Demand for car loans continues to surge and borrowers are largely keeping up with their payments, but some industry watchers see troubling signs in the way loans are being structured.

Ally Financial said Wednesday that its consumer auto loan originations rose to $8 billion in the third quarter, 13% higher than in the same period last year. JPMorgan Chase and Wells Fargo also reported strong growth in car lending when they released third-quarter results Tuesday.

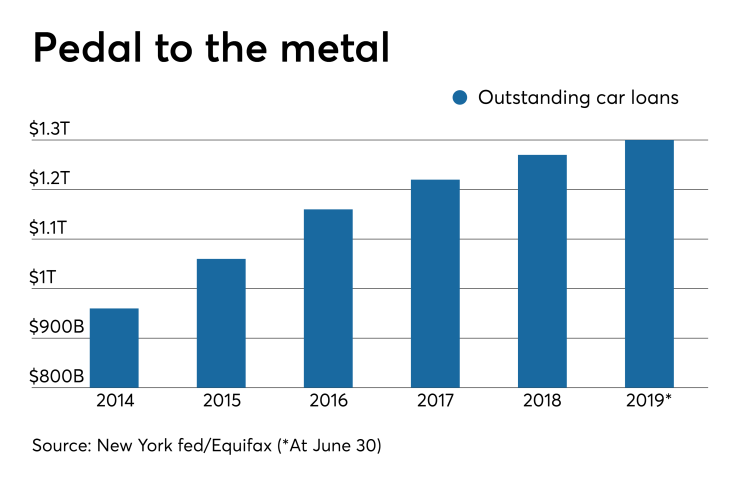

Over the last five years, auto debt outstanding in the United States has risen by 43% to $1.3 trillion, according to data from the Federal Reserve Bank of New York and Equifax.

The borrowing binge has been fueled in part by longer repayment periods, which make monthly payments more affordable for consumers at a time when vehicle prices have been rising.

But longer loan terms also increase the risk to the lender. Once rare, loans with terms repayment periods in excess of six years made up 31% of all new auto originations in the second quarter, according to S&P Global Ratings.

“To the extent that loan terms lengthen, the severity of loss could increase due to the slower amortization of the loan balance,” analysts at S&P Global Ratings wrote in a July report.

So far, most auto lenders, and particularly banks that tend to focus on more creditworthy borrowers, have not paid a substantial price for stretching out repayment periods for six or seven years. The New York Fed found that 4.64% of auto loans were at least 90 days delinquent in the second quarter, up from a post-crisis low of 3.14% in 2014, but still generally manageable.

“We see the credit environment as stable for the foreseeable future,” said Christopher Donat, an analyst at Sandler O’Neill.

During the third quarter, Wells Fargo charged off 0.65% of its auto loans, which was down from 1.10% in the same period a year earlier. JPMorgan charged off 0.32% of its portfolio, down from 0.35% in the third quarter of 2018.

Ally reported Wednesday that charge-offs comprised 1.38% of its retail auto loan portfolio in the third quarter, up from 1.32% a year earlier.

“Credit performance remained in line with our expectations this quarter,” Ally CEO Jeffrey Brown said during the company’s earnings call. “We continue to see a healthy U.S. consumer. Jobs are prevalent, unemployment is a 50-year low, wage growth continues to outpace inflation, and debt service levels remain well-managed.”

Ally, Chase and Wells Fargo all offer loans of at least six years.

Ally's auto loan terms have consistently averaged around 70 months, according to Chief Financial Officer Jennifer LaClair. She said that customers’ credit scores, the ratio between their payments and their incomes, and the amount of equity they have in their cars have remained extremely steady.

“As we look at our business, nothing has changed in terms of the way in which we originate,” LaClair said.

One day earlier, Wells Fargo reported that its auto loan originations increased by 45% in the third quarter — a sharp increase that was partly the result of an earlier restructuring of the bank’s auto lending unit.

In remarks that echoed those made by Ally executives, Wells Chief Financial Officer John Shrewsberry said that the FICO scores of the bank’s auto loan customers have not budged. The percentage of a borrower's monthly income that is going toward car payments has also held steady, he said.

Some auto lenders may use more stringent underwriting requirements for 84-month loans in an effort to soften the blow of potentially higher losses, S&P Report said in a report last month.

The report found that loans to prime borrowers with terms of 73 to 84 months had cumulative net losses that were four times higher on average than loans with terms of 60 months or less did.