-

While the e-commerce giant has deemphasized the technology, banks and payment firms are testing the biometric option.

February 6 -

The Swedish financial institution adds P2P payments as it tries to bolster its neobank aspirations. Payment firms don't like the U.K.'s potential restrictions on stablecoins and more in the American Banker global payments and fintech roundup.

January 14 -

The technology company recently announced iris authentication in smart glasses, bringing new attention to a nascent high-tech payment option that has also attracted Mastercard and Bank of America.

November 28 -

The cards, which are expensive, have not grown quickly. But payment companies are angling for a pickup.

September 27 -

Biometrics for in-store payments are taking off; the next logical step is e-commerce. Here's how that may work.

September 12 -

Paying for items with your palm or face isn't commonplace yet, but it's coming. What banks need to know.

August 15 -

The rollout of new technologies in point-of-sale retail payments in the U.S. has historically been slow, and consumer adoption of those new payment flows can be even slower. Can consumers' propensity for self checkout help push adoption?

February 14 -

Biometric payment terminals were on full display at the National Retail Federation's Big Show in New York. American Banker's Joey Pizzolato tried terminals from Ingenico and JPMorgan Payments. What he found might surprise you.

January 27 -

Crooks can use deepfakes and other machine learning tools to circumvent traditional authentication security methods. Payment experts discuss how firms can protect themselves.

September 9 -

The bank partnered with fintech PopID for biometric payments at fast-food retailer Whataburger, but widespread adoption from consumers and merchants could be an uphill battle.

August 12 -

JPMorgan Chase is planning to test new technology that would let consumers pay with their palms or faces at certain U.S. merchants.

March 23 -

Mastercard has begun to trial a biometric payment system for brick-and-mortar stores, using facial recognition rather than contactless cards, smartphones or memorable PINs.

May 17 -

The bank is piloting fingerprint-reading cards that work with existing payment terminals. Its goals are to strengthen security for large transactions and to inform future deployments in other markets.

July 12 -

The payments technology provider is adding a handprint biometric digital ID to its authentication system through a partnership with the French fintech A3BC.

July 7 -

The Faster Identity Online Alliance has established its first user-experience guidelines and delivered new standards designed to more quickly move authentication processes past traditional username-and-password combinations.

June 23 -

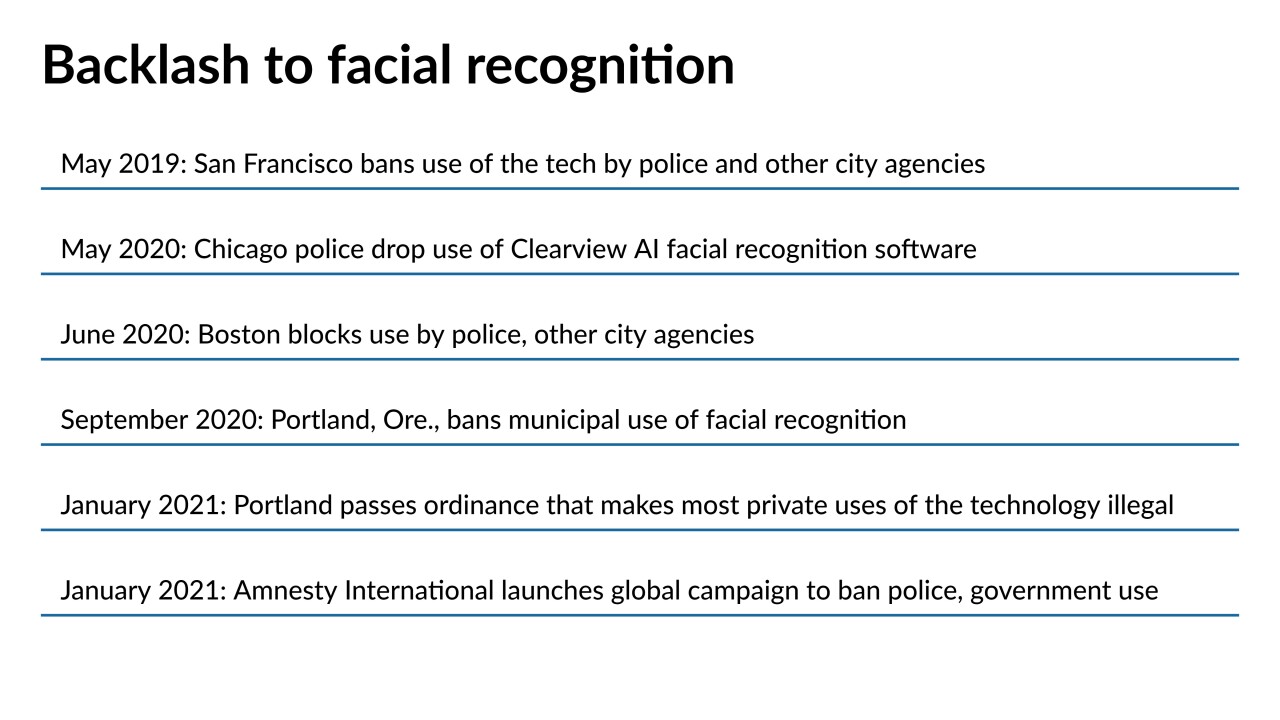

Citing the risk of bias and misidentification, cities and civil liberties groups are calling more loudly for a ban on the use of face scans.

May 3 -

The e-commerce giant's Amazon One palm-scanning can enroll consumers for building access and other use cases that require an ID.

March 12 -

With mobile payments and banking apps on the rise, biometric authentication is now increasingly common in consumer finance, says Fingerprints' Michel Roig.

February 26 Fingerprints

Fingerprints -

With the ongoing coronavirus pandemic prompting more consumers to use contactless payments, the U.K.’s banks have lobbied for higher contactless payments limits, a move which could benefit the biometrics payments industry.

January 29 -

Biometric authentication has always been a challenging subject with consumers, who are accustomed to using the technology to unlock their phones but are still wary about how much personal information they share with retailers and card issuers.

January 25