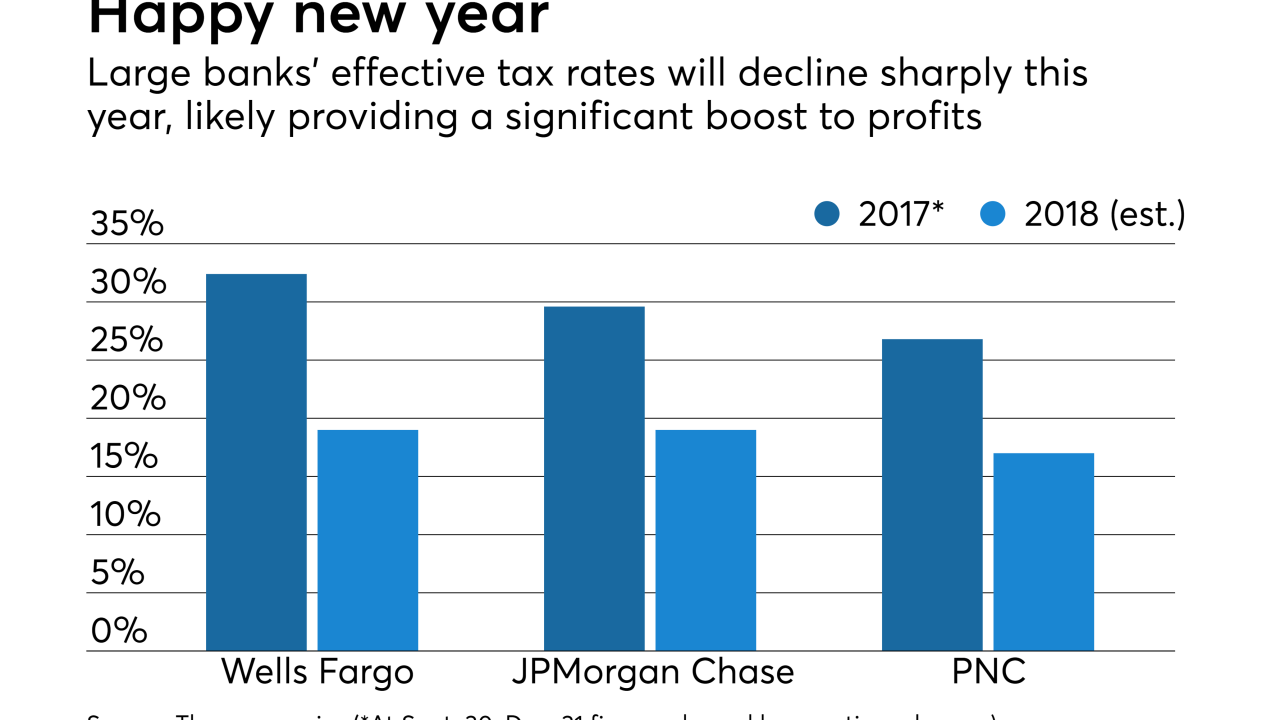

Bankers hoped the tax overhaul would stimulate a boom in business borrowing, but several said this week that hasn’t happened yet. PNC’s Bill Demchak warned that the tax cuts could be encouraging lenders to underprice loans.

April 13 -

William Parsley was most recently PNC's chief investment officer and treasurer and had previously served as head of consumer lending.

February 22 -

Bank stocks tumbled on Monday amid a wider sell-off as investors' concerns mounted that wage growth could lead to inflation, higher borrowing costs for businesses and changes in the Fed's rate-hike plans.

February 5 -

Swelling capital levels, tax cuts and changing attitudes about post-crisis regulation could encourage bigger banks to issue the one-time payouts to reward shareholders and better manage their returns.

January 31 -

Look for banks to boost dividend payouts, expand into new markets, increase their tech spending and, eventually, ramp up their C&I lending. But don't expect much in the way of M&A.

January 21 -

Though business owners are more optimistic about the direction of the economy since the tax law was passed, it's doubtful their borrowing will increase meaningfully until they see more signs of more robust growth, bankers say.

January 16 -

Executives of large banks told investors and analysts what they wanted to hear Friday when they said they plan to increase returns to shareholders.

January 12