-

Federal Reserve Chair Jerome Powell said the central bank was ready to raise interest rates in March and didn’t rule out moving at every meeting to tackle the highest inflation in a generation.

January 26 -

The expenses jumped 33% last quarter, which was generally in line with trends elsewhere in the credit card industry. The battle for new customers is “intense,” CEO Richard Fairbank told analysts.

January 26 -

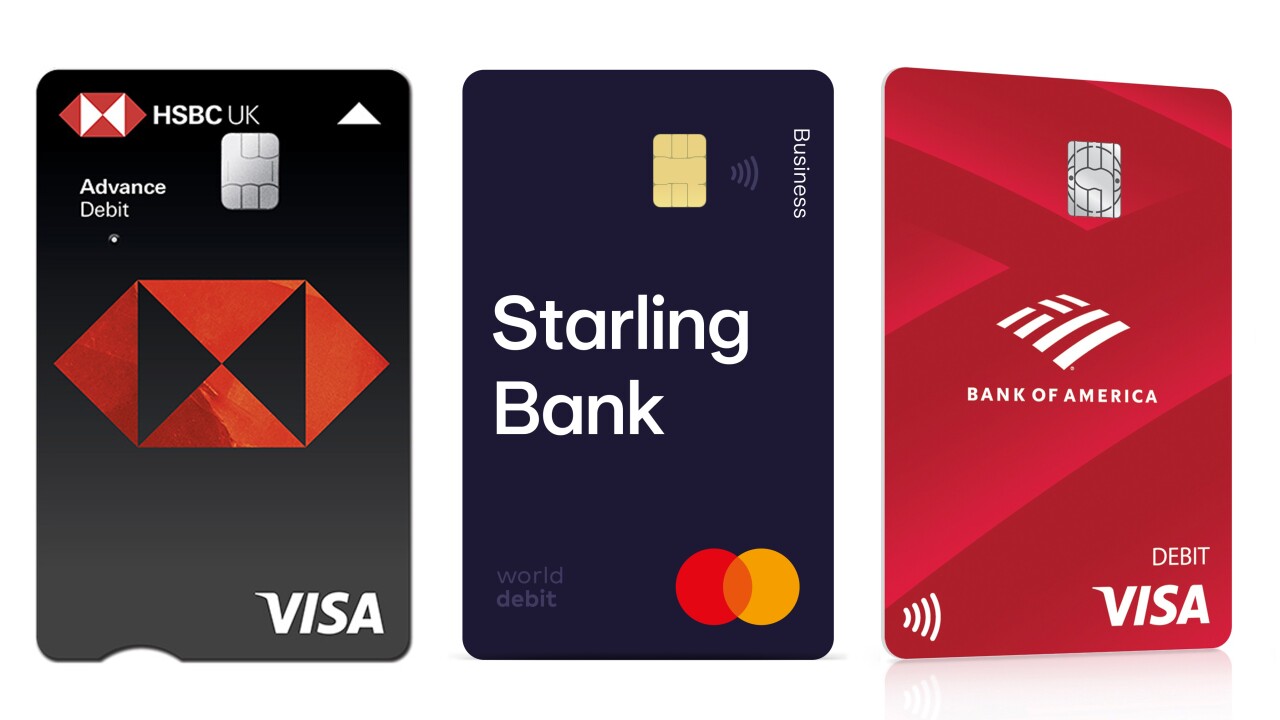

Switching from a horizontal layout — a relic of embossed account numbers — is an attempt by issuers like HSBC, Starling Bank and Bank of America to address accessibility challenges faced by customers with dementia, visual impairments and other conditions.

January 24 -

A new service speeds payments by using artificial intelligence to predict which buyers are most likely to pay.

January 21 -

Bank of America revamped leadership across its wealth management business, placing more responsibilities on current heads Andy Sieg and Katy Knox.

January 21 -

The Tennessee bank reported an uptick in commercial lending during the fourth quarter. Executives pointed to the impact of a 2020 acquisition that allowed First Horizon to bulk up in in Florida, Georgia and Louisiana.

January 20 -

JPMorgan Chase will introduce a credit card with Instacart this year, the first foray into grocery for the country’s largest co-brand credit card issuer.

January 20 -

A coalition of trade associations representing some of the world's largest retailers called on U.S. antitrust regulators to examine the fees charged by credit card companies after Amazon.com threatened to ban Visa cards in the U.K.

January 19 -

The decision to drop the London interbank offered rate as a benchmark interest rate means that contracts for hundreds of trillions of dollars in financial assets need to be rewritten. U.S. regulators should allow existing agreements to be amended without the threat of massive litigation.

January 19

-

While money market fee waivers ate into the company’s revenue last quarter, as low interest rates led asset managers to make concessions to customers, executives predict a turnaround in 2022 after the Federal Reserve starts monetary tightening.

January 18