U.S. Bancorp

U.S. Bancorp

U.S. Bancorp with nearly 70000 employees and $554 billion in assets as of December 31 2020 is the parent company of U.S. Bank National Association the fifth-largest commercial bank in the United States. The Minneapolis-based bank blends its relationship teams branches and ATM network with digital tools that allow customers to bank when where and how they prefer.

-

The Office of the Comptroller of the Currency announced Friday that it has lifted restrictions relating to U.S. Bank's flawed efforts to prevent money laundering and Citi's deceptive marketing and billing practices.

December 21 -

The Financial Accounting Standards Board is requiring all companies to record leases for property and equipment on their balance sheets. Here’s how that revision could affect banks’ loan decisions — and their own capital ratios.

December 11 -

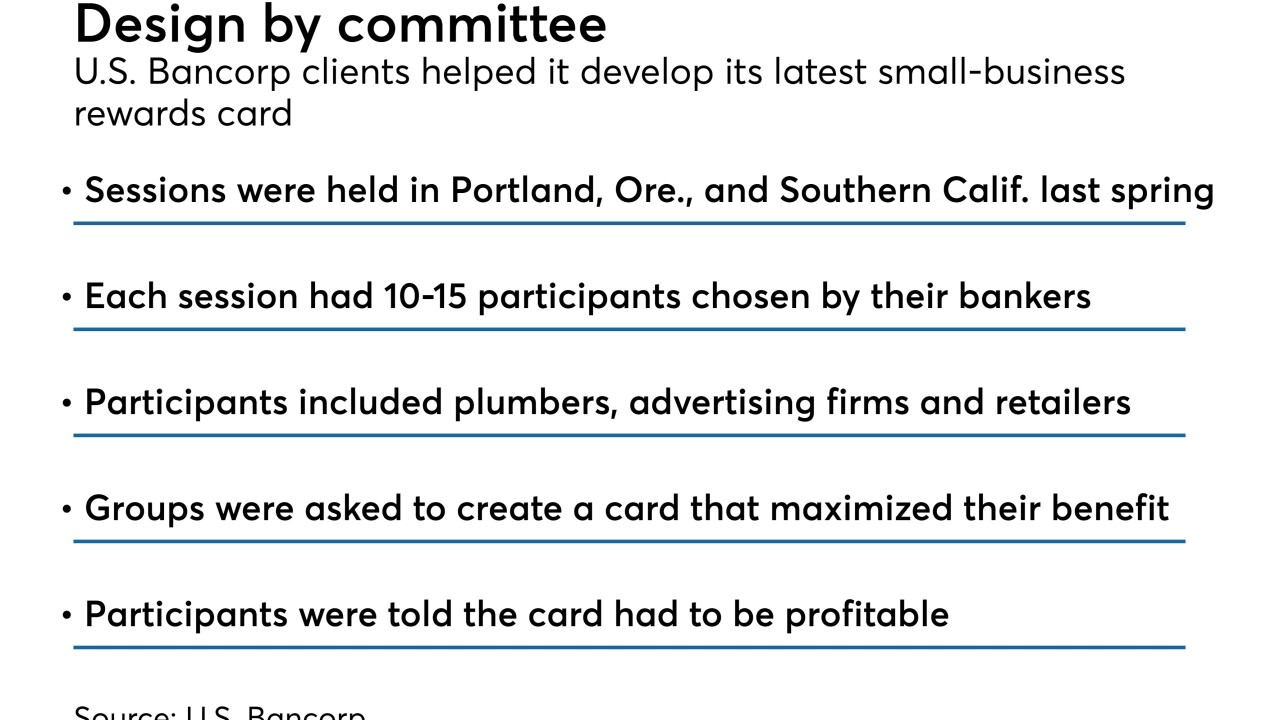

The regional bank is working with customers to help develop and launch new products, including a small-business credit card.

December 7 -

Big-bank execs downplayed gloomy economic forecasts and said a commercial lending rally, niche M&A and smart tech spending will drive growth in 2019.

