-

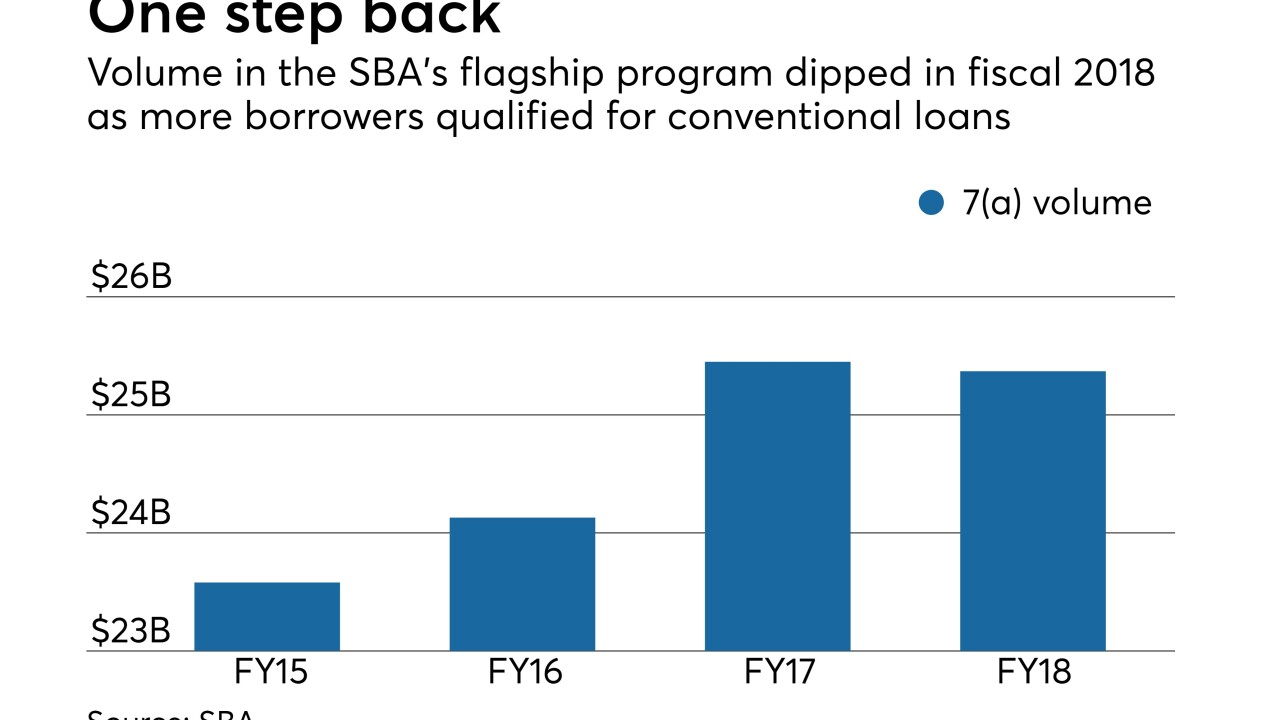

The agency's 7(a) program had a small year-over-year decline, with bankers pointing to lender discipline and more borrowers qualifying for conventional loans.

