Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

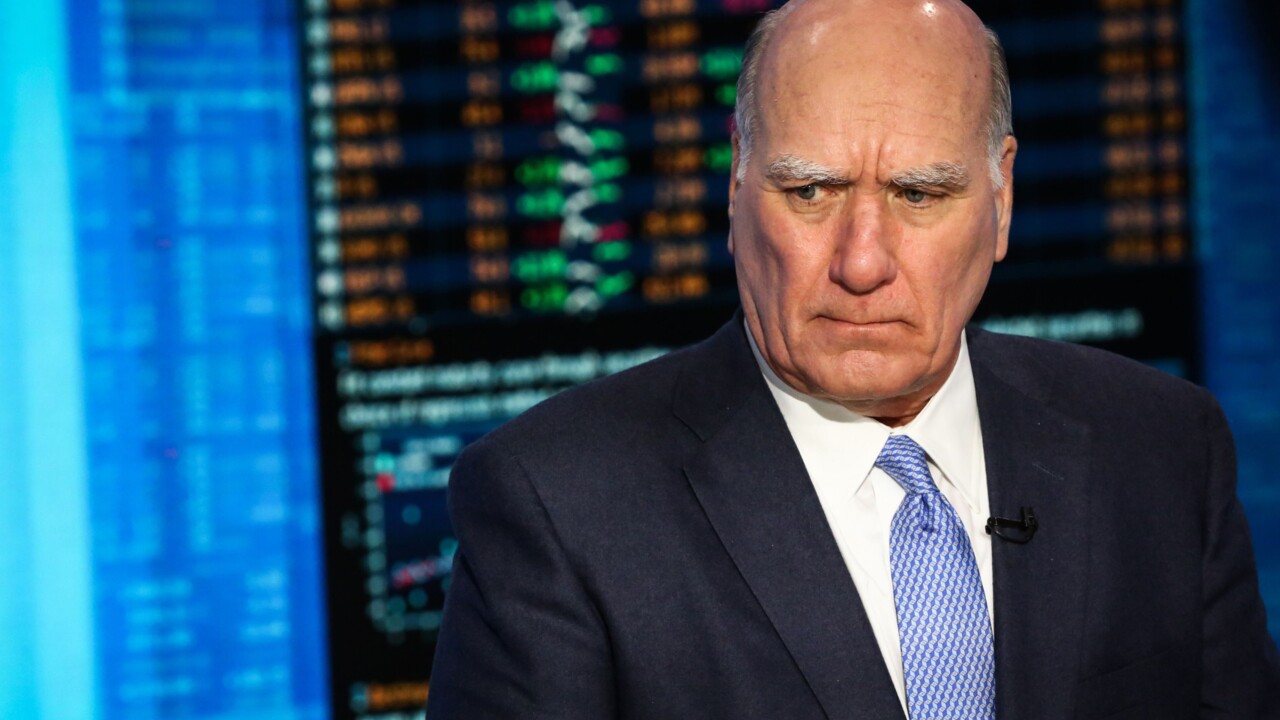

Chief Executive Officer Charlie Scharf plans to name Bill Daley, the former White House chief of staff, to a senior post to improve relations with authorities in Washington, according to people with knowledge of the plan.

November 7 -

Top officials at Bank of America and Wells Fargo said that commercial loan demand is weak, even as U.S. consumers show strength. Their comments echo recent findings by the Federal Reserve.

November 5 -

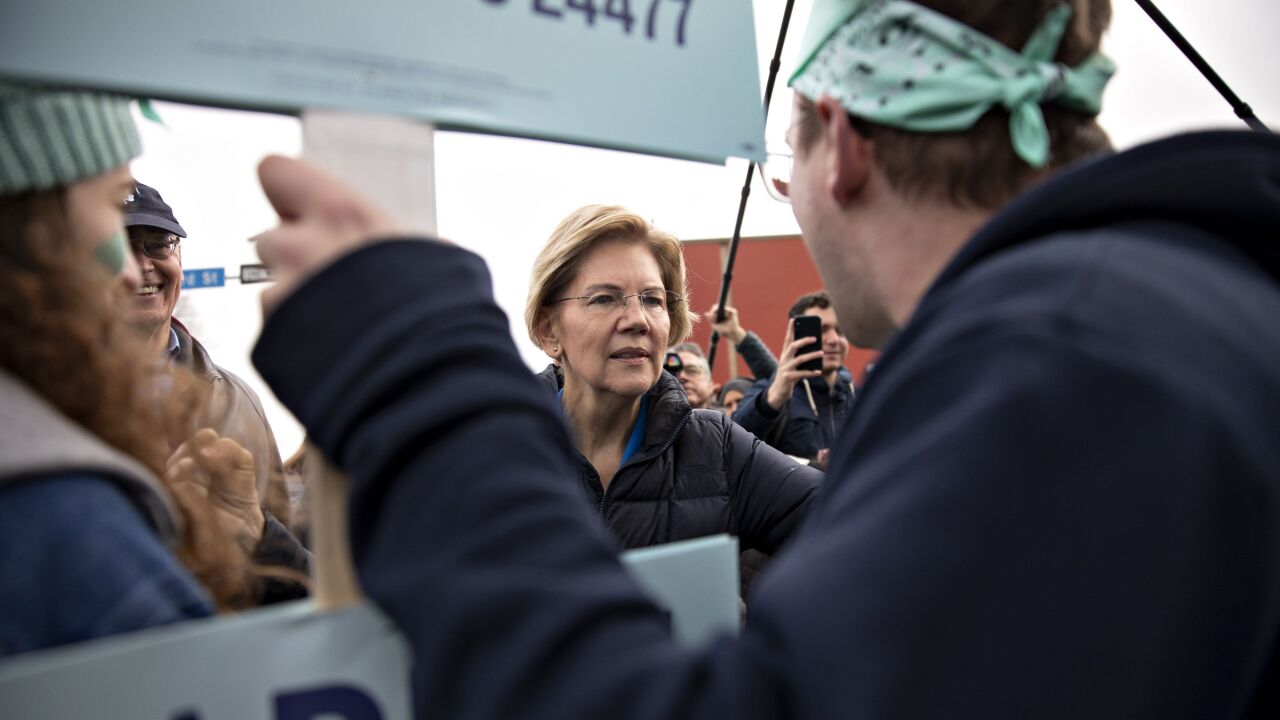

If elected president, Sen. Elizabeth Warren would charge large banks a fee to help pay for her Medicare-for-all plan.

November 4 -

CEO tells employees he wants them to be 'impatient' in fixing the bank’s woes; the new independent body would police banks’ compliance with AML regulations.

November 1 -

Rep. Ayanna Pressley, D-Mass., has proposed requiring annual testimony by the heads of the U.S. "global systemically important" banks.

October 31 -

The new CEO is the first outsider to head the scandal-ridden bank in decades; Facebook CEO faces the House Financial Services Committee on Wednesday to discuss Libra.

October 22 -

The legislation, sponsored by Rep. Cindy Axne of Iowa, aims to hold public companies accountable for moving jobs overseas. It won unanimous support from House Democrats but attracted only two votes from Republicans.

October 18 -

While demand is strong and loan performance generally remains solid, the prevalence of longer loan terms has sparked concern that losses will eventually spike.

October 16 -

They’ve long used their marketing muscle to wrest deposit share from smaller competitors. Now, amid growing concerns that the economy is weakening, they could be benefiting from consumers’ flight to safety.

October 16 -

Third quarter profits at JPM, Wells Fargo and Citigroup got a boost from consumer banking; the company tells Fed it will remain a passive investor.

October 16