December 4 -

Quicken and U.S. Bank are launching a co-branded contactless credit card that will integrate with Quicken's personal finance software and mobile app.

November 29 -

The card is being launched in partnership with U.S. Bancorp, which will handle the underwriting and provide the credit.

November 28 -

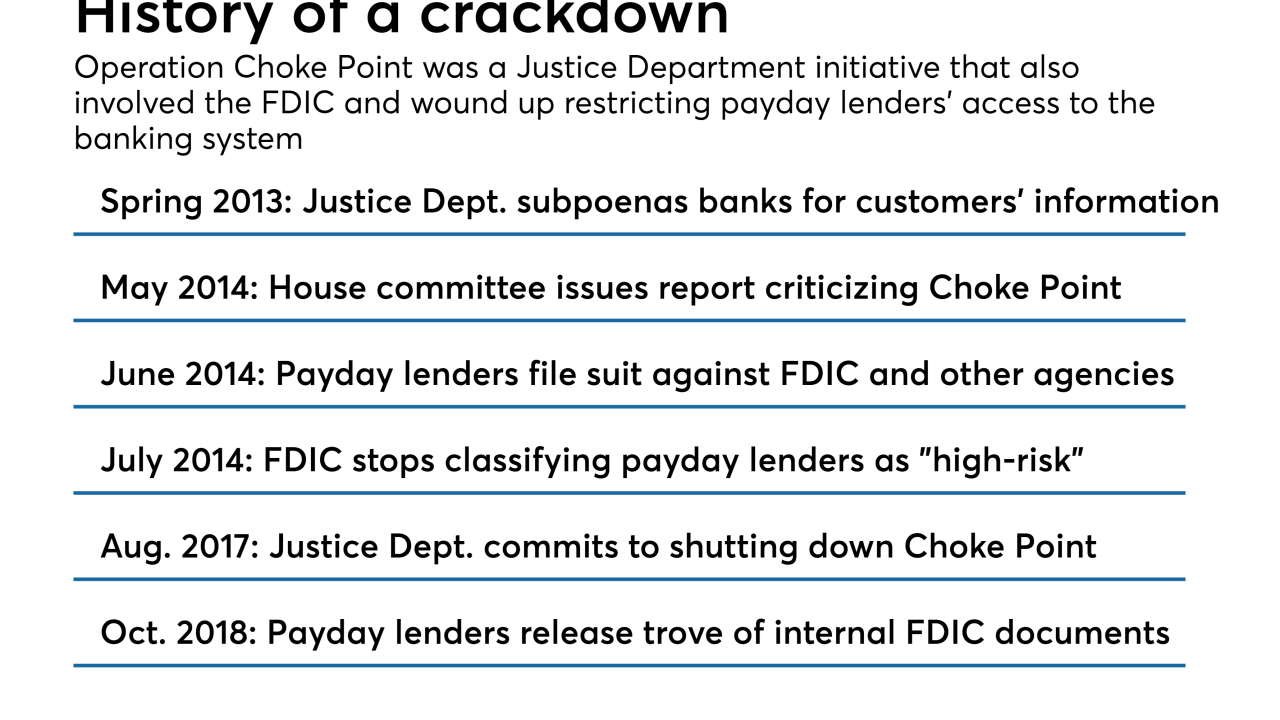

Payday lenders argue that banks cut ties with their industry due to pressure from biased and hostile regulators. But the reality, in some cases, may be more nuanced.

November 16 -

Berkshire Hathaway plowed $13 billion into bank stocks in the third quarter that included new investments in JPMorgan and PNC and additional investments in Bank of America and Goldman Sachs.

November 15 -

Payday lenders argue that banks cut ties with their industry due to pressure from biased and hostile regulators. But the reality, in some cases, may be more nuanced.

November 8 -

Wells Fargo puts two top execs on leave as scandal's reach grows; regional banks freed from SIFI label lobbying regulators hard for more relief; FDIC to launch innovation office to help banks compete with fintechs; and more from this week's most-read stories.

October 26