The U.S. is the world’s largest economy, based on

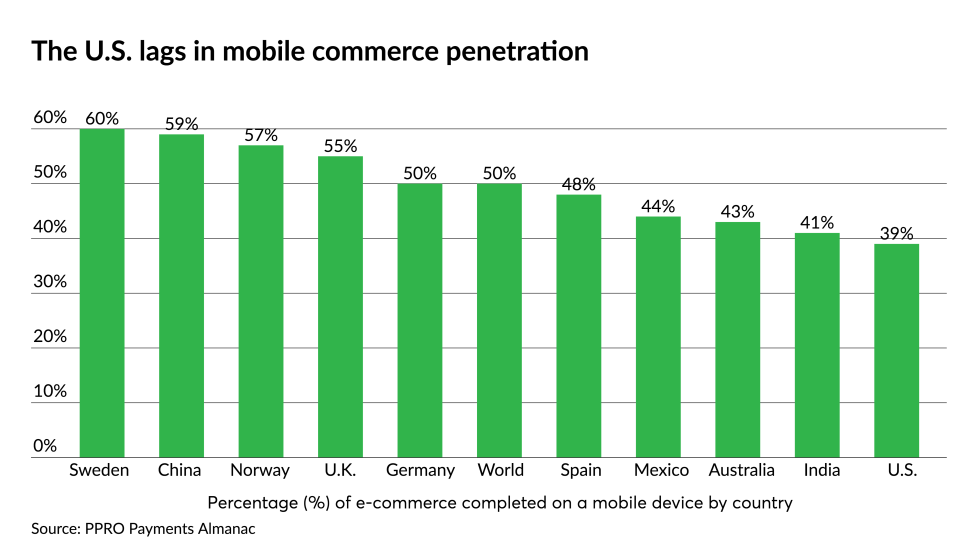

To endure, these shops relied heavily on e-commerce, even if it was new territory to them. They also adopted mobile commerce, but the U.S. still lags other countries in this activity.

“Of the merchants that survived the initial pandemic shock, they are thriving,” said Derek Webster, founder and CEO of CardFlight. “Merchants discovered the need to shift from purely in-store sales model to an omni channel one that includes online, delivery and curbside pickup.”