The bank-run Zelle P2P network has moved $75 billion in funds since its launch last year, with certain consumer segments adopting the service for making payments to friends and family, and venture capital is swirling around the mobile payment apps that set their sights a bit higher.

But despite this activity, consumer use of P2P is a mixed bag.

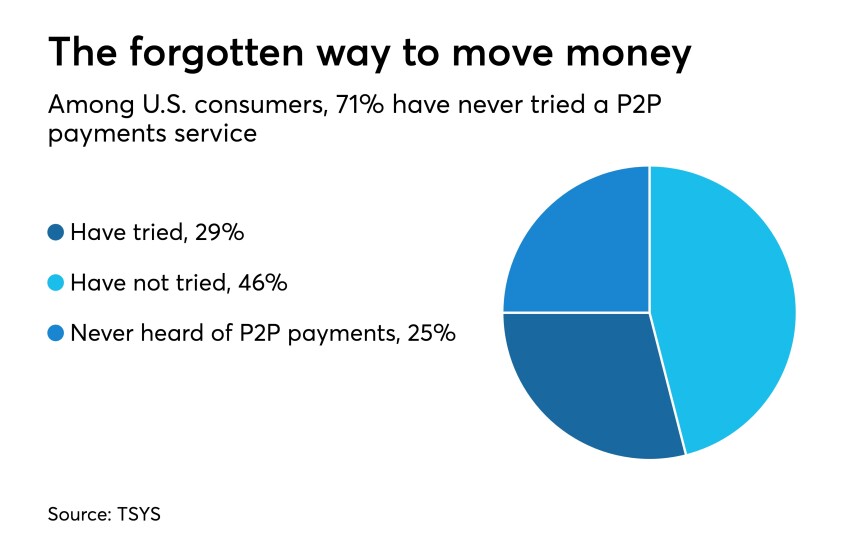

Most notably, 71% of consumers have no experience with P2P payments, according to Total System Services' latest annual survey of U.S. consumer payment habits, released Tuesday.

These findings are somewhat offset by growth in digital P2P reported by Aite Group and large banks that participate in the Zelle network, but even those findings illustrate lingering points of friction.

Nearly half, or 46%, of all consumers surveyed said they haven’t used a P2P service and 25% said they’ve never heard of the concept, suggesting that providers have a lot of work to do in driving awareness and education before P2P usage becomes routine.

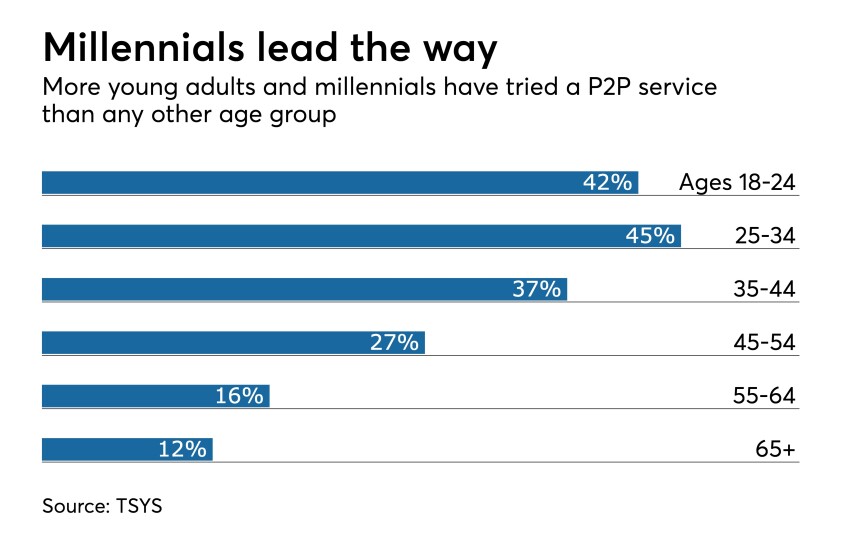

P2P use declines among older consumers, with only 37% of adults 35-44 having ever used P2P; 27% of those 45-54; 16% of those between 55 and 64 and 12% of those 65 years and up.

“We see a high propensity for P2P adoption among younger people because they’re more exposed to technology in their lives, which drives their willingness to adopt its use,” said Gavin Rosenberg, a senior director of product marketing at TSYS. The study overall points to the fact that as banks integrate new payment options with familiar mobile banking tools, more consumers are likely to test and adopt them, and the same is likely to be true for P2P services, Rosenberg said.

With close to 1 in 5 consumers lacking enough knowledge about P2P to estimate their own potential interest in the payments technology, it’s clear there is plenty of opportunity for banks to fill that void while consumer attitudes are still flexible.