October 9 -

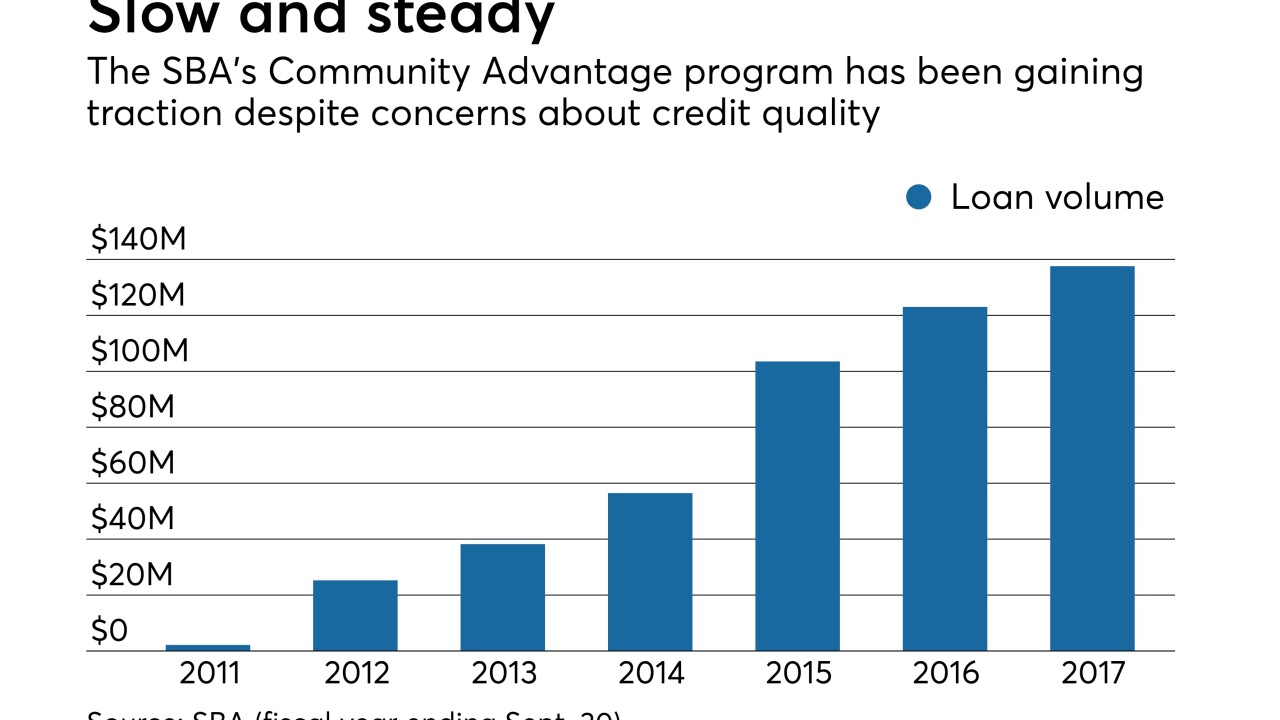

Some lenders fear a moratorium on new participants, and other restraints, could be the beginning of the end for the agency's Community Advantage program.

September 26 -

The House of Representatives passed two bills that would tie appraisal waivers for Small Business Administration loans to bank rules for commercial real estate loans, despite objections from the Appraisal Institute about its members being cut out of transactions.

September 26 -

Organizers of Dogwood State Bank are looking to raise $75 million in hopes of opening by mid-2019.

August 31 -

The USAmeriBank deal was supposed to give Valley National Bancorp a bigger presence in Florida, but it did more than that — it provided a model for banking businesswomen that Valley can copy in its New York and New Jersey markets.

August 30 -

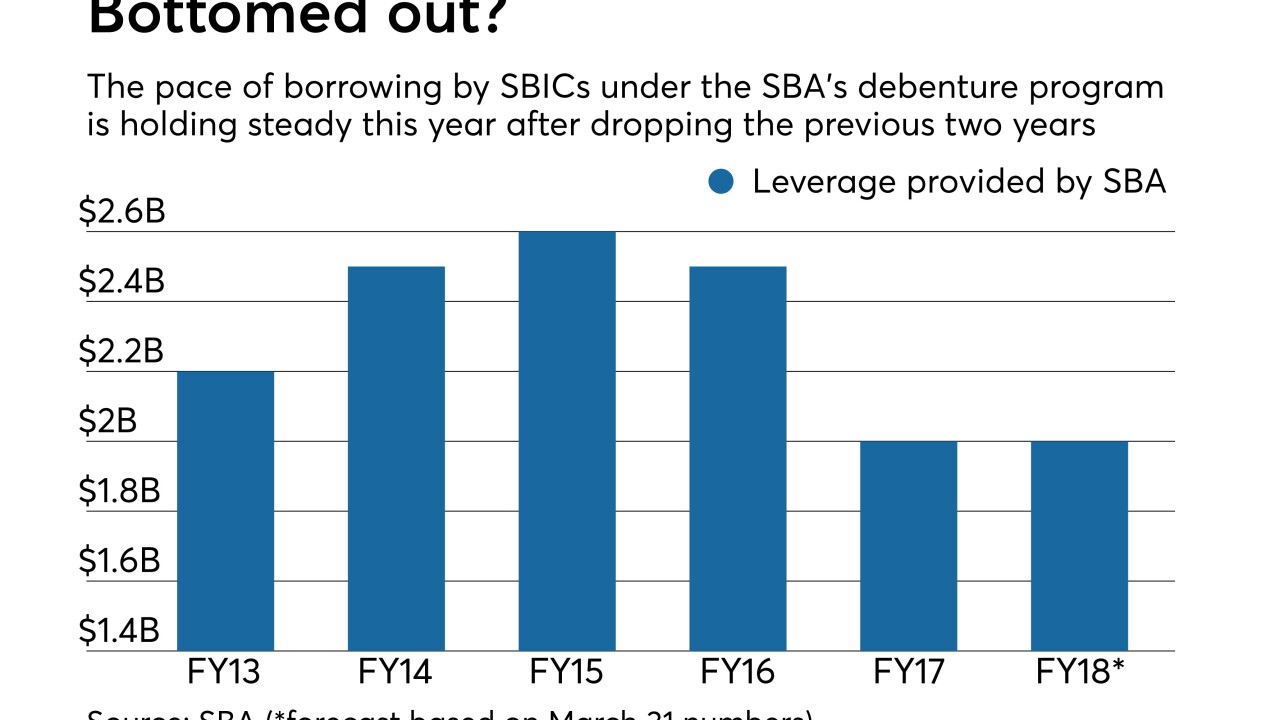

While the Small Business Investment Companies program has reported disappointing results since its 2015 peak, participating funds are getting more looks from curious bankers.

July 12 -

A number of banks are upgrading technology and hiring more lenders to better reach small-business owners, who are becoming more confident in their outlooks.

June 27 -

The explosion in construction of self-storage facilities is being backed by banks hungry for commercial loans. Some market participants fear a glut is in the making and the credits could sour.

June 20 -

The bill is one of two SBA-related measures the Senate approved late Tuesday and sent to President Trump to sign into law.

June 6 -

Credit unions in Tennessee and Ohio were singled out by the U.S. Small Business Association.

June 4