David Heun is an associate editor for technology at American Banker.

-

Personalized advice, embedded finance and virtual branches are among the initiatives financial services companies have on their drawing boards for the coming year.

By Miriam CrossJanuary 4 -

Bankers were given a chance to weigh in on a new breach notification proposal, and federal regulators apparently took their comments to heart before issuing the final rule.

By David HeunNovember 30 -

A new report finds that financial companies are the most targeted by fraudsters seeking to steal usernames and passwords. They're fighting back with specialized tracking technology, special domain names and other increasingly sophisticated techniques.

By David HeunNovember 23 -

The firm's global head of transaction banking says practicing meditation helped him manage a team that built a new corporate banking platform. His leadership of the project was one reason Moorthy was selected as a finalist for American Banker’s Digital Banker of the Year.

By David HeunNovember 17 -

Criminals are finding weaknesses in the complex network of applications on banks' sites and exploiting them to launch attacks.

By David HeunNovember 10 -

The company, whose software is used by four of the top five U.S. banks, says it will use the money to improve its identity verification and fraud detection technology.

By David HeunNovember 9 -

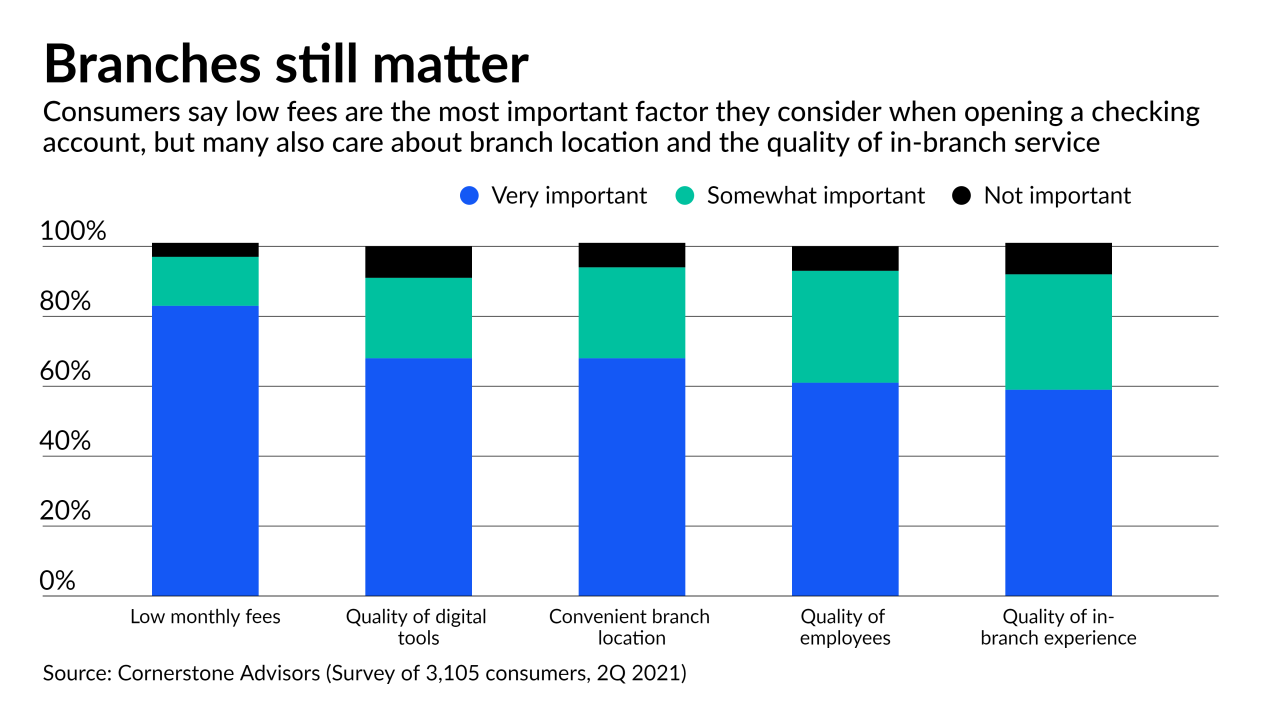

Many of the consumers who embraced online and mobile channels during the pandemic are seeking help from human bankers more than ever, according to research from Cornerstone.

By David HeunNovember 5 -

If law enforcement concludes that the company's devices were used in a cyberattack on U.S. companies, banks may need to change the way they choose, test and monitor point-of-sale equipment.

By David HeunOctober 29 -

Collaborations among rival banks and fintechs can be mutually beneficial, Vanessa Colella says. A recent example is a small-business loan portal Citi created that other banks can use.

By David HeunOctober 27 -

The credit bureau's $638 million deal to buy the ID verification firm is its second M&A agreement in a little over a month to broaden its line of products and services that help customers combat fraudsters and identity thieves.

By David HeunOctober 27 -

The bank is the first to offer a service from The Clearing House’s Real Time Payments network that lets businesses send bills to retail clients, who are given the option to pay them immediately.

By David HeunOctober 25 -

Account takeovers and ATM skimming are rampant in cities like Las Vegas and New York. Meanwhile, scammers are targeting travelers as they attempt to pay airlines, cruise ships, car rental companies and hotels.

By David HeunOctober 22 -

The new ATMs deter card-skimming fraud through encryption, individually paired card readers and a design that requires users to dip their cards at an angle.

By David HeunOctober 15 -

Cybersecurity teams are using scoring systems, standard formats and other tactics to prioritize the deluge of alerts they're receiving about commonly used programs.

By David HeunOctober 13 -

Even with an industry-driven standard in place, some institutions still resist parting with client information.

By David HeunOctober 6 -

Under Morais, Ally Bank hit a number of milestones in 2020, including topping the 2 million mark in deposit customers.

By David HeunOctober 6 -

FirstBank is working with the two major U.S. real-time payments systems so that it can suit the preferences of different customers. Its flexibility could set an example for regional and small institutions.

By David HeunOctober 1 -

Email scams in which hackers siphon small amounts of money from thousands of accounts at once are on the rise. Here's what banks are doing about it.

By David HeunSeptember 16 -

Eligible users may trade bitcoin and ether through the company's app and also use bitcoin when completing debit card purchases. More cryptocurrency options will be offered in coming months.

By David HeunSeptember 13 -

As the need for easy-yet-secure mobile banking authentication escalates and consumers become used to logging in by looking into a camera, banks are taking the technology more seriously.

By David HeunSeptember 13