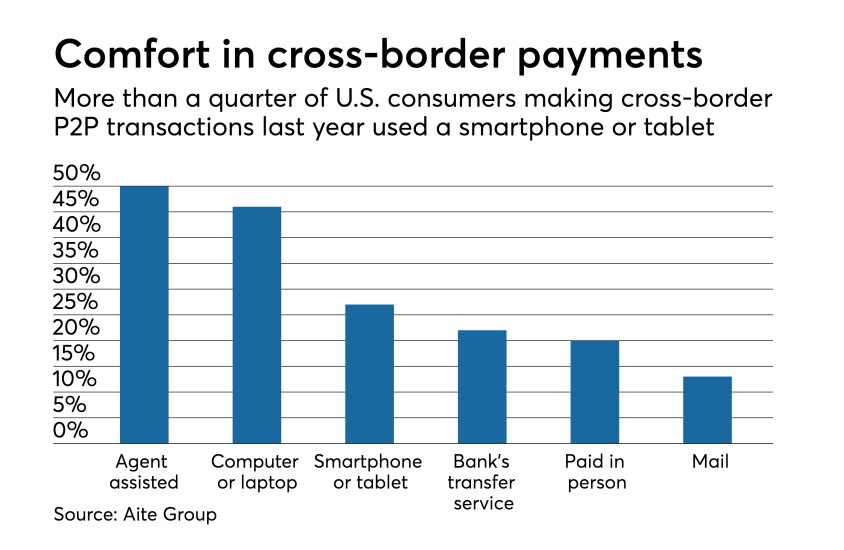

Walk-in services are still the most popular means for U.S. customers to send money across borders, with half seeking agent assistance, according to new data from Aite Group. Nearly as many—46%—conduct international funds transfers directly from a computer or laptop.

There is some movement with digital payments. Among consumers making a cross-border funds transfer within the last year, 27% used a smartphone or a tablet, Aite said. Less than a quarter of consumers used bank’s money-transfer service and 13% send funds by mail. Aite surveyed 1,127 U.S. consumers in the fourth quarter of 2017 about their use and preference of P2P services.

Competition is intensifying among providers of mobile app-based cross-border money transfer services like TransferWise and Remitly, while legacy providers like Western Union are attempting to retain market share by straddling both the walk-in and mobile markets by artfully blending solutions to suit users’ needs.

“There has been a pretty significant increase in the use of mobile banking and mobile P2P payment methods and a decrease in the use of cash and checks, indicating there’s still a lot of room for mobile to grow,” said Talie Baker, a senior analyst with Aite Group, who conducted the study.

Fifty-six percent of consumers in 2017 said they were interested in phones they could use to send a P2P payment, up from 48% in 2016 and 47% in 2016, indicating consumers’ awareness of new mobile features to perform financial tasks.

Consumers in the 2017 study ranked many features as more important than P2P: Stopping a fraudulent transaction (80%), getting instant transaction notifications (72%), the ability to turn a payment card on or off within the phone (64%), receiving instant offers and promotions (59%) and storing loyalty and rewards cards (58%).

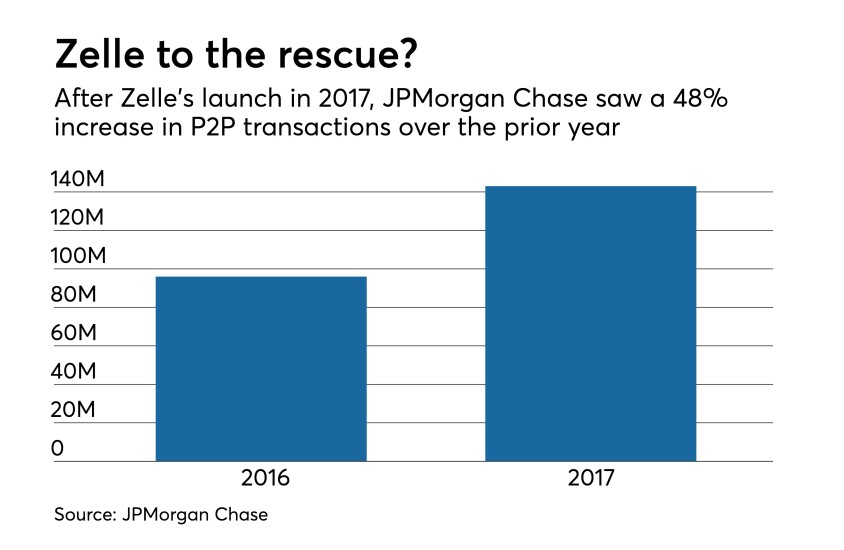

The move seems to have been successful. Chase executives last month told investors that after Zelle launched, the bank saw a 48% increase in P2P transactions during 2017 over the previous year, with transaction volume rising to 143 million from 96 million. Chase said the greatest increase within the bump in P2P transactions was in payments between Chase customers and other banks, not just among Chase customers.

Similarly, Bank of America — another founding member of Zelle — said in January that it processed nearly 68 million Zelle transactions in 2017, an 84% increase from the previous year. In the fourth quarter, Bank of America handled more than 23 million Zelle transactions, totaling nearly $7 billion, up 91% from the fourth quarter of 2016.

But that growth may be thwarted by Zelle's aggressive anti-fraud efforts. Zelle allows consumers to use its app even if they are not a customer of a Zelle bank, as long as the recipients of any transfers use a Zelle bank. But in recent months, many consumers have complained that Zelle would not approve their accounts for enrollment. According to Early Warning, the bank collective that operates Zelle, this "friction point" can arise when it suspects a user is enrolling a bank account that has been compromised by fraud.