The coronavirus pandemic has changed how consumers work, live and relax, as well as how they move money and ultimately what they buy.

Some industries such as travel and hospitality have been devastated as companies have imposed corporate travel bans, state and local governments have closed casinos and sports leagues have postponed or cancelled games. Other spending categories, such as grocery, have benefited as consumers are cooking more meals from home instead of eating out at restaurants.

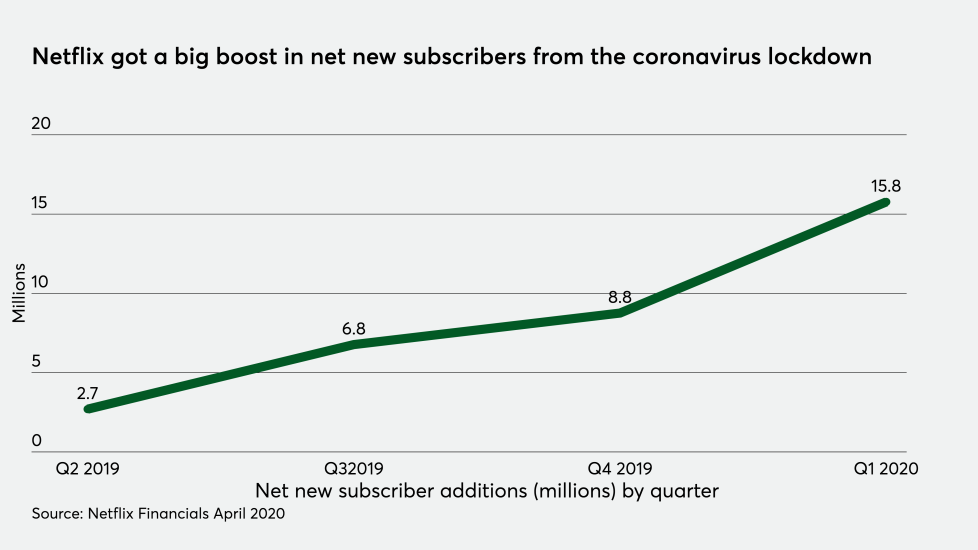

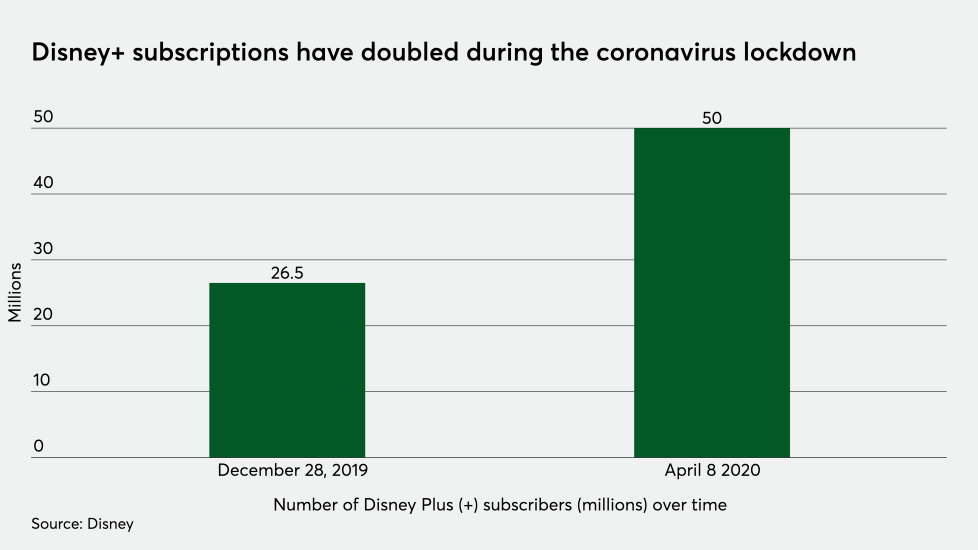

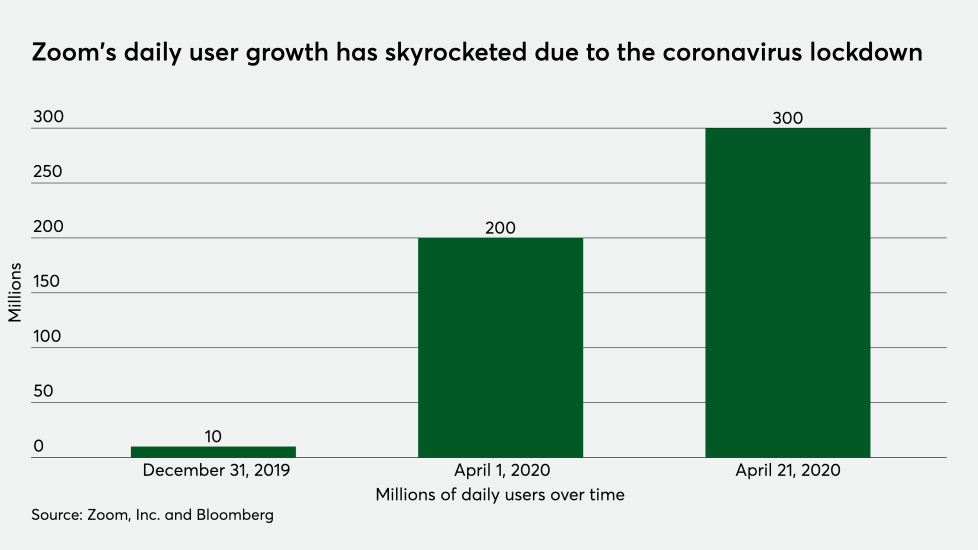

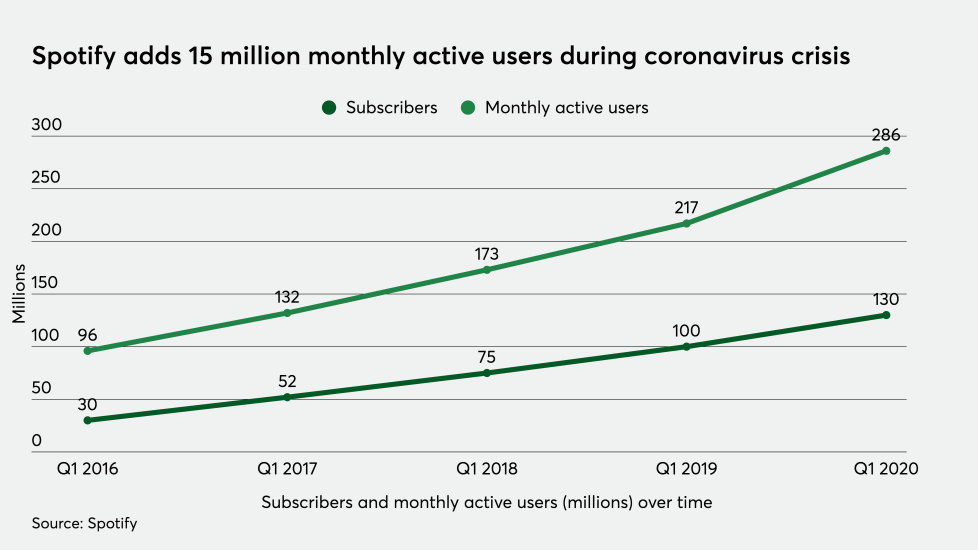

However, there is one area of commerce that has experienced an uneven consumer response to the coronavirus crisis: subscriptions. Some companies have benefited greatly while others have not.