Virtual assistants, whether on our smartphones such as Apple's Siri or in our smart home speakers such as Amazon's Alexa, have made a full-scale invasion of consumers’ lives with the hope that they will improve them.

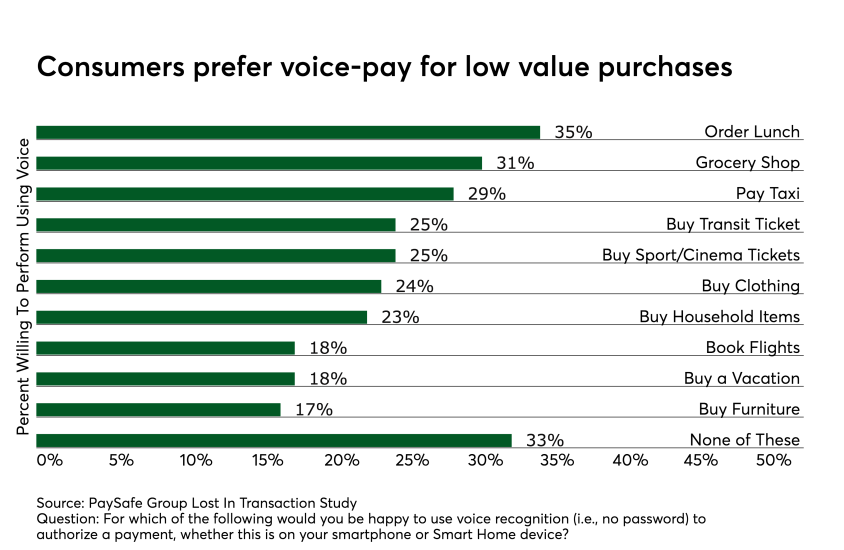

Virtual assistants are also being brought forward into a variety of other internet-of-things devices such as automobiles and appliances, with the goal of finding new moments where consumers are willing to spend money — sometimes guided by machine learning.

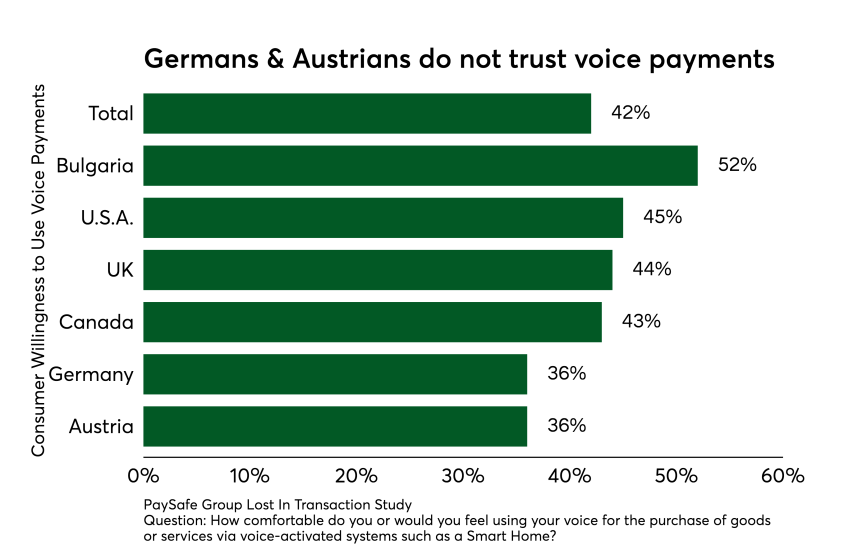

Improvement in existing voice recognition technology is key for enabling growth in voice-based shopping and keeping transactions secure while defeating fraud. However, convincing consumers in the trustworthiness of voice payments may be more of a challenge, especially when other biometric methods, such as fingerprint authentication, are much more familiar.