-

The Treasury Department announced the initiative just as the leaders of the three countries signed a multilateral trade pact to replace the North American Free Trade Agreement.

November 30 -

The comments by Brent McIntosh, Treasury's general counsel, are at odds with concerns by state regulators and consumer groups who fear that a national standard on how firms handle data breaches could weaken pre-existing rules.

November 27 -

The French bank was hit with the fine after it was found to have unsafe practices that violated sanctions against Cuba and other sanctioned countries.

November 19 -

FDIC Chairman Jelena McWilliams questioned whether regulators and banks are fully capturing the emerging risks of a new shadow banking system.

November 15 -

Sen. Elizabeth Warren said regulators are failing to respond to what she thinks could be a new meltdown in the making: the trillion-dollar market for leveraged loans.

November 15 -

A new group aims to foster collaboration between fintechs and state and federal officials in the fight against crime — without hindering legitimate business innovation.

November 9 -

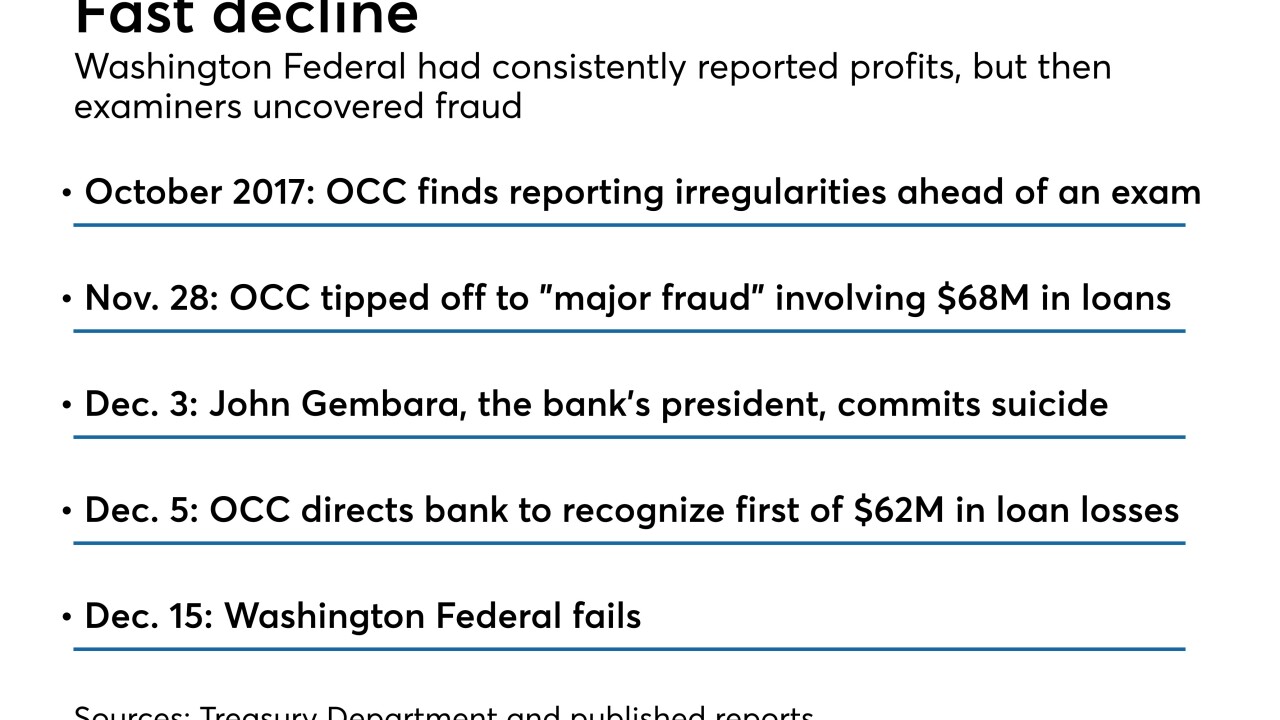

Examiners could have done more to minimize the brunt to the Deposit Insurance Fund from Washington Federal Bank for Savings, which hid fraudulent loans and will cost the fund more than $80 million, according to a report from the Treasury’s inspector general.

November 8 -

Federal "Opportunity Zones" that reduce exposure on capital gains could draw rich investors — and commercial lenders along with them — into economic development projects in thousands of troubled communities around the country.

October 29 -

The U.S. has arrested a Treasury Department employee for leaking confidential bank records pertaining to Paul Manafort, Rick Gates, the Russian Embassy and Maria Butina, who's been accused of being a Russian agent.

October 17 -

Craig Phillips, a counselor to Treasury Secretary Steven Mnuchin, said the department is not trying to undermine the role of state regulation of fintechs.

October